The annual Wealth Forum Platinum Circle Advisors Conference, organised by WealthForum, a distributor-focused platform run by Vijay Venkatram, a former mutual funds industry official, is a much-anticipated event. Most fund distributors look forward to it. India’s top 300 independent financial advisors are invited to attend this two-day conference in Mumbai. On August 30, 2018, in the first edition of this event, a senior fund industry official who was also a part of AMFI’s (the Rs 25 trillion Indian mutual fund industry’s trade body) financial literacy committee was in attendance. He stepped on to the stage to share AMFI’s vision for an upcoming advertisement campaign. After the successful ‘Mutual Funds Sahi Hain’ campaign, the sequel attempted to draw a comparison between mutual funds and bank fixed deposits, alluding to safety and a somewhat regular income. Some distributors in the audience felt the comparison was wrong as fund houses never assure returns, unlike bank FDs. “It was brazen and careless,” recalls one of the distributors present in that audience. They persuaded the gentleman to drop the idea, but this distributor told this journalist that “it didn’t look as if our objections were heard on that day.”

The flawed parallel with FDs

Their worries were short-lived. Days later, on 17 September, Infrastructure Leasing & Financial Services’ was downgraded to default or ‘D’ rating. Other companies belonging to the IL&FS group, such as IL&FS Financial Services, IL&FS Solar Power and IL&FS Tamil Nadu Paper, too, got downgraded that month. A total of about 33 funds (across liquid, ultra short-term bond, short-term bond and credit risk categories) held these companies in their portfolios; the cumulative value of these holdings in these funds added up to Rs 2,308 crore as of August 2018. According to data from CRISIL, debt funds, on an average, excluding government securities and overnight funds, declined 0.10 per cent in the month of September 2018, with many schemes having lost money, according to data from ACE MF.

Better sense prevailed. The AMFI campaign on debt funds was dropped, as it was clear that debt funds too could lose money. In fact, two liquid funds – those that were widely considered as schemes that never give negative returns – declined in value too; Principal Cash Management Fund (PCMF) lost nearly 8 per cent and Union Liquid Fund (ULF) lost around 3 per cent that month. In the following months, either several companies’ credit ratings were downgraded or they delayed payments to fund houses, including to Essel Group, Dewan Housing Finance (DHFL), Anil Dhirubhai Ambani Group (ADAG) companies and many others. By the end of 2018, both PCMF and ULF returned far less than a bank FD would. There were many other casualties too, over the course of the past one year.

“Thank God, the crisis had broken out; else, had the (advertisement) campaign come out and investors had invested in MFs, it would have been a bigger calamity,” said the distributor quoted above, who did not wish to be identified.

It has been a year since the IL&FS crisis broke out. One after another, skeletons came tumbling out of the debt fund closet. Finally, the capital market regulator, the Securities and Exchange Board of India (SEBI) revised debt fund regulations. Perhaps the biggest learning this year for investors was that although debt funds are useful and needed in our portfolios, no scheme comes without risk, though the dosage varies.

You win some, you lose some

Amit Bivalkar, founder and director, Sapient Wealth Advisors and Brokers says that instead of focusing on return of principal, many investors and distributors focused on returns, when they invested in debt funds. “Debt funds return on capital and not return of capital,” he says. When investors invest in FDs, they look more for safety, and less on returns. Unless, of course, depositors get swayed by co-operative banks that typically pay slightly higher interest rates, like in the case of Punjab & Maharashtra Co-Operative Bank that went bust last week.

The fact is that debt funds can lose money just as swiftly as equity funds. On April 30, 2019, as Reliance Home Finance and Reliance Commercial Finance were downgraded to ‘Below Investment grade,’ 38 debt and hybrid funds’ net asset values (NAVs) fell. On June 5, 2019, DHFL was downgraded to default rating, though fund houses had marked down the security a day before when the payments were due, but didn’t come through. Due to this default, on June 6, the NAVs of at least 104 debt and hybrid funds declined. On June 26, a small-sized credit-risk scheme lost around 26.5 per cent when one of its holdings got downgraded.

Surge of inflows chased debt scrips

Although the chase for yields had started earlier, fund industry officials say it intensified sometime after demonetisation. In November 2016, after the government of India banned high-value currency notes, people deposited large sums of money in banks, which later got invested in financial instruments such as mutual funds. While investors poured funds into equity schemes through systematic investment plans, they also parked sums in debt funds as alternatives to bank fixed deposits, as the latter’s rates decreased due to the massive inflows into bank deposits. In 2017, debt funds saw a net inflow (more money came in than went out) of Rs 42,755 crore.

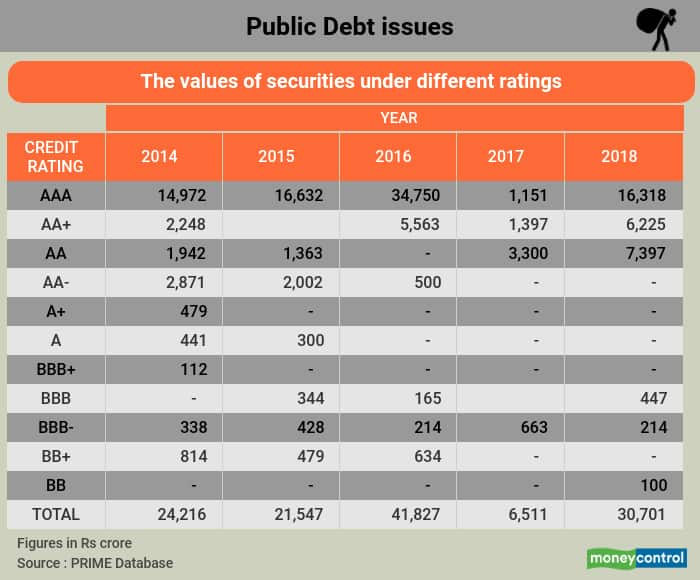

High inflows into debt schemes meant that fund managers got a bit adventurous and invested in instruments with weaker credit profiles. According to figures from PRIME database, the public issuances of AAA-rated scrips (the ones with the highest credit rating) fell to Rs 1,151 crore in 2017, as compared to Rs 34,750 crore in 2016. Issuances of AA+ credit rated securities also fell. On the other hand, Rs 3,300 crore worth of instruments with AA ratings were issued in 2017 as opposed to none in 2016.

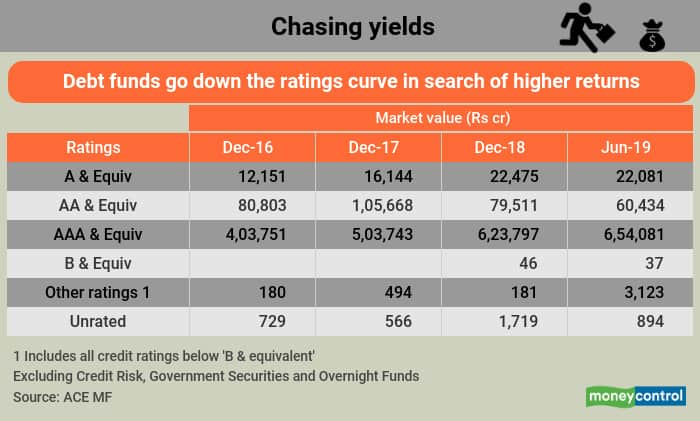

The heavy inflows into mutual funds also nudged fund managers to take the extra bit of risk to get a kicker in returns. Many fund houses started investing in the debt instruments of companies that came with a weak credit rating, but those were thought to be well-managed. According to ACE MF data, debt funds’ investments in securities rated ‘AA and equivalent’ went up by the end of the year 2017, as opposed to the previous year. Debt funds’ investments in ‘A-rated and equivalent’ instruments were also higher than earlier.

Ten of India’s largest fund houses had invested in Essel Group companies by the end of December 2018. This was a month before the Essel group crisis happened, with a combined exposure of a little over Rs 8,000 crore, as per Morningstar data. A total of 21 fund houses had invested in the troubled Reliance ADAG companies as of March 2017, with a collective exposure of around Rs 11,322 crore. A total of 15 fund houses were invested in IL&FS and its group companies by the end of August 2018, just as the group had begun to unravel, with a combined exposure of around Rs 4,461 crore.

“Some fund managers did not really understand the ‘risk’ in many investments where they invested. But the credit crisis has now alerted them to what risks can do, if not managed well,” says Deepak Chhabria, chief executive officer, and director, Axiom Financial Services Ltd., a Bengaluru-based distributor of financial products.

The silver lining

Debt funds may have gone through severe turbulence, but experts say that they should not be completely avoided. Srikanth Bhagavat, managing director, Hexagon Capital Advisors Pvt. Ltd, which runs Hexagon Wealth, analysed the one-year and three-year rolling returns of credit risk funds. One-year rolling returns are a series of one-year returns over a long period; rolling returns are meant to show a pattern. For his study, he took 15 of the largest credit risk funds. His study points out that over a one-year rolling period, credit risk funds are volatile, as indicated by a figure called standard deviation. The average one-year return of these funds was close to 8 per cent. On an average of 22 time periods, these funds gave returns of less than 7 per cent.

But if you had held credit risk funds for a period of at least three years, things would have evened out. The average return rises to 9 per cent. Volatility, as measured by standard deviation, goes down. And here’s the clincher: unlike the one-year time periods, when some credit risk funds lost money, over a three-year period, not a single credit risk fund from this set witnessed any erosion in NAV. Of course, that is no guarantee on future returns. Besides, this is a limited set, not the entire universe of credit risk funds. “But there is a method to madness,” he says. “Credit risk funds are not throwaway funds, but investors and advisors should understand the risk and volatility that come with them and then invest accordingly,” Bhagavat adds.

“Investors also must accept that in a market-related product, you cannot be extremely rigid about the time you wish to withdraw money. If after three years, you plan to exit and if at that time a credit event blows up, you have to extend your withdrawal time by a few more months till the issue gets resolved. That flexibility is necessary,” adds Chhabria.

In the meantime, SEBI has also revamped the investing norms of debt funds. Apart from standardising rules on how fund houses had to deal with downgraded securities, nudging them to side-pocket the infected part of the portfolios and pouring cold water over stand-still agreements, SEBI has also placed new restrictions on underlying investments to ensure that funds do not go overboard in investments that could potentially blow up later.

Vijay Venkatram of WealthForum is hopeful of the future. “This was a first full-blown credit crisis. Our learnings on how to manage public money in credit cycles has just begun. There are lessons to be learnt here; not to go over-board in weak credit companies, not look at just yields but also look at overall portfolio. Whether or not funds should involve riskier products in short-term debt funds is something I am sure the MF industry will surely think about,” he says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.