Mid-cap funds have outperformed their large-cap counterparts over the last one year. The category cannot be ignored for sure, as an essential ingredient for your portfolio.

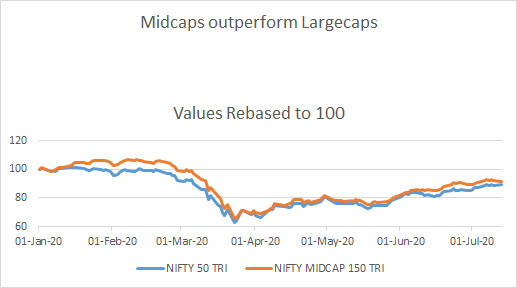

Value Research data indicates that mid-cap funds lost 2.95 per cent as a category over the last one year, whereas their large-cap cousins declined 5.78 per cent loss. Even when the markets bounced back after the rout in March, mid-cap funds delivered 21.09 per cent gains, versus the 19.9 per cent that large-cap schemes managed. This relative resilience is one of the key reasons to consider adding mid-cap funds to your portfolio.

Why mid-cap funds have done well?

Mid-cap stocks had been battered in 2018 and the first half of 2019. Valuations were beaten down and were attractive. So a rally was always on cards. In addition, many schemes in the category upped exposure to segments such as pharma that rallied substantially over the past few months. Large-caps did not have such large exposures. In addition, the troubled banking and financial services segment still accounted for a large portion of the portfolio of large-cap funds, whereas mid-cap schemes did not load up on the segment.

“Midcap funds give investors exposure to some emerging spaces and long-term themes which are not present in the large cap space: software product companies, logistics, chemicals and agrochemicals and staffing,” says Aniruddha Naha, Senior Fund Manager, PGIM India Mutual Fund.

Fund managers earlier invested in small-cap firms to generate higher returns during raging bull markets. But now, the proportion is kept low, at 11 per cent on an average. As on June 30, 2020, the average market capitalisation of mid-cap fund portfolios was Rs 18097 crore, as per Value Research. All schemes have ensured that the number stands above Rs 10,000 crore.

“Going forward, midcap funds should be less volatile as the SEBI categorization has clearly defined the stock universe of well-established names,” says Ravi Kumar TV, founder of Gaining Ground Investment Services. “Many companies with leveraged balance sheets have lost investor interest resulting into price erosion and thereby moved out of the universe. The fund managers too prefer investing in quality stocks,” he adds.

Picking the right mid-cap fundGoing by the past returns for making investments is not the best way to start. Some experts also ask investors to avoid schemes with large asset sizes, as they may not be nimble footed. However, as large chunk of the funds goes into relatively liquid names.

“Markets are expected to remain volatile ahead of US presidential elections. Investors should not make their investment decision based on outperformance in the recent past,” says Sayalee Khandke, Manager Research, Investica.

Had you invested in mid-cap funds in 2014 or 2017, in the subsequent years you would have got very low returns. “In midcaps you typically experience prolonged period of no returns or losses, followed by a period of good returns,” says Ravi Kumar. If you have the ability to hold on to your investments for long, you may generate good returns.

Is this the time to add mid-caps to your portfolio?The BSE Mid-cap index is up 38 per cent from its March lows. It may be time to exercise some caution. But if you wish to invest for the long term of 10 years, you can build add mid-cap funds to your portfolio.

“Fund manager stability and the ability to contain downside in volatile times are two key factors investors should keep in mind while picking mid-cap funds,” says Khandke. She further advises investors to moderate their expectations from these funds.

Systematic investment plans help you to reduce timing risks. “Mid cap funds can be considered when you are investing for financial goals such as retirement or child’s education which are 10 to 15 years away. Over long periods, midcaps tend to significantly outperform broader markets,” says Ravi Kumar.

Restrict allocation to mid-cap funds to a maximum of 20 per cent of your equity investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.