Sonam Dalal*, a 42-year-old divorced marketing executive from Mumbai, faced chaos after falling ill without a will. Her ex-in-laws exploited outdated nominations on policies and accounts, sparking disputes over her apartment, mutual funds, and heirloom jewelry—assets she assumed her sister would inherit. With elderly parents unable to intervene, she endured months of legal battles, draining a lot of money in fees to untangle ownership and block unintended transfers to her former family.

This ordeal illuminated why a will is crucial for her: as a childless divorcee, intestate laws could default assets to distant relatives or ex-ties, erasing her autonomy. A will ensures precise distribution to chosen beneficiaries, averting family conflicts and safeguarding her hard-earned legacy.

Sonam's story is not unique; it's a cautionary tale echoing the silent struggles of single women across India—unmarried, divorced, or widowed—who navigate financial independence amid cultural shadows.

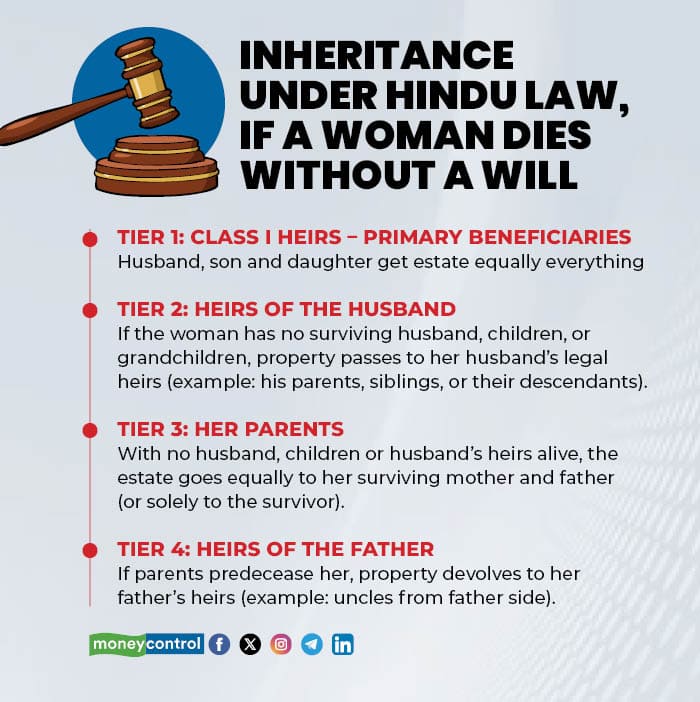

Foregoing a will invites unintended fallout under religion-specific laws. "If an unmarried Hindu woman passes away without a will, her assets go to her parents; if they’re deceased and have no other siblings, they revert to her father’s heirs, not her mother’s side. That means an uncle she hasn’t spoken to in years could inherit her flat," said Shraddha Nileshwar, Head of Will & Estate Planning at 1 Finance, said.

Similarly, if her husband has passed away and she has no children, her property will go to her husband’s family and not her own.

If a single woman doesn't have a will, she'll die 'intestate', and laws will decide who gets her assets, not her wishes. This leads to three bad outcomes: long legal fights that tie up her assets, people she didn't care about getting her stuff, and her true wishes being ignored. For women who worked hard to be independent, it's a loss of control, explains Shweta Tungare, Co-founder of LawTarazoo.

With rising divorce rates and delayed marriages, these women control growing wealth, yet many overlook estate planning, leaving assets vulnerable to intestate laws and family disputes. This is why estate planning and will writing are integral part of financial planning.

Unique Challenges: A silent crisis of autonomy and oversightSingle women in India—whether unmarried, divorced, or widowed—wield unprecedented financial independence, yet estate planning remains a blind spot, fueled by cultural norms that sideline women from legacy discussions.

Nileshwar said, “Many hesitate to formalize estate plans, a reluctance often traced to cultural conditioning that prioritizes nurturing over legacy-building.” This gap widens amid the absence of candid inheritance discussions and uncertainties in selecting executors or beneficiaries, leading to inadvertent oversights.

This hesitation amplifies vulnerabilities--unmarried women under the Hindu Succession Act, 1956, see assets default to parents or siblings, potentially sparking discord if elderly parents falter or siblings’ clash. Divorced women without children grapple with outdated nominations on accounts or policies tying funds to ex-spouses. For widows, particularly those with adult children, must shield inherited property, jewellery, or heirlooms from presumptive family claims.

Tungare highlights the "triple barrier" that prevents women from planning their estate: societal expectations that family will handle everything, lack of knowledge about legal rights, and discomfort discussing death. She warns that single women are particularly at risk, as they may end up with distant relatives inheriting their assets if they don't have a will.

Many women build wealth but fail to protect it, leaving their independence vulnerable to unexpected events.

Common Mistakes: Procrastination and misunderstandingsProcrastination tops the list of errors, with many single women dismissing estate planning as a distant concern. "The biggest mistake is procrastination—thinking 'I'm too young' or 'I'll do it later,'" Tungare said.

Overlooking nominations on banks, funds, or policies compounds this; outdated details can funnel assets to unintended recipients, turning grief into litigation.

Another pitfall is conflating nominations with inheritance. Nileshwar clarified, "A nominee is just a caretaker, not the heir. True ownership passes only through a valid will or legal succession process."

Single women often neglect digital assets or sentimental bequests to non-relatives, assuming blood ties suffice. To sidestep these, experts advise taking action now to avoid this: create a will after major life changes, keep nominations up-to-date, and review estate planning every 2-3 years.

Empowering distribution starts with deliberate documentation. For unmarried women, Nileshwar said, "a clear, registered will specifying who should inherit what, especially if you wish to benefit friends, charities, or extended family." Financial support to parents should be recorded as it helps avoid future contestation. Ensure that you mindfully keep your estate separate from that of your future spouse, especially during the initial years of the marriage.

Divorced or widowed women must audit joint holdings and nominations. "If your ex or late husband’s name still appears on accounts or property, update ownership through mutation or transfer forms," said Nileshwar.

Legal experts recommend three key things -- a precise will naming beneficiaries without ambiguity, a trusted executor over default family picks, and registration with secure storage. Single women should also consider powers of attorney for medical and financial decisions during incapacity.

In India, a woman has absolute rights over her self-acquired property—use that power deliberately.

Maintaining a digital asset inventory (bank accounts, lockers, investments) with executors or trusted advisors ensures seamless transitions.

Also read | Digital Life certificate made easy: Pensioners can submit Jeevan Pramaan without bank visits — here’s how

Financial tools as legacy buildersLife insurance, financial instruments and trusts emerge as agile allies.

Nileshwar points out that life insurance pays out tax-free, helping to pay off debts, support loved ones, or donate to charity, all without getting stuck in probate.

Trusts, such as revocable or irrevocable, streamline asset distribution, minimize taxes, and maintain privacy. While, annuities ensure consistent income, safeguarding financial independence.

Also have living wills in place which would come handy in dire medical conditions.

These instruments offer single women strategic leverage, ensuring wishes prevail without probate delays or disputes.

Navigating Laws: Rights, rulings, and remediesIndian laws affirm single women's property parity, yet nuances demand vigilance. Shaishavi Kadakia, Partner at Cyril Amarchand Mangaldas, affirms: "Single women have the same right to own property and assets as single men or married persons. The law does not discriminate amongst persons based on their marital status, including in relation to ancestral property." For instance, The Hindu Succession Act, 1956 (amended 2005), grants unmarried daughters equal coparcenary rights.

Muslim personal laws fix shares (e.g., daughters inherit half of sons), limiting flexibility.

“Under Sharia inheritance law (primarily Sunni Hanafi school), if a deceased person leaves only one daughter and no sons, she receives a fixed share of half of the estate as a Quranic heir. The remaining half goes to the nearest male agnate relative (asaba), such as brother, paternal uncle, or more distant male paternal kin, if present,” Nileshwar explained.

To protect your assets, create a will that overrides default inheritance laws, set up trusts to keep control, and name beneficiaries on your accounts and policies.

“Streedhan, a woman’s personal assets (jewelry, gifts, property) received before or during marriage, remains her exclusive property under Indian law,” Nileshwar said.

Single females should document Streedhan in estate planning to ensure clear ownership.

For widowed women, Streedhan is not part of the husband’s estate and remains solely hers, but she must protect it from claims by in-laws through a will.

In divorce, Streedhan cannot be claimed by the ex-husband and must be returned if held by him.

Beyond Streedhan, single women should focus on documenting all personal and inherited assets — including bank accounts, digital assets, and investments — to ensure smooth succession, preventing oversights in an increasingly virtual world.

Note: *Name changed.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!