Insurance ombudsman offices across India have started admitting policyholder complaints that involve compensation claims of up to Rs 50 lakh.

Until November 10, when the finance ministry amended the insurance ombudsman rules, the maximum compensation that these offices could award to policyholders was capped at Rs 30 lakh.

Industry watchers and insurance ombudsman officials had, in the past, pointed out the need to enhance this limit. This is because many policyholders today buy term insurance, health insurance, critical insurance and personal accident policies with sums assured of over Rs 1 crore.

As per a study conducted by insurance broking and online aggregation firm Policybazaar.com, the most preferred cover amount for high networth policyholders was Rs 1.75 crore in the financial year 2022-23.

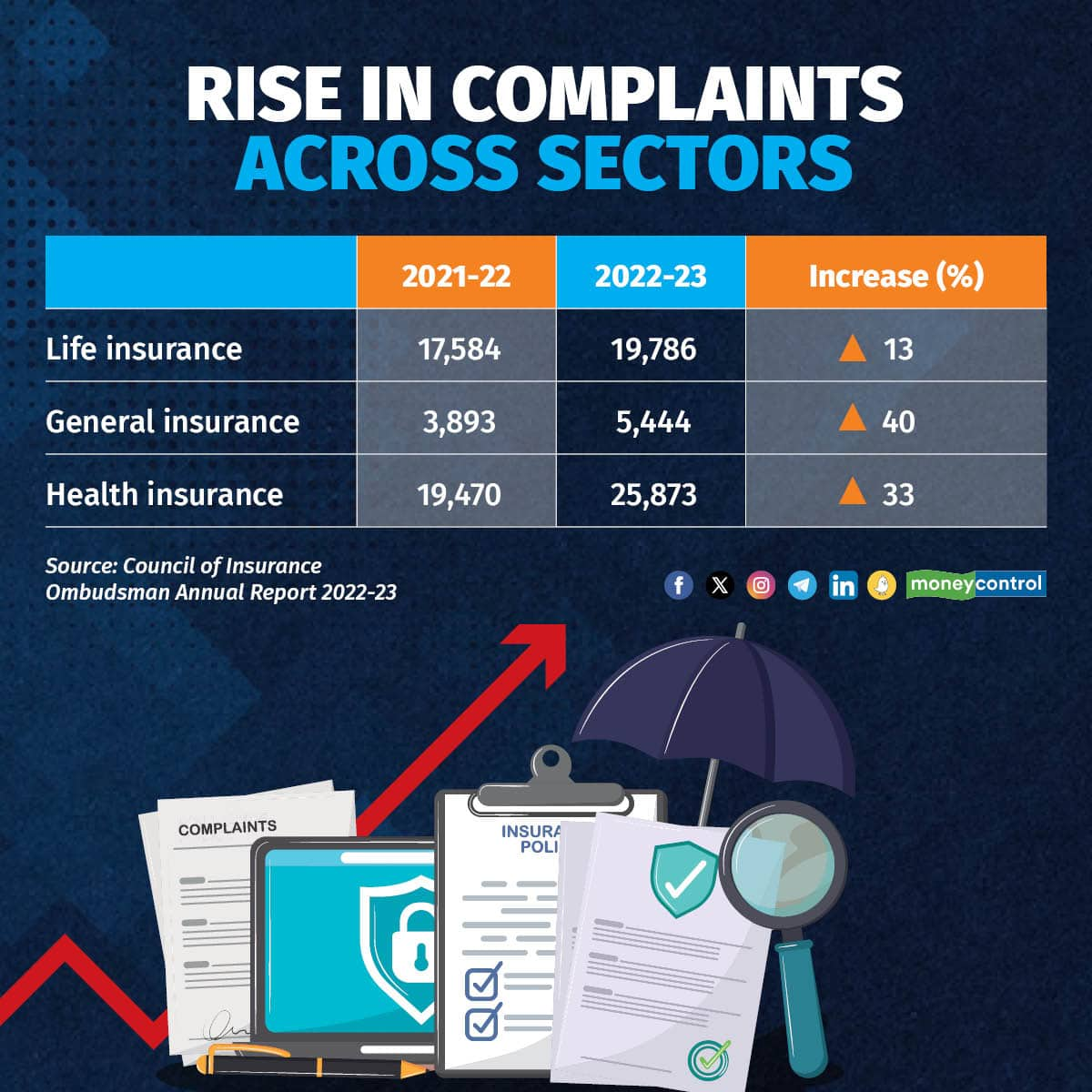

Also read: Why policyholders are unhappy with insurance companies

Higher value claims under the ombudsman ambit now

Rising disposable incomes, coupled with an increase in awareness around the importance of pure protection term cover to secure the financial future of dependents and affordable premiums, have spurred many to buy high-value term insurance policies.

Those who cannot approach insurance ombudsman offices have to knock on the doors of consumer courts for relief. “The increase in limit is a very positive move. This will ensure quicker resolution of even high-value death claims. Else, such individuals have to approach consumer courts, where, in our experience, the resolution time ranges from 1-2 years. At the ombudsman level, the resolution comes through in three months,” says Shilpa Arora, Chief Operating Officer, Insurance Samadhan, a firm that assists policyholders wjth getting their grievances against insurance companies resolved.

However, many believe that customers are better off taking their grievances directly to consumer courts. “They are more likely to get satisfactory resolution and compensation through consumer courts,” says consumer activist Jehangir Gai.

Claim rejected? Escalate the matter to ombudsman offices

Policyholders need to know that in the case of claim rejections, push-back can ensure that the claims are settled to their satisfaction. If you are unhappy with your insurer’s actions – rejection of your grievance or failure to respond – you can file a complaint with the Insurance Regulatory and Development Authority of India (IRDAI) and insurance ombudsman offices in your city.

Also read: Five common reasons for policyholders to be dissatisfied with insurance companies

You can either reach out to the offices in your city or jurisdiction or take the online route (www.cioins.co.in/Complaint/Online) within a year of your insurer rejecting the complaint.

Before approaching insurance ombudsman offices, write to the insurer and wait for 30 days. If the company fails to respond, reach out to ombudsman offices. These regulator-mandated adjudicating authorities have to dispose of the case within 90 days of having received it.

The insurance ombudsman will, after examining arguments on both sides, pass an order. If you are not satisfied with the verdict, the next step is to approach consumer courts. However, the order will be binding on insurance companies.

Also read: Moneycontrol-SecureNow Health Insurance Ratings: Your guide to picking the right policy

Penalties for non-compliance

Insurance companies are required to implement the ombudsman’s order within 30 days. If they do not, policyholders need to alert the ombudsman offices again. In such cases, insurers have to shell out penal interest (two percentage points over the prevailing bank rate), as per the Protection of Policyholders Regulations, 2017.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!