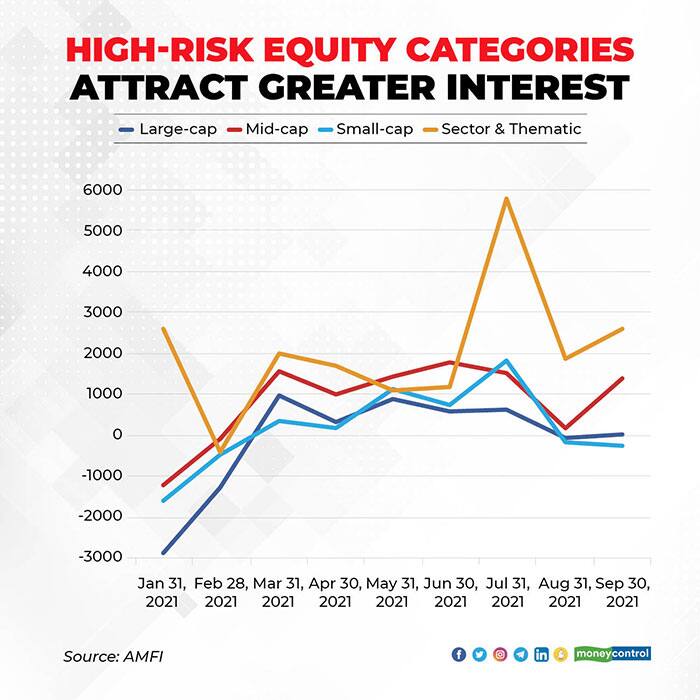

The run-up in the equity markets has increased mutual fund (MF) investors’ appetite for risk. In 2021 (CY21) thus far, mid and small-cap schemes have garnered net flows of Rs 7,250 crore and Rs 1,648 crore, respectively. But large-cap funds have witnessed net outflows to the tune of Rs 946 crore. Are investors getting too adventurous and ignoring risks?

Sectoral and thematic funds have received Rs 18,509 crore of net inflows, which is about a third of the total net flows the MF industry received in CY21.

The sector and thematic fund categories have also seen several new fund offerings (NFOs). Clearly, investors seem willing to take on more risks in their pursuit of higher returns.

Industry experts say higher flows in mid and small-cap schemes are expected, especially in the second part of a bull market. “In such periods, we have also seen in the past that mid and small-cap stocks tend to outperform. Even poor quality companies see strong run-up in their stock prices, even outperforming quality large-cap names. However, retail investors need to be careful as there can be heightened volatility in the short-term,” says G Pradeepkumar, chief executive officer of Union MF.

As a category, large-cap schemes have delivered 30 percent on an average so far in CY21. On the other hand, mid-cap schemes have delivered returns of 48 percent. Leading the pack are small-cap funds with 64 percent return.

Lower expectations from benchmark indicesFinancial planners say investors’ preference for mid and small-cap schemes could be attributed to benchmark index levels.

“Investors relate large-caps with the Nifty and Sensex. As these indices are at their record highs, they feel that there isn’t much room left for large-caps to generate higher returns. So, they are moving to mid- and small-cap schemes to chase returns,” says Amol Joshi, founder of Plan Rupee Investment Services.

Joshi adds that investors also want to participate in sectors that may not be present in the large-cap space.

Advisors warn that mid and small-caps could also be the worst-hit if there is a market correction. “We had seen a similar rally in mid and small-caps as markets recovered from the 2008 financial crisis. However, they disappointed investors after 1-1.5 years of the rally,” says Anup Bhaiya, founder and managing director of Money Honey Financial Services.

Pradeepkumar of Union MF says that while the overall market appears expensive at this stage, mid and small-caps appear even more expensive. “Investors getting into mid and small-cap funds should at least have a five-year investment horizon to tide over any short-term volatility,” he says.

Sector funds: High-risk, high-returnThere were several sectoral and theme-based funds launched by mutual funds this year – both active and passive. Why are these schemes generating interest?

Bhaiya says that there are undervalued pockets in the markets that appear attractive. “Auto, energy, PSU, banking and financial services stocks have not participated as much in the market rally. So, there may be opportunities in this space as valuations are attractive and things are now looking positive,” he says.

“Such funds can give better returns than diversified equity funds, but are suitable for savvy investors that understand the sector well, and have the ability to handle the heightened volatility. They can make tactical allocations to such funds,” he adds.

Fund houses are planning to launch more of such funds. In a recent interaction with Moneycontrol, George Heber Joseph, chief executive officer of ITI MF said that his fund house had plans to launch infra, pharma, banking fund and thematic funds on the lines of the build India fund.

Also read: George Heber Joseph of ITI Mutual on why index funds could turn risky with overvalued sectors

A few fund houses have also filed for theme-based schemes that could capture the growth of the emerging electric vehicle industry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.