The digital payments landscape in India is undergoing a significant transformation, driven by initiatives of the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI).

The Unified Payments Interface (UPI) armour has been strengthened by a host of launches, ranging from UPI Circle and instant loans to UPI-enabled cross-border transactions.

UPI Circle for shared digital paymentsThis feature allows two individuals to jointly manage a single bank account for digital transactions. It is designed to help individuals who depend on others – for instance, children or caretakers – for money management, giving them greater control over their financial decisions.

To set up UPI Circle, members must obtain explicit consent from the primary user to authorise either full or partial delegation for a secondary user. Under the full delegation option, the primary user can set a monthly payment limit of up to Rs 15,000, allowing the secondary user to carry out transactions within that limit.

In the case of partial delegation, the primary user retains control, reviewing and approving each payment request initiated by the secondary user. In both cases, the secondary user must accept the primary user's request within 30 minutes to complete the UPI Circle transaction.

To ensure safe and secure transactions, it's essential for both the primary and secondary users to be updated about the latest UPI frauds, tactics, and prevention strategies.

Also read: MC Explains: How NPCI's new UPI Circle works

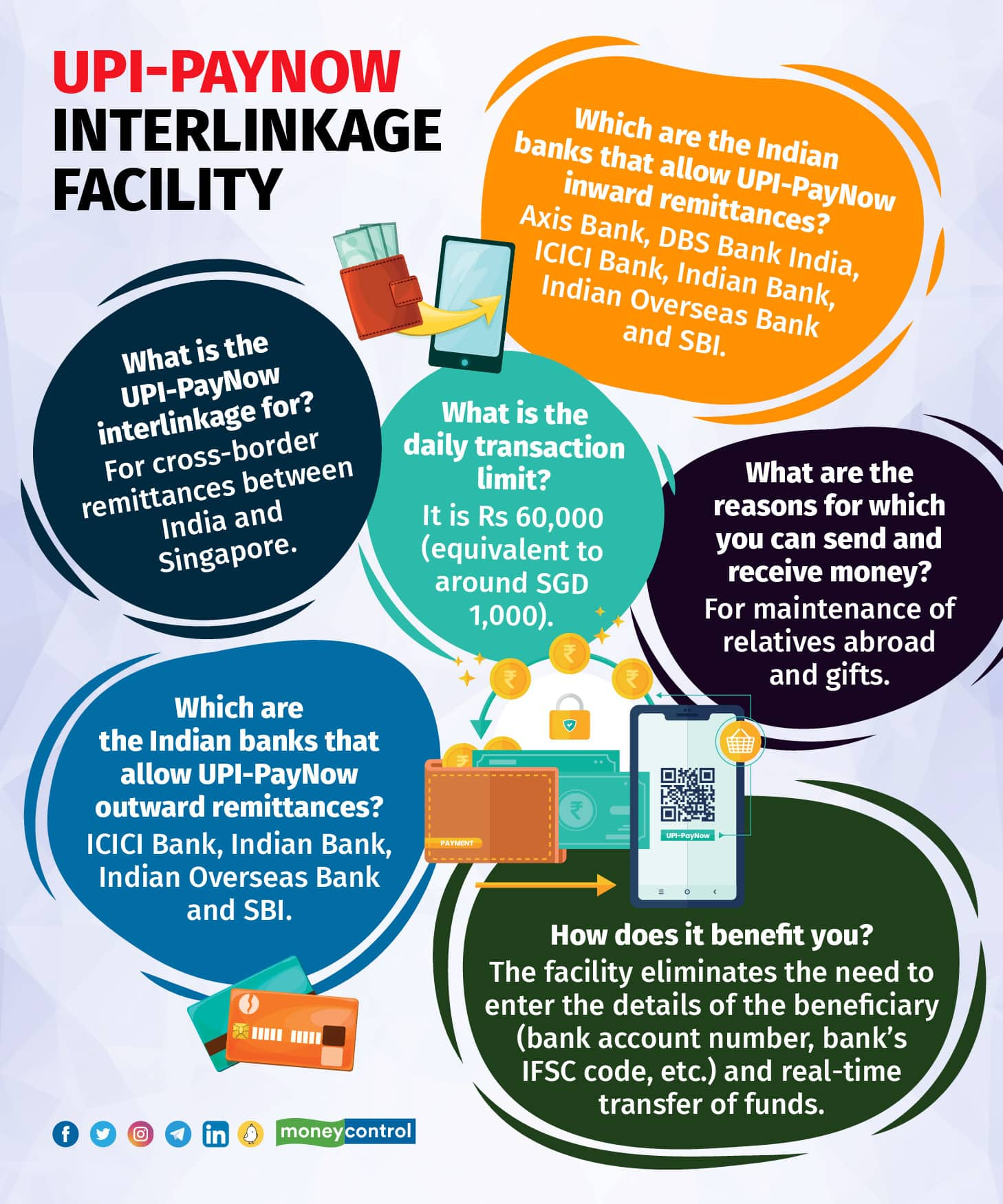

Cross-border payments get a boost with UPI-PayNow linkThe UPI-PayNow interlinkage facility is a significant step in cross-border transactions between India and Singapore. This facility enables users to make instant, safe, and cost-effective transactions between the two countries using their respective fast payment systems, UPI and its equivalent network of Singapore, PayNow.

This facility offers several benefits, including convenient transactions, increased acceptance, and cost-effectiveness. Users can seamlessly transfer funds using their UPI ID, mobile number, or Virtual Payment Address (VPA). Additionally, merchants in India and Singapore can accept payments, facilitating easier transactions for individuals. Furthermore, the facility aims to provide more affordable transactions compared to traditional cross-border payment methods.

In India, participating banks include Axis Bank, DBS Bank India, ICICI Bank, Indian Bank, Indian Overseas Bank, and State Bank of India. Meanwhile, in Singapore, DBS Bank Singapore and Liquid Group, a non-bank financial institution, are part of the initiative.

The daily transaction limit is Rs 60,000 (equivalent to around SGD 1,000).

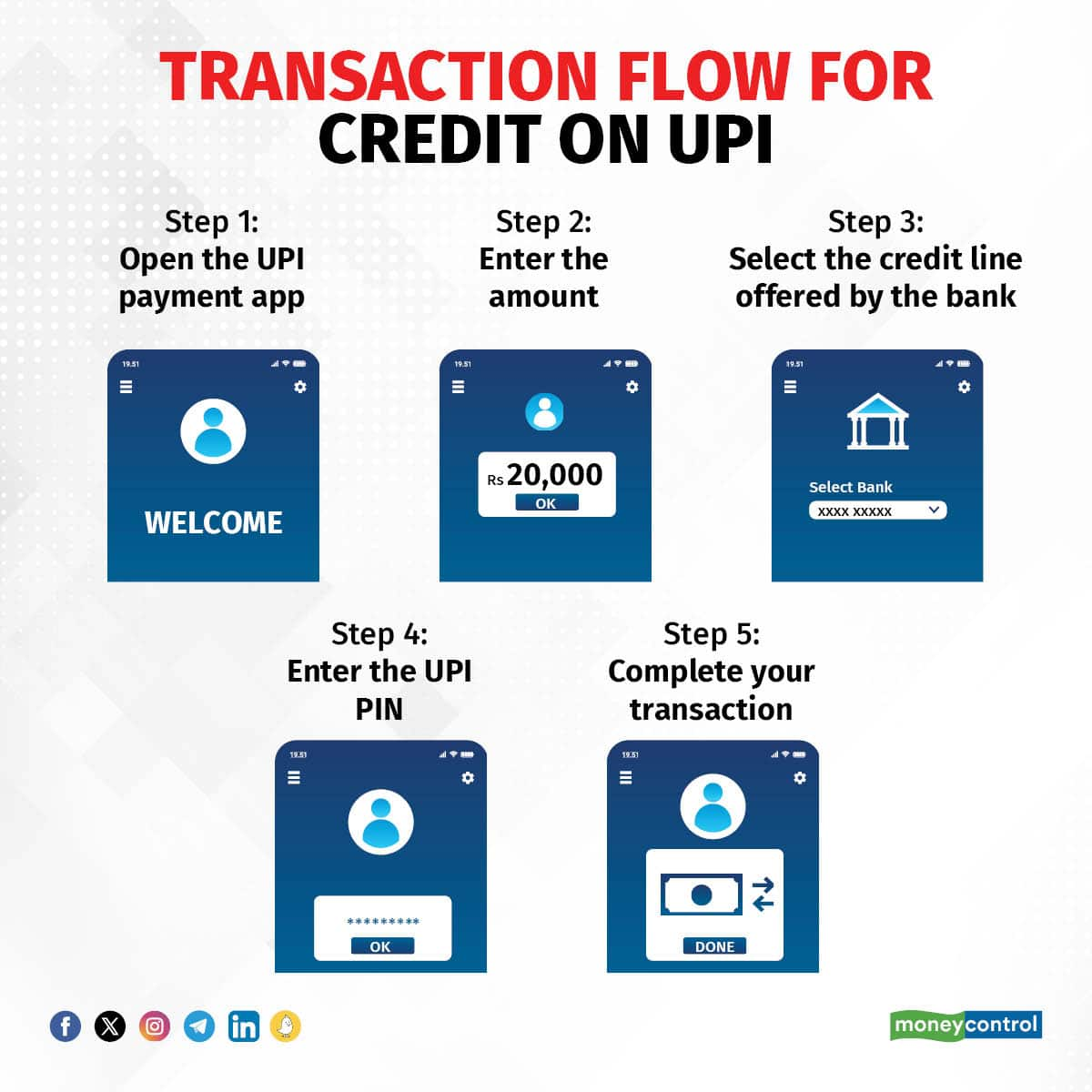

The NPCI launched a credit line facility linked to UPI in September 2023. This feature enables users to access instant credit directly through their UPI-enabled apps, such as BHIM, PayZapp, Paytm, GPay, and others. Essentially, it's a pre-approved credit facility that customers can utilise while making purchases through UPI. Based on their creditworthiness, banks and financial institutions offer these predetermined loans, which users can draw upon to make UPI payments.

In terms of advantages, the facility ensures quick and convenient loan disbursals, eliminating the need for traditional loan approval processes and extensive documentation.

Users, especially those from the lower-income segments, can now meet their financial needs promptly whether for emergencies, education, healthcare or business ventures, without the hassle of collateral or lengthy paperwork.

To access the UPI credit line, users must apply through their linked bank, providing required documents such as income statements, and identity and address proofs. The bank will assess financial information, including eligibility, income, credit score, and repayment history, before approving the credit limit and its terms. Application procedures and requirements may vary across financial institutions.

The interest rates for the UPI credit line are determined by the bank, the borrower's credit score, and current market conditions, and are lower than those of credit cards, offering a relatively affordable credit option.

Introduced by NPCI in September 2022, the UPI Lite feature enables users to make transactions of up to Rs 5,000 without entering a PIN, facilitating faster processing. Users can add funds to their UPI Lite account through their UPI app, which provides a convenient top-up option. It is currently available on payment apps such as Paytm, BHIM, Google Pay, and others, with participating banks including Canara Bank, HDFC Bank, Indian Bank, and several others.

UPI 123PAY: Secure payments for feature phone usersNPCI launched UPI 123PAY in March 2022, enabling feature phone users to make secure UPI payments without internet. Users can dial a designated number, select services, validate beneficiaries, and enter their UPI PIN to complete transactions. A 4-6 digit UPI PIN is required for registration, and the same PIN is used for all transactions. The per-transaction limit is Rs 10,000, and the service is available in 12 languages, including English, Hindi, and several regional languages.

UPI for NRIsUPI has become friendlier to non-resident Indian (NRI) customers since 2024. They can access UPI-based apps using their international mobile numbers linked to their non-resident-external (NRE) or non-resident-ordinary (NRO) accounts, eliminating the need to maintain an Indian mobile number for UPI transactions. This facility is available to NRIs living in ten countries – US, UAE, Singapore, Australia, Canada, UK, Saudi Arabia, Oman and Hong Kong. They can access this feature to pay bills, transfer money, and also make purchases in India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!