Did you buy iPhone 17 or any other device that cost you a heap? It makes sense to get it protected.

The phone warranty will cover you for any manufacturing defects but if you drop your it and break your screen or if your phone is water damaged, you will not get coverage.

Here is where phone protection plans come in. A damaged iPhone 16 screen, for instance, can set you back by Rs 25,000 to Rs 30,000 but if you have Apple Care, the repair can be done at a much lower price.

"For many customers, the most significant benefit of screen damage and liquid damage protection is not having to 'worry'. Whether it’s a minor issue or a major breakdown, they know authorised service professionals will handle it promptly. This assurance creates a stress-free ownership experience,” said Mayank Gupta, co-founder, Zopper, which partners with retailers to provide comprehensive protection to smartphones.

The Comprehensive Care Plan from Zopper is exclusilvely for iPhone 17 series and is priced almost one third of Apple Care + at Rs 4,999- Rs 6,999 two years of coverage, including accidental and liquid damage, device malfunctions, genuine Apple parts, and authorised service repairs. The important point to note here is it is only available for iPhone 17 series .

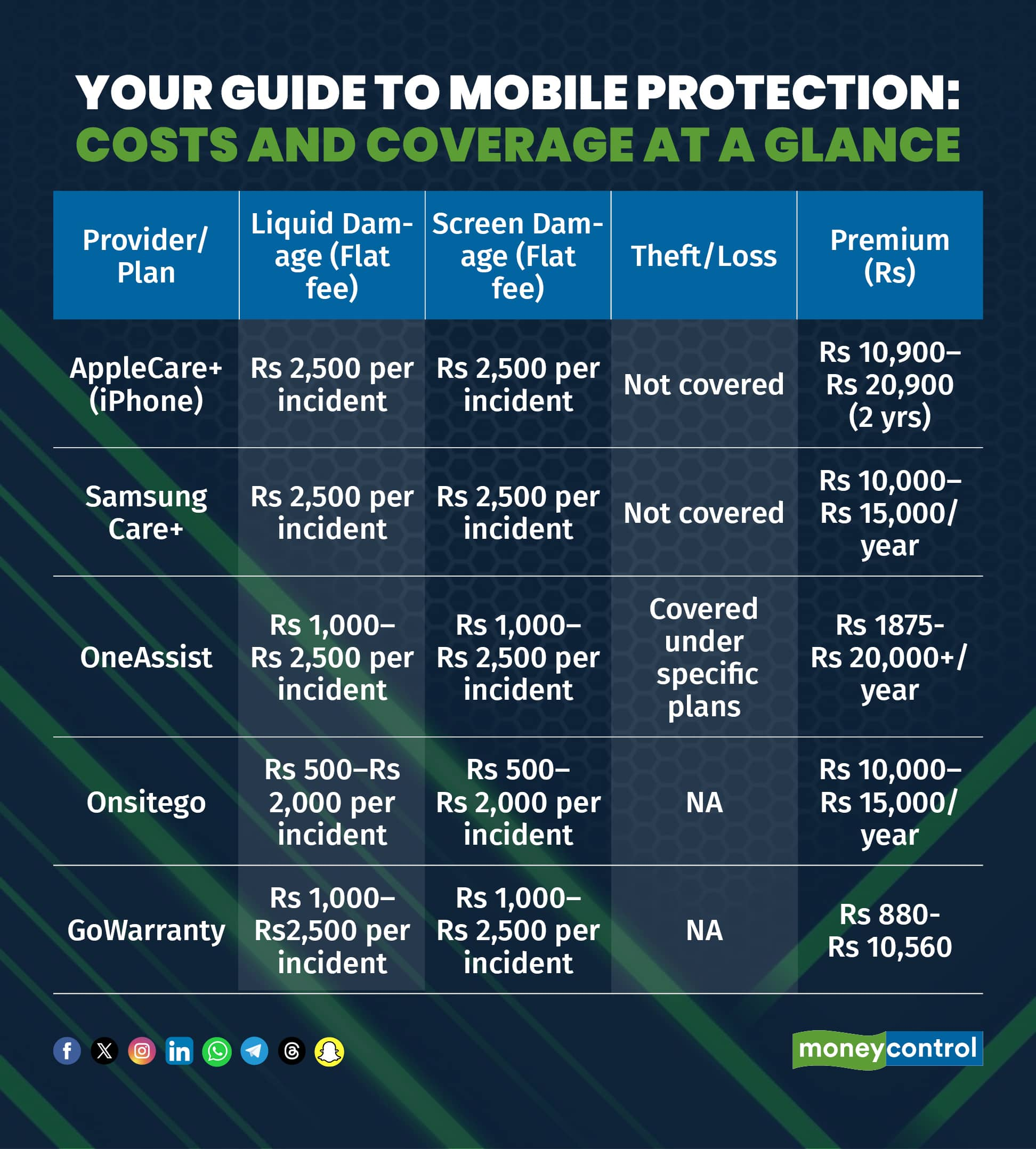

Here is a lowdown on coverage offered by manufacturer (AppleCare+ and Samsung Care+) or third-party for screen, liquid and other damages.

Screen damage coverage

Typically, phones come with toughened glass but they are still susceptible to getting damaged if the phone drops from a height. Screen damage protection covers incidents such as cracks, shattering, or scratches resulting from accidental drops. If you have a protection plan, you can save a lot of money.

Liquid and accidental damage

Most flagship phones today come with water-resistant or waterproof features but with age, they may become susceptible to liquid damage. Liquid damage coverage safeguards against spills, rain exposure, or immersion accidents that could render a device unusable. Most plans combine screen and liquid damage in a single policy.

Such plans mostly activate upon purchase, limit claims per period and require enrollment within a short window after buying the device.

Theft/ loss

Most of these plans do not cover theft or loss of your phone. So you need a separate cover. Digit Insurance, for example, provides coverage for theft or loss. In this case, the amount of phone value refunded decreases as the phone grows older. Bajaj Finserv also offers a plan that offers additional theft insurance benefits.

Key features and enrollment

When you purchase a phone, you need to purchase and activate these plans immediately upon purchase. You can also purchase these plans online. You can even purchase them on EMI on sites such as Amazon and Flipkart.

In most cases, they provide doorstep repair and some may also provide you with an alternate phone to use while the phone is in repair. Some of these plans like AppleCare also come with on-call technical support.

“Before purchasing such protection covers, it is essential to carefully review the coverage details and read the terms and conditions to make sure they meet your needs. Verify that the claim process is straightforward and the company is offering the coverage,” Gupta said. Check whether the repairs are done at authorised service centres. Sometimes, the number of claims might be restricted to two to three a year.

It is also important to understand what is excluded. For example, cosmetic damage is not covered. This means that surface-level issues like scratches, scuffs, dents, or discoloration that do not affect the functionality of the phone are not covered.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.