Union Budget 2021 is all set to hit the retirement corpuses of individuals who rely almost entirely on Employees’ Provident Fund (EPF) for their retirement needs.

Finance Minister Nirmala Sitharaman has proposed to tax interest income on EPF contribution exceeding Rs 2.5 lakh a year from April 1. It’s not only affluent individuals with basic salaries of around Rs 21 lakh or more per annum who will be affected, but also employees who invest more than 12 percent of their basic voluntarily in the scheme (VPF).

Such employees can choose between two options. They can continue with EPF whose post-tax returns work out to 5.8 percent annually assuming highest tax bracket and 2019-20’s rate of 8.5 percent. It is still higher than what 5-10-year fixed deposits offer currently. Alternatively, they can look at moving the ‘excess’ contribution to other instruments such as Public Provident Fund (PPF), equity mutual funds and National Pension System (NPS).

At present, PPF yields tax-free return of 7.1 percent. However, lower interest rates in the system mean that PPF and EPF rates might not be sustainable over the medium-to-long-term. They could see a reduction when the central government reviews the rates. Small saving scheme interest rates, which includes PPF, come up for review every quarter, while EPF interest is declared at the end of the financial year.

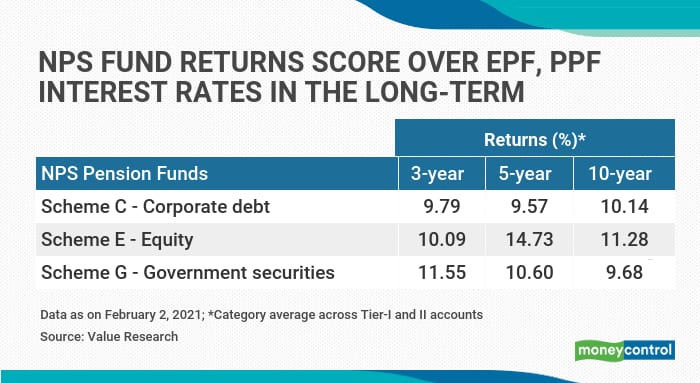

NPS is a market-linked retirement instrument where returns across its government securities, corporate debt and equity schemes are currently higher than EPF interest rate, as per data from Value Research (see table). However, EPF is tax-free at all stages – investment, accumulation and maturity – at the moment. NPS, on the other hand, does not entirely enjoy EEE (exempt-exempt-exempt) tax benefit. NPS contribution is eligible for deduction of up to Rs 1.5 lakh under section 80C, besides additional deduction of Rs 50,000 under section 80CCD (1B). At maturity, you can withdraw up to 60 percent of the corpus tax-free, but the balance 40 percent has to be compulsorily converted into annuities. This annuity income – or pension – will be taxed as your regular income during your retirement years. You will also have to be prepared to stomach market volatility during the investment period.

Take into account these risks and rewards of the new-age pension scheme before making your decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.