The idea of dealing with payment obligations at the earliest is tempting. And therein lies the charm of single or limited premium term-life insurance plans – be done with the premium payments in one go or a few years in return for life cover for 20-30 years.

Despite their seemingly obvious appeal, single or limited premium term plans are not necessarily the best option for most people.

One, it does not make sense to pay the entire premium upfront when you get the same life cover for the policy period, irrespective of the payment plan. Two, if you have surplus funds, you could consider investing that money rather than pay a large upfront premium.

On the other hand, if you have cash flow issues, then a regular premium term plan can be a more affordable way of getting life cover.

“Plans with shorter premium term options were originally curated for those with high income for short durations – like cricketers, film stars or people going abroad on deputation,” said Manoj K Pandey, a faculty member at Birla Institute of Management Technology and a life insurance veteran. “This helped them in paying the premiums quickly and getting the policy benefit for a long duration. Now, times have changed and insurance companies are providing this option in almost all policies.”

Also see: Moneycontrol SecureNow Health Insurance Ratings

Why pay now?

In regular premium term plans, you pay premium annually, monthly, quarterly or half-yearly over the course of the policy term, which typically ranges from 20 to 30 years. Limited premium plans come with shorter premium payment periods of five or 10 years, or even one single premium payment.

Regardless of how soon the premium is paid off, the amount of life cover opted for will last for the entire policy period. If you are 35 years old and you opt for a Rs 1 crore life cover with a term of 25 years, you will be protected until you turn 60 under all three options. The premium paid will vary, depending on what you choose.

With a single premium plan, you essentially pay the insurer upfront in full for a life cover. In case of a regular premium plan, if the policyholder passes away during the policy term, future premium payments will stop and the family will receive the sum assured. That’s not possible with a limited premium plan.

Questioning the logic of limited premium plans, Kalpesh Ashar, a SEBI registered investment advisor, asked, “Nobody knows the future. Then, why pay a larger amount upfront for the same sum assured when there is uncertainty about the mortality of the policyholder?”

According to Pandey, single or limited premium payment term options look attractive as the total premium outgo is less than in the case of regular plans. “But this may not always be beneficial for the customer. In case of an early death, the insurance company is a clear beneficiary as they would have got all the premiums in advance. These options serve the insurance company well as they collect the premiums in an accelerated way and that adds to their higher investment income in the long run,” said Pandey.

Also read: LIC launches Dhan Vriddhi, a single premium guaranteed endowment policy

Why not invest?

For those who cannot afford to pay upfront premiums, the decision is simple – pay smaller instalments over the course of the policy period. The end goal is to get a life cover. For those who can afford it, investing the surplus and letting it compound over a longer period of time may be a better alternative.

Paying premium upfront comes with an opportunity cost – most of the money spent on upfront premiums can be invested. The returns will depend on where the money is invested.

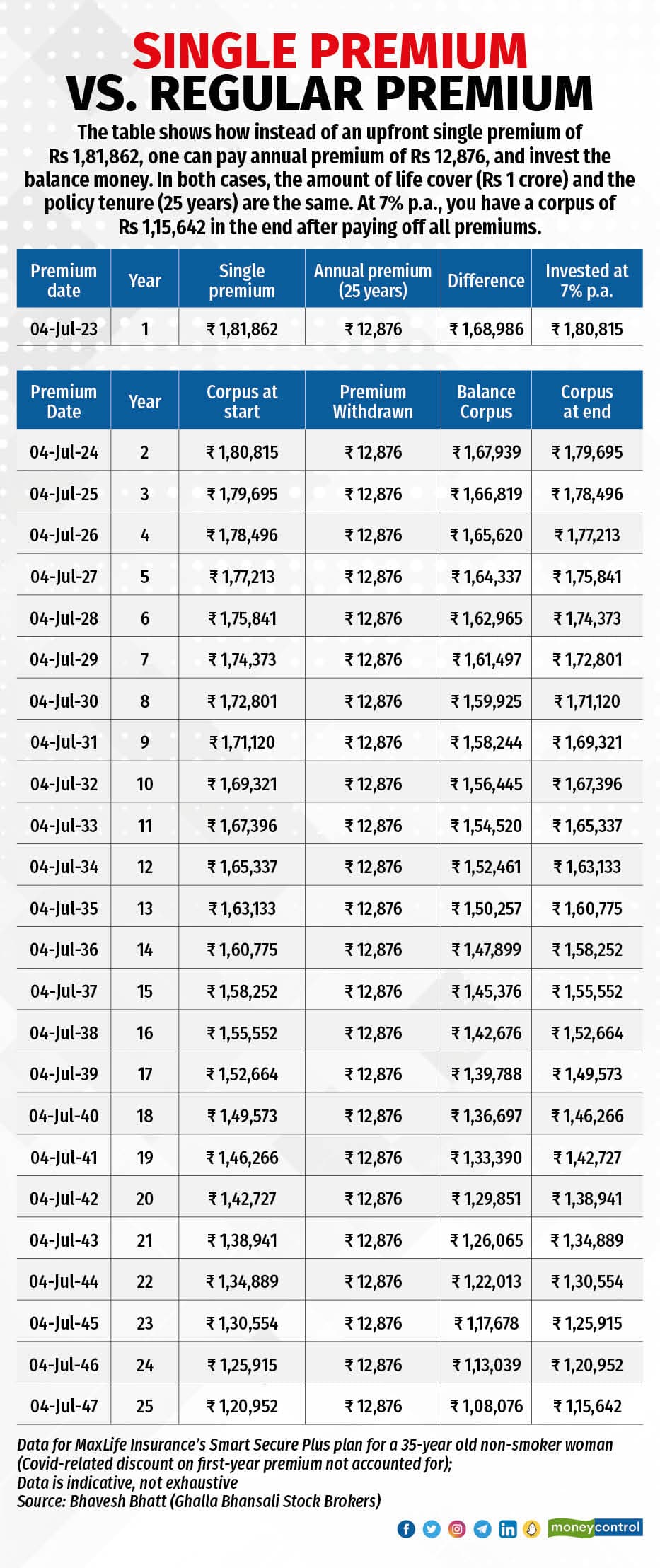

Let’s assume that a 35-year-old woman opts for a Rs 1 crore life cover for 25 years and she remains alive through the policy term. If she chooses an annual premium of Rs 12,876 for 25 years instead of a one-time premium payment of Rs 1,81,862, then she can spare Rs 1,68,986 for investing. Even at a 7 percent per annum rate of return on the balance amount (after paying the annual premium), she will end up with a corpus of Rs 1,15,642 (see table). If she invests at 8 percent p.a., she will have Rs 2,28,860 at the end of 25 years.

Now, one could argue that one also needs to account for the difference in premiums paid - single premium of Rs 1,81862 versus a total premium of Rs 3,21,900 paid over 25 years. There are a few points to note here. One, this simple summation of premiums does not account for the time value of money. Two, investing the money saved in upfront premiums can help you recoup the extra amount paid as annual premium. But most importantly, in the event the policy holder passes away earlier on during the policy period, more premium will have been paid under the single rather than the regular premium option.

The investment logic apart, a regular premium plan also comes with other advantages. One can opt for a critical illness rider. Bhavesh Bhatt, president of Ghalla Bhansali Stock Brokers, said this rider is not available with a single premium plan. He also said that some insurance companies limit the number of years of cover for single premium plans.

There’s a tax angle, too. Premiums paid on a life insurance policy can be claimed as deduction (maximum limit of Rs 1.5 lakh) under Section 80C of the Income Tax Act. With a limited premium plan, one can claim this deduction only for a few years.

However, Bhat said regular premium plans are not necessarily better in terms of tax planning. “Most people will have anyway exhausted the Rs 1.5 lakh limit under Section 80C on other investments and expenditure. So, this is not an additional tax benefit for a life insurance policy,” Bhatt said.

Also read: Why a pure term plan + MF works better than traditional insurance policies

Lumpy income, future unpredictable

Still, Bhatt said that from a financial point of view, it makes sense to go for a regular premium term plan. But if one doesn’t have the discipline to set aside the money every year, then you can clear your premium payments with a limited premium plan.

“This particularly plays on the minds of those who have a limited career span, for example, sportspersons and actors, or those with uncertain cash flows such as business people,” said Bhatt.

To sum up, those with a regular income stream are better off with regular premium term plans. They are an affordable way to get life cover. But those with unpredictable cash flows or limited career spans can consider limited premium plans. This way, they can put their large cash flows to good use by securing life cover for their family’s long-term financial security.

Also read: Personal Finance: A life insurance policy or fixed income investment? What to choose?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!