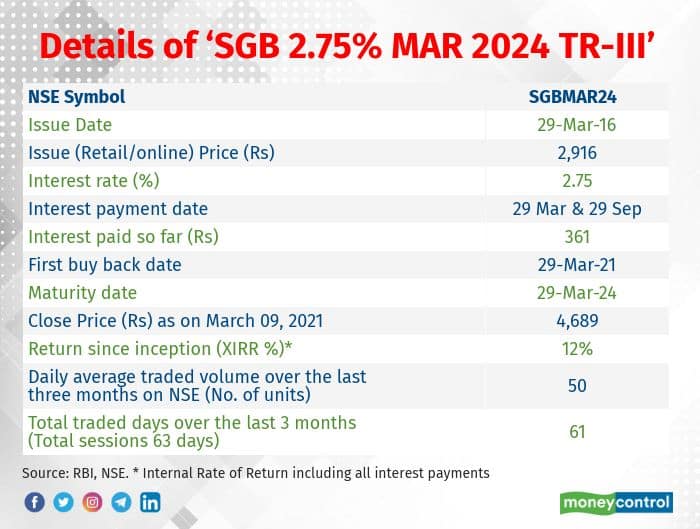

Investors of the first few tranches of Sovereign Gold Bonds (SGBs) now have reasons to rejoice. Apart from the massive gains in made due to rising gold prices in the last three-odd years, the early versions have now come up premature redemption. The early redemption of ‘SGB 2.75% MAR 2024 TR-III’ (NSE symbol: SGBMAR24) is due on March 29, 2021. So far, the RBI has facilitated such early redemption for the first two tranches. With gold prices having corrected recently, should you withdraw or must you stay invested?

SGBs are issued by the RBI on behalf of the Government. These bonds were first launched in November 2015 and have been sold in 49 tranches subsequently. SGBs score over other gold investment options as they pay a fixed interest on the holding (2.5-2.75 per cent per annum) apart from giving a discount of ₹50 on the issue price if invested online at the time of initial offer. They are tax-efficient too, as the capital gains are tax-exempt if they are held till maturity (eight years).

SGBs offer limited exit optionsSGBs are eight-year instruments, but impose a five-year lock-in. Although SGBs are listed on the stock exchanges, they are thinly traded. However, to provide an exit window, the RBI provides a buyback facility at the end of the fifth, sixth and seventh years.

The first buyback – SGB Tranche 1 (issued in November 2015) – was on November 20, 2020. Subsequently, the RBI came out with the buyback liquidity window for the second tranche (issued on February 2021) on February 8, 2021.

The third tranche ‘SGB 2.75% MAR 2024 TR-III,’ issued on March 29, 2016, is going to complete its fifth year on March 29, 2021. The RBI is expected to open the buyback window for these bonds on March 29, 2021.

How do I surrender my SGB units?After holding for five years, the RBI allows you to surrender the bonds on the date of interest payment. Inform your agent or bank or post office that enabled you to buy these bonds. Make sure you initiate your redemption request at least 10 days before the interest payment date.

For the third tranche, it is better to submit your early redemption application at least before March 18, 2021.

The redemption price will be a simple average of the closing price of gold during the previous week (Monday to Friday) published by the India Bullion and Jewellers Association. The redemption proceeds are transferred to your bank account.

So far, the amount invested in ‘SGB 2.75% MAR 2024 TR-III’ has grown at the annualised rate of 12 percent (XIRR; as on March 05, 2021), including the coupon payments. The total coupon amount paid out so far is Rs 361.

Price movement and liquidity

Capital gains are tax-exempt only if you hold SGBs till maturity (8 years). However, tax experts differ on the capital gain tax implication of premature withdrawal. Nakul Kulkarni, Business Analyst, Zerodha, says that premature (either through the exit window or through stock exchanges) will attract a long-term capital gains tax of 20 percent.

But if you sell these bonds before 36 months, then you have to pay short-term capital gains tax at your slab rate.

It is the first financial year in which these bonds are coming up for premature redemption. So, the capital gain taxation details are still open for interpretation.

After a stupendous rise through 2019 and 2020, gold prices fell by more than 20 percent from their August 2020 highs. Rising US treasury yields and strengthening dollar have made gold-buying expensive.

Gold hedges our portfolios against inflation. Chintan Haria, Head-Product Development & Strategy, ICICI Prudential AMC, says, “Given the monetary stimulus globally, inflation is likely to head north owing to higher agriculture and commodity prices. It is an opportune time for investors looking to increase their gold holdings.”

If the value of your SGB holding now exceeds about 10 percent of your overall portfolio, then you can take some profits off the table. Else, stay invested.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.