Securities and Exchange Board of India (SEBI), in a welcome move, has announced that fund houses can now launch index-based tax-saving ELSS funds. Till now, all Equity-Linked Savings Scheme (ELSS) funds in India have been active ones where fund managers decide the fund’s portfolio.

As per the SEBI circular, passive ELSS funds will be based on chosen indices which themselves are made up of stocks from the top-250 companies in terms of market-cap. But there is one caveat to this. The Asset Management Companies (AMCs) cannot have both active and passive ELSS funds. They need to choose between the two options. We will discuss the impact of this restriction a little later.

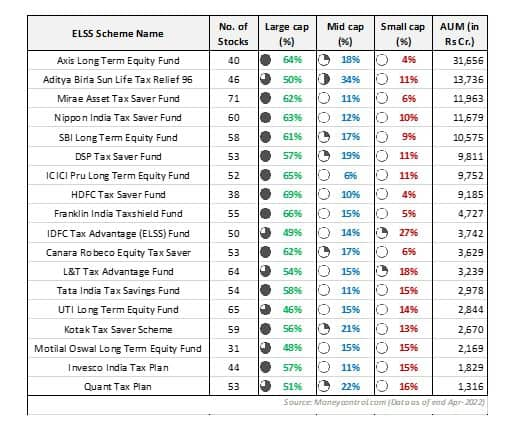

But first, let’s see how existing ‘active’ ELSS fund portfolios are managed, and what it tells about the future of passive ELSS funds.

Note – The portfolio marketcap allocation is a dynamic figure and keeps changing on a daily basis. The data above is based on schemes’ month-end portfolios in April 2022.

As is quite clear from the numbers, most ELSS funds have a bias for large-caps (in the range 55-70 percent). There are a few which have a reasonably large share of mid- and small-cap stocks as well. But though higher exposure to mid- and small-caps can help generate excess returns during bull markets, they can also fall more in bear phases.

It is for this reason it is said that in choosing an ELSS fund for your portfolio, pick one which suits your risk appetite and complements the other non-ELSS funds in your existing portfolio.

How passive ELSS might differ from existing ELSS?

As per the announcement, passive ELSS have to be based on a chosen index which should consist of stocks from the top-250 companies by market cap. As per the categorisation definition, large-cap companies are from 1st to 100th while mid-cap companies are from 101st to 250th ranked in terms of market cap.

Considering the above restrictions on the choice of base indices for passive ELSS funds, here are a few options that might be launched in future:

Passive ELSS with Large-cap Orientation

· Nifty50 Index ELSS fund – Will be made up of top 50 large-cap companies

· Nifty100 Index ELSS fund – Will be made up of all 100 large-cap companies

· Nifty Next50 Index ELSS fund – Will be made up of 51-100th ranked large-cap companies

Passive ELSS with Mid-cap Orientation

· Nifty Midcap150 Index ELSS fund – Will be made up of all 150 mid-cap companies

· Nifty Midcap50 Index ELSS fund – Will be made up of the top 50 mid-cap companies

Passive ELSS with both Large- & Mid-cap Orientation

· Nifty200 Index ELSS fund – Will be made up of all 100 large-cap and the top 100 mid-cap companies

ALSO READ: Which are the best passive mutual funds for your portfolio?

AMCs with existing ELSS may not go passive

This is pretty obvious. Barring a few, all AMCs already have ELSS funds. Some are huge and have AUMs ranging from Rs 5,000 crore to Rs 32,000 crore. And since active ELSS funds have a higher revenue impact (due to higher expense ratio for the investor) for AMCs than passive ones, fund houses may not be too gung-ho about the option to go for passive ELSS. Also because, SEBI has strangely asked fund houses to choose between active or passive ELSS. They can’t offer both.

So, only those few (and newer) AMCs that don’t already have ELSS funds might launch passively-managed ELSS schemes.

In my view, a better option would have been to allow AMCs to have both active and passive ELSS fund options and let the investor/advisor make the choice. But maybe, the reason for a forced-choice is to not create more clutter in the MF space. Or maybe, it is to give a fillip to new AMCs as it’s clear that existing ones may not go for passive ELSS.

It’s also possible that in the near future (and I hope so) SEBI allows fund houses to offer both versions of ELSS.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!