The number of complaints against digital lending apps has more than doubled to 1,062 in FY23, the finance ministry told Lok Sabha in July 2023. Further, as per the National Crime Records Bureau (NCRB), the total number of cyber fraud cases, which includes frauds committed through online apps, stood at 14,007 in 2021, as per the latest available data.

This is despite a crackdown by the government and the Reserve Bank of India (RBI) on illegal digital lending apps.

“Some fraudulent lending apps may be evading regulatory scrutiny and exploiting unsuspecting borrowers through deceptive practices,” said Rohit Garg, CEO and Co-Founder, SmartCoin, an app-based consumer lending platform.

The digital lending sector has grown manifold in recent times, attracting opportunistic fraudsters, leading to an increase in cases of fraudulent lending activities, he added.

“With rising complaints and fraudulent transactions the greatest obstacle digital lenders face is in winning the trust of their target customers,” said Rishi Agrawal, CEO and Co-Founder, TeamLease RegTech. Instances of fraud erode this very trust, with more and more people refraining from availing of digital lending services, he added.

Let’s look at the steps taken by digital lending apps to comply with the guidelines and secure customer data and privacy. Also, what digital lending borrowers should do in such a scenario.

Measures taken to crack down on illegal digital lending apps

The RBI has introduced a comprehensive legal framework to regulate the digital lending ecosystem. Regulated entities (such as banks and non-bank financial companies) that work with digital lending apps are required to conduct due diligence on such entities before entering into any partnership or arrangement and ensure that such platforms comply with the regulatory framework. “These include rules requiring full and transparent disclosure of credit products and interest rates, fair collection practices, and protection of borrower data,” said Shilpa Mankar Ahluwalia, Partner and Head-Fintech, Shardul Amarchand Mangaldas and Co.

Also read | Small loans have seen big growth, TransUnion CIBIL report reveals

For instance, digital lending apps are barred from accessing mobile phone resources, such as files and media, contact lists, call logs, and telephony functions, among others. Then one-time access can be taken for the camera, microphone, location, or any other facility necessary for the purpose of digital onboarding/ know-your-customer (KYC) requirements. Explicit consent of the borrower needs to be taken for such access. The borrower should be able to give or deny consent for the use of specific data. The borrower can decide to restrict disclosure to third parties, data retention, revoke consent already granted to collect personal data, and, if required, make the app delete or forget the data.

“The registered entities shall also provide a Key-Fact-Statement (KFS) to the borrower before the execution of the contract in a standardised format. They cannot levy any fees, charges, etc, which are not mentioned in the KFS to the borrower at any stage during the term of the loan,” Agrawal added. KFS provides details like the loan amount, rate of interest, loan tenure, the repayments due, fees and penalties a borrower might incur, etc. It also has the details of the third parties involved in the contract and the grievance redress officer.

How the RBI's Digital Lending Guidelines secure borrowers

The RBI's Digital Lending Guidelines have sought to strengthen the lender-borrower relationship in the digital lending space. It now seeks to ensure that the lender on record (i.e. the RBI-licensed bank or non-bank financial company that is actually granting the loan) controls and supervises all aspects of the borrower relationship. “While the customer onboarding and interface may be managed by a digital lending app or another technology platform, certain aspects (such as all fund flow and documentation) must now be directly between the lender and borrower only,” Ahluwalia said. This is a significant change from the earlier market practice where technology platforms were managing the end-to-end customer journey, she added.

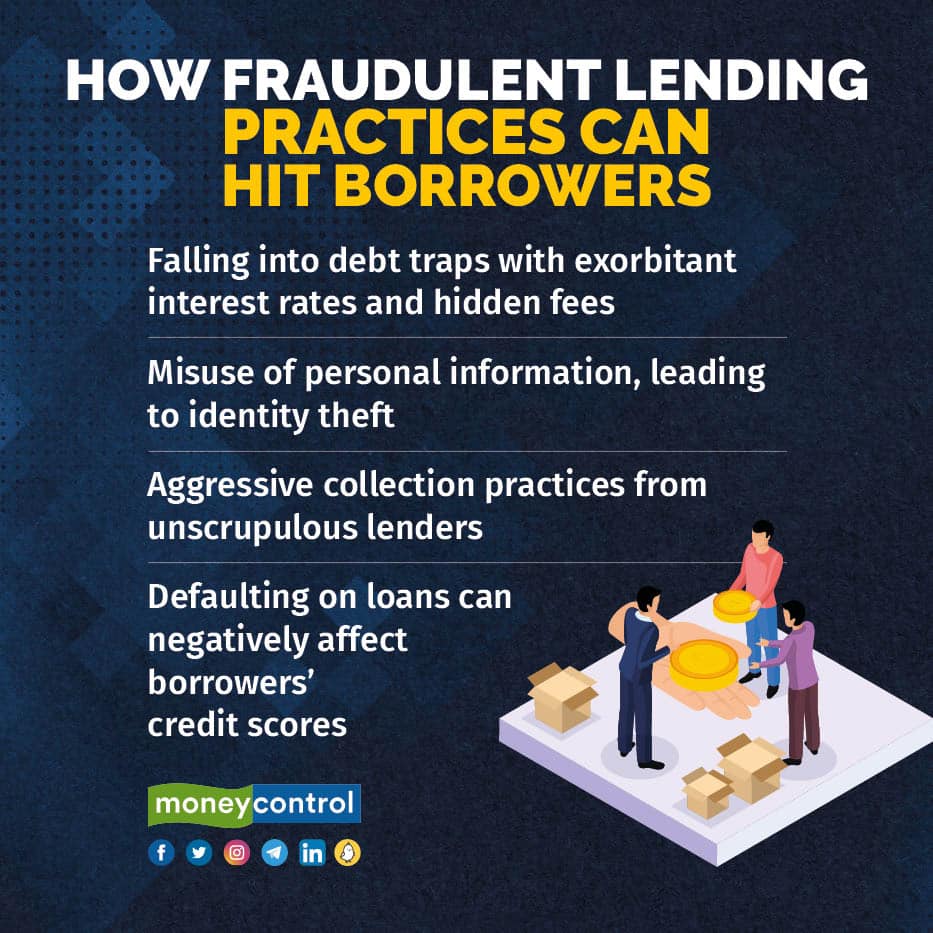

The guidelines enhanced transparency between lenders and borrowers. It discourages unfair lending practices and ensures unscrupulous lenders do not exploit the borrowers.

“The guidelines mandate the establishment of a proper grievance redressal mechanism, giving borrowers an avenue to seek resolution for any issues they face,” said Ahluwalia.

With increased transparency and fair practices, borrowers are better equipped to make informed decisions and avoid falling into debt traps.

Also read | Tapping an app for a loan? Beware of these fraud traps

Ways to identify regulated entities and illegal digital lending apps

The easiest way consumers can identify illegal digital lending apps is to conduct their own due diligence. As per the RBI guidelines, regulated financial institutions must provide a list of digital lending apps they have partnered with. Any lending app that claims to be associated with any bank/NBFC must be listed on the website of that financial institution.

“So, a simple background check will allow borrowers to ascertain whether a digital lending app is legal,” said Agrawal. He added that any lending app that wants to be available on an app distribution platform must provide the necessary licence and other documentation.

Further, digital lending apps are now required to display their lending licences for approval on the Play Store/ App Store, ensuring that only licensed entities can operate on the platform. Therefore, borrowers should verify the app's lending licence and regulatory status on the mobile app platform or official websites of financial regulators, such as the RBI.

Garg added that borrowers should be cautious of apps that promise unrealistically quick loans or require excessive personal data without adequate justification.

Furthermore, they should also take into consideration reviews and ratings, especially the red flags from other users to gauge the legitimacy and credibility of the lending app.

Also read | Age of fintechs: These financial intermediaries make life easier but there're caveats too

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.