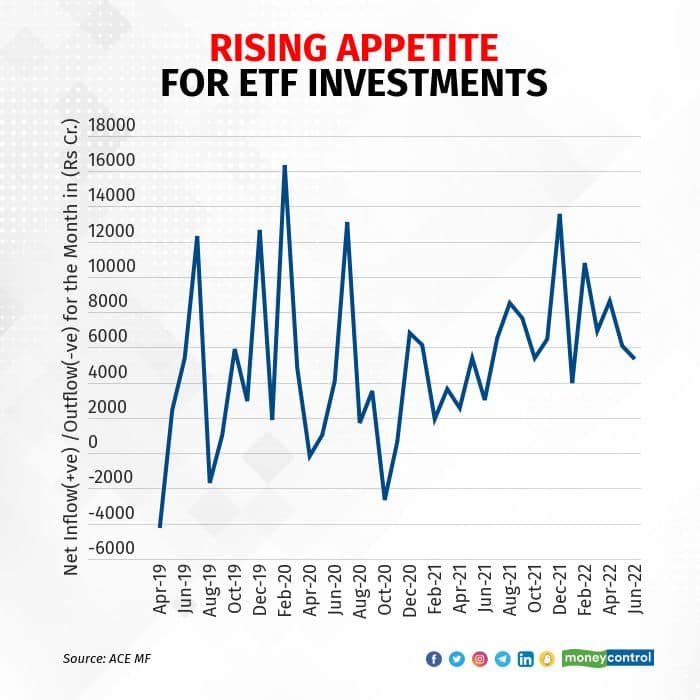

Exchange-traded funds (ETF) are gaining popularity in India. And the capital market regulator, Securities & Exchange Board of India (SEBI), is watching the space closely. In May 2022, SEBI came out with a list of reforms to make ETFs more accessible to investors, and more transparent as well. One of the measures that it announced was the compulsory disclosure of every ETF’s iNAV.

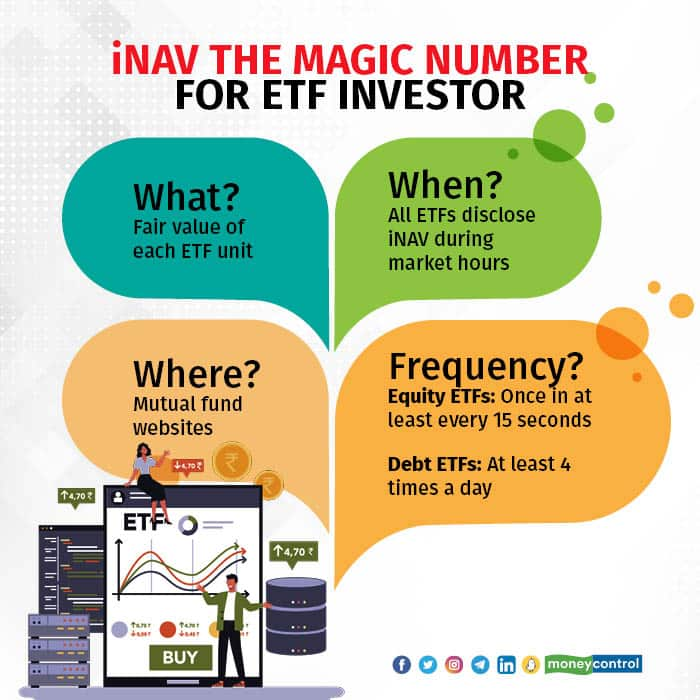

It’s quite simply an ETF’s net asset value (NAV), but disclosed through the course of the day, compared to being disclosed at the end of the day for mutual fund (MF) schemes, as has been the practice of the MF industry for many years. Here’s how an ETF’s iNAV can help you make a better decision on whether you should buy or avoid a scheme. And here is how you can make the most of the additional set of information.

Checking your ETF’s worth

The biggest challenge in buying or selling an ETF is its liquidity. Many ETFs in India are illiquid or infrequently traded. The price you pay to buy an ETF is known as the market price. This gets determined by its demand and supply; the number of buyers who wish to buy that ETF compared to the number of sellers out there. If an ETF is illiquid, you could end up buying it at a price that is far from its actual net asset value (NAV; a scheme’s true value). But NAV is usually published at the end of the day. You obviously cannot wait till after the market hours to check the NAV and then decide to buy or sell it.

That’s where the iNAV comes in. The iNAV of equity ETFs have to be disclosed with a maximum lag of 15 seconds, and for debt, a minimum of four times a day. The fund houses update the iNAV for equity funds with a lag of around 10 seconds. The iNAV of ETFs are available on the respective fund house’s website in the ETF section or in the NAV section. The iNAV so declared are time-stamped and keep getting updated.

Better prices and transparency

SEBI has also given clear instructions to fund houses to appoint at least two market makers, and further defined the framework for market making in the units of ETF. Put simply, the market makers offer two-way quotes — both bid and ask, for the ETF units. This ensures ample liquidity.

The regulator has also asked the fund houses to accept buy and sell orders directly only when the transaction size exceeds Rs 25 crore. This order will be implemented from November 1, 2022. More liquidity thanks to market makers and more transparency, thanks to iNAV disclosure will enhance the liquidity of ETFs and offer you a helping hand.

And last but not the least, every passive fund, including ETFs, publishes tracking error. This is the difference between returns given by the fund and that given by its benchmark index. The lower the tracking error, the better for your fund, because a low tracking error means that your fund manager is closely mimicking the underlying index.

How to use iNAV to your advantage?

Except the largest ETFs in India, many are illiquid, with the total daily volumes traded not being sizeable. In such times, a look at the iNAV and tracking error can be of help. Choose a fund with low tracking error.

iNAV of the ETF gives you an idea about the fair value of the units of the ETF at a given moment in time. As the markets are dynamic, iNAV prices keep changing. Also, iNAV is a fund’s truest value, since it does not account for other charges and taxes that get paid while creating ETF units. These include securities transaction tax (STT), brokerage, stamp duty, depository charges, etc. To be sure, an ETFs creation is a process whereby a market maker or a buyer gives the underlying basket of shares to (and in exactly the same proportion as it is required for) the mutual fund, in exchange of ETF units.

Siddharth Srivastava, Head-ETF Products, Mirae Asset Global Investments, says, “Around 13-15 basis points towards the cost associated with creation of ETF units gets added to a scheme’s actual NAV.”

After you shortlist the schemes with the lowest tracking errors, check their iNAVs and market prices at which they are available. The smaller the difference between these two prices (iNAV and market price), the better is your ETF.

Limit order work better than market orders

There’s more to be done before you buy ETF units on the exchange. To make sure you’ve got the buying price just right, place a limit order.

In simple words, a limit order lets you buy or sell a specified quantity on the stock exchange at a price specified by you. On the other hand, a market order is one which lets you transact at prices prevailing on the market.

“Always place a limit order so that the order gets filled either by other investors’ best counter offers or by the market makers around the iNAV,” says Srivastava.

If you are keen to transact a large quantity, you should stick to limit orders. Placing a market order in such cases may lead to a situation where the units get transacted at a price far from the fair price, giving you a raw deal.

Placing a market order can also increase your impact cost; the variance in market prices at which you buy or sell your entire ETF quantity.

“Depending on the time elapsed between the time at which the iNAV was announced and the time at which you place the order, the prices on the exchange may change. Impact cost and market makers’ spread also can change the prices, though it is a minuscule component in most cases,” said a senior MF official, who was not authorised to speak with the media.

“Impact cost plays a big role while transacting in mid-cap and small-cap stocks and ETFs that invest in them. You have to be extra careful while transacting in mid-cap and thematic ETFs. Instead of getting into these trade execution hassles, one may be better off investing through the fund of funds (FoF) or index fund route, although both come with some extra cost,” says Jignesh Shah, founder of Mumbai-based Capital Advisors.

SEBI’s guidelines on iNAVs and other measures, excluding the minimum unit creation size, became operational on July 1, 2022.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.