The high returns that debt funds enjoyed in 2020 may come to an end soon. The massive government borrowing program announced in Budget 2021 is expected to increase bond yields, due to an over-supply of government bonds issuances. When bond prices decrease, yields rise as they share an inverse relationship. Given this backdrop, it’s wise to allocate a part of your debt investments in avenues that come with 1-3 years’ maturity, and can help mitigate interest-rate risk. Kotak Bond Short Term Plan (KBST) is one such scheme that invests in this bucket and has a proven record. Here’s what it’s all about.

The schemeKBST is a short-term debt scheme that invests in securities in such a way that the entire portfolio’s Macaulay duration remains between 1-3 years. Typically, short duration debt schemes keep their portfolio duration between one and three years. Deepak Agarwal has been the fund manager since 2013.

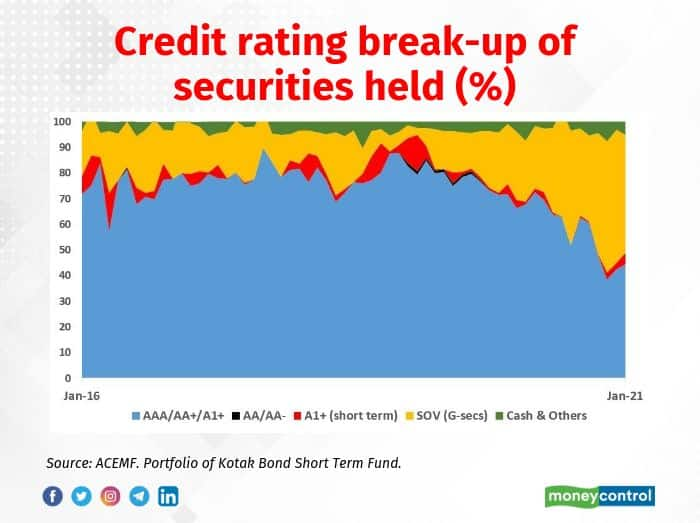

The fund focuses on safety, liquidity and returns while managing the portfolio. In its January 2021 portfolio, the fund holds 95 per cent in the highest rated corporate bonds and G-secs (government securities) and the balance in cash equivalents.

“Our investment strategy largely focuses on high-grade bonds. The entire portfolio is invested in AAA-rated securities, despite the scheme’s offer document allowing it to hold bonds of investment grade (securities rated ‘BBB- and above),” says Lakshmi Iyer chief investment officer-Debt & Head-Products, Kotak Mahindra AMC explains.

To benefit from falling yields, the fund increased its allocation to government securities in the last 15 months. It almost halved its exposure to corporate bonds in this period.

Apart from investing in the highest-rated bonds, the scheme has also reduced its risk levels by ensuring that it doesn’t invest a lot in any single group. As per its latest available portfolio, the most it has invested in a single corporate group is 7.2 percent. The regulator, Securities and Exchange Board of India (SEBI), allows a limit of up to 20 percent.

The fund’s duration strategy is actively-managed.

What would be the fund’s strategy in the future? Iyer says that she doesn’t expect interest rates to go down any further for at least the next three to four quarters. “It makes sense for investors who have a 12-24 month time horizon to invest in short to medium kind of strategies, which will have lesser volatility,” she says.

Short-term bonds return investors’ funds quicker than long-term securities. It’s, therefore, easier to hold them until maturity.

Also, in a rising rate scenario, the proceeds of the short maturity papers can be redeployed in bonds with higher yields. This will improve the fund’s performance.

“It's a very curtailed strategy, which reduces volatility and offers you carry (capital appreciation) also. Liquid funds typically offer returns close to the reverse repo rate of 3.35 percent currently. Whereas a well-managed AAA-rated strategy with a duration bandwidth of 1.5-2.5 years yields you 5.2 percent to 5.3 percent,” adds Iyer.

Investors with a very low risk appetite or retirees can park a portion of their investments in these funds. “If you have short term liquidity needs or want to rebalance your asset allocation, then you can consider adding short term debt funds to your portfolio,” says Harsh Jain, Co-founder and COO, Groww.

But short-term funds too can hold lower-rated bonds, so a credit quality check is necessary even in short-term bond funds.

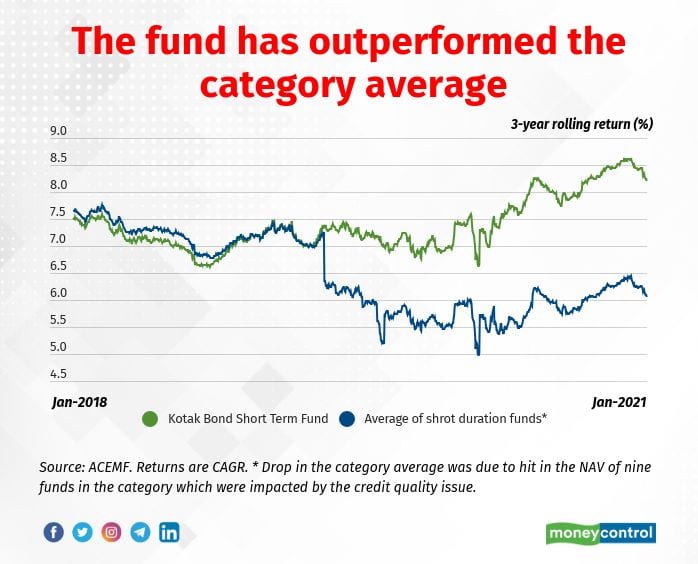

Steady returnsKBST has been a steady performer within the category. Do not expect top-of-the-chart returns from KBST. Some schemes in this category may outperform on account of their investments in slightly lower-rated bonds. In the last one year, of the 26 schemes in this category, one-third of the schemes had allocated atleast 5 percent to lower-rated bonds (rated AA & Below).

Despite a conservative portfolio, the fund has given healthy returns and outperformed the category average over the past one, three and five-year time periods.

A scheme’s rolling returns can help assess its consistency. We took the three-year rolling returns over a total time period of five years. Even with this filter, KBST did well, outperforming the category average.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.