A social media post by an aggrieved mutual fund (MF) investor went viral over the weekend of June 22-23 when the user claimed that investments made on fintech platform Groww never made it to the fund house.

Groww responded, clarifying that no fraud occurred. The platform explained that the customer's money was not deducted and that the MF transaction did not happen at all.

The issue prompted a sharp reaction on social media, highlighting investors' concerns over their investments on wealth-tech platforms. So, what are the key learnings from here?

What’s the issue?A Groww user had invested in a Parag Parikh Mutual Fund scheme in 2020. According to the user, the transaction was successful, and was assigned a folio number. However, while trying to redeem the amount recently, the user found out that no investment was registered in the fund.

Groww later responded that the customer's account was showing an incorrect investment due to a reconciliation issue. “The customer never made this investment, and no money was deducted from her bank account. We deeply regret the reporting error and have resolved the issue,” the platform’s statement read.

Also read | The great, big WhatsApp stock market scam and how to avoid it

“To ensure that the investor doesn’t get anxious about the claimed amount, we have credited it to the investor on a good faith basis. We have also asked the investor to provide the bank statement showing the debit of the amount claimed to have been invested. This will facilitate our scrutiny, as well as that of our regulators,” Groww further said.

How did it happen?The first thing to note here is that MF-related regulations have been updated and made more comprehensive in the last four years, since the investment was made by the cusotmer.

According to a SEBI (Securities and Exchange Board of India) rule, which was introduced in February 2021, the applicable NAV (Net Asset Value), when purchasing units of a MF scheme, is effective only after the availability of the funds in the bank account of the MF.

In MF schemes, the applicable NAV is based on the cut-off timings of the purchases, irrespective of the amount of investment.

Before that, a folio could have been created without payment, if the amount was less than Rs 2 lakh.

“Today, if the payment does not come through to the MF, which could be for any reason, be it cheque bounce, rejected payment or failed transaction, an RTA (Registrar and Transfer Agent) sends the reverse feed for the said units. The said units become zero and the folio will not show the units,” said Amol Joshi, Founder of Plan Rupee Investment Services.

Also read | LIC warns policyholders over alleged offers to acquire existing policies

This Groww issue might have occurred in two ways – either the RTA failed to send the reverse feed or the platform’s system failed to account for the reversed units, and the units keep on showing in the client’s dashboard.

However, in this case, Groww has confirmed that the customer's account was showing an incorrect investment due to a reconciliation issue.

Can such cases happen again?In MFs, the units are allotted, based on the time when the money reaches the AMC account. For that to happen, the money trail goes through multiple banking channels - sponsor bank, nodal bank, and eventually into the account of the AMC.

According to Joshi, after February 2021, it is highly unlikely that such cases would have occurred as MFs now allot units only after they get the money into their account. “SEBI has plugged that earlier gap when units were allotted even if the money was not deposited,” he said.

However, some experts are of the opinion that these issues might happen if the platform that you have been investing with has reconciliation or IT issues.

Key learnings for investors

While a repeat of the Groww case is unlikely today with the regulators filling in the gaps with regards to the payment trails and the realisation of the NAV units in the client’s account, the role of investors doesn’t stop once they have made the payment.

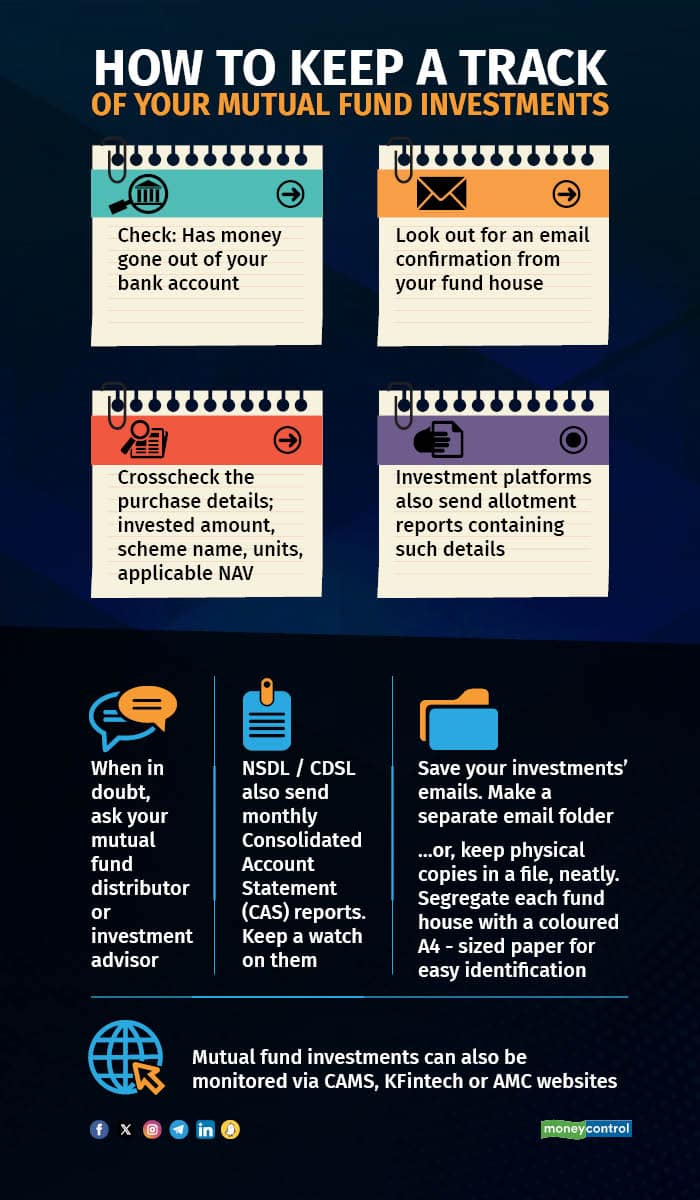

“When investing via a platform or distributor, investors receive 3-4 confirmations. The first step an investor must take is to check the money deduction message from the bank. An MF house also sends the statement of purchase on mail,” said Ravi Kumar TV, founder of Gaining Ground Investment Services.

Also read | Front-running case: Is Quant Small Cap Fund liquid enough?

Investors must crosscheck the purchase confirmation emails sent by MF houses, which list details of the invested amount, the scheme in which the amount is invested, number of units allotted and the NAV at which the units have been purchased.

The investment platforms also send an allotment report containing such details to the investors.

Even distributors have their own portals, where investors can check their investment details.

Further, the National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL), which are central securities depositories that hold electronic securities for stock market investors, also send monthly Consolidated Account Statement (CAS) reports, which capture all the investments linked to your PAN.

A warning for investorsAn MF distributor said on condition of anonymity that in the Groww case, it is still unclear how this came to be. “It is generally easy to blame an issue on a computer glitch; the bigger concern is that the issue went undetected for four years,” said this distributor.

Also read | Quant MF under scrutiny: What is front-running and how does it hurt investors?

The person suggested, “When the investment mail comes to you, maintain a separate folder for the investment reports. Preferably, download and save them on your system. Also, there is no harm in taking a printout and keeping a physical copy. Second, match your investments with NSDL/CDSL CAS reports. Regularly keep a watch on your investments.”

For aggrieved investors, the appropriate recourse is to raise their concerns with their respective investment platforms and the SEBI Complaints Redress System (SCORES), an online platform that enables investors to file complaints against SEBI-regulated entities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.