Ever since I joined this industry way back in 2003, I have grappled with one question: does size of a mutual fund matter while taking investment or redemption decisions?

The size of a fund will never be static, as this will keep on changing as markets grow. Here we dwell primarily on equity mutual funds.

A few factors that play out as per the fund size are:

-Impact Cost

-Brokerage Cost

-Research Cost

-Over Diversification

-Expense Ratio

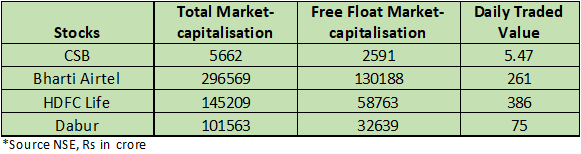

Impact Cost: When a fund of, say, Rs 5000 crore size wants to buy a reasonable quantity of a particular stock, it can trigger a price rise, resulting in a loss to its investors. As impact cost is incurred while buying, so can be the case while selling a large chunk of shares in the market. To give an idea, we have taken few stocks with different market capitalisation. Let’s say the fund manager of a Rs 5000 crore scheme wants to buy CSB stock to the tune of 2 percent holding, which is Rs 100 crore.

With a daily traded value of Rs 5.47 crore, it would be a herculean task to build the same allocation. Bharti Airtel might also take couple of days, even though it is part of large-cap stocks. But HDFC Life, with daily traded volume at Rs 386 crore, would be much easier to buy. This cost (price movement) that the fund manager pays while buying/selling to build allocation to a particular stock is called impact cost.

Brokerage Cost: There are different transaction costs that a mutual fund needs to pay, usally depending on its. At the AMC level, brokerage cost can be fairly low for larger funds. Smaller schemes may have to pay a higher proportion of brokerage cost.

Research Cost: When the size of a fund is large, it looks for newer stocks to invest.To increase coverage, more analysts may be required, thus increasing costs.

Over Diversification: With more number of stocks under coverage, there is a tendency to add more to the fund, thus resulting in laggards creeping in.

Expense Ratio: Fund houses are governed by SEBI on how much they can charge on schemes. As the AUM of the fund rises, the expense ratio keeps reducing. The sweet spot could be around Rs 5000 crore while comparing expense ratio across funds.

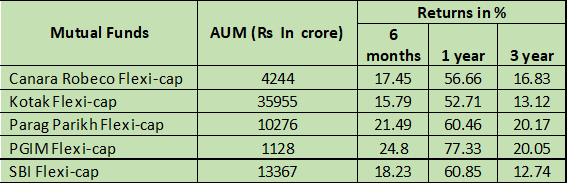

Here are a few flexi-cap funds, their AUM and returns over the past three years.

We have taken returns for up to three years as most of the funds in the industry have risen in size mainly over this period. Funds with a size around Rs 10000 crore and lower have been able to provide better returns than schemes above this size over the three-year tenure. Of course, there could also be many other factors that affect the performance of the funds but the size of a fund does matter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.