India’s largest insurer – Life Insurance Corporation of India (LIC) – is expected to file its IPO (initial public offering) prospectus soon. While LIC is ironing out the finer points before launching the mega IPO (expected to be worth over Rs 1 lakh crore), brokers are getting ready to cash in on the huge interest from LIC policyholders.

The government’s decision to create a 10 percent policyholders’ quota in the IPO – a first-of-its-kind – and the possibility of a discount on IPO price, has pushed several policyholders to open their demat accounts. A demat account is a must to invest in any IPO.

Brokerages believe that the LIC IPO may help them to get several new customers, as many first-time capital market investors will be opening their demat accounts just to invest in the IPO.

“We expect 10-30 lakh new demat accounts to be opened just to participate in the LIC IPO,” says Prakarsh Gagdani, chief executive officer of discount broker 5Paisa.com, an IIFL subsidiary.

However, the final numbers could beat the estimates as Gagdani admits that if policyholders are given a discount, then several of them would want to apply for the IPO.

LIC penetration vs broking penetrationLIC has over 25 crore policyholders, compared to 8 crore existing demat accounts. As several of these will be first-time investors in stock markets, brokers want to simplify the investing process for them.

“We are making our user interface simple so that these investors can easily open their accounts,” says Ajay Menon, MD and CEO-broking and distribution, Motilal Oswal Financial Services (MOFSL).

“Penetration of LIC is much more than that of broking industry. So, this will help us to get new customers. We are getting in touch with policyholders as well as LIC agents,” Menon adds.

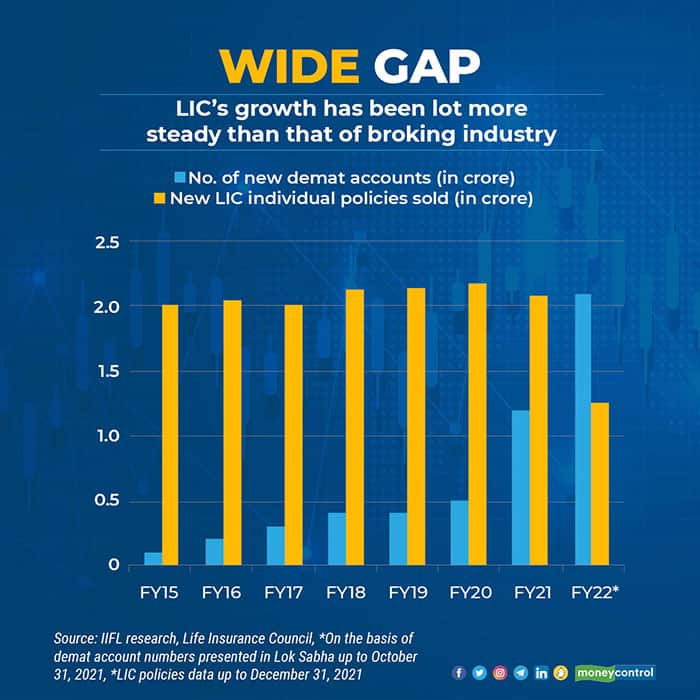

Over the last seven years (financial years 2015-2021), LIC, on an average, sold 2.08 crore new individual policies. On the other hand, demat accounts have only now started to see sharp growth amid the COVID-19 pandemic.

In financial year 2020-2021, the number of demat accounts grew by 29 percent year-on-year and in the current financial year 2021-2022 (up to October 31, 2021), the number has grown by 37 percent.

Also read: LIC IPO: Decoding the metrics, products and terms in life insurance that matter for investorsOnline investing platform Groww is also gearing up for the LIC IPO. We have built our systems to support the additional technicalities (policyholder quota) of the IPO. We are seeing lot of interest across our YouTube and social media channels,” says Harsh Jain, co-founder of Groww.

No missing out on a big brandLIC has been a household name for long. The insurance company has 61.4 percent market share of new business premiums in the life insurance space as of December 31, 2021 (data from insurance regulator IRDAI). This is 1.59-times the market share of the entire private sector life insurers. Compared to the second-largest insurer SBI Life, LIC's market share is 6.7-times.

LIC agents say policyholders don’t want to miss out on such an investment opportunity and want to make sure that they fulfil all the requirements.

“Every day, we are seeing 200-300 PANs getting updated in our client database. We currently service over 45,000 policies. Since the last two months, our offices in Maharashtra have been receiving an average of over 30 calls and visits from those keen on participating in the IPO,” says Bharat Parekh, a Mumbai-based LIC agent.

LIC has told policyholders to update their PAN and demat details.

Some are even buying new policies just to be eligible for the IPO. “We primarily deal with high networth individuals. Many of them are coming forward to buy LIC policies for their family members so that the entire family is eligible for the preferential allotment,” he adds.

These policyholders would also need handholding as several of them are likely to be older in age.

“Our entire family will be investing in LIC IPO. In fact, my 78-year-old mother-in-law will be opening a demat account specifically to invest in the public offer. It’s a highly trustworthy brand and having been LIC policyholders over the years, we want to now be part of its IPO too,” says Kirit Joshi, 51, Nagpur-based businessperson.

Sonal Mehta, 55, home-maker, says all five members of her family, including her elderly in-laws, want to participate in the LIC IPO. She adds that her household help is a LIC policyholder and is also aware of the IPO. “If she takes the call to invest, I plan to help her open a demat account,” she says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!