Arbitrage funds have seen net redemptions of Rs 20,548 crore in the three months ended August 31, 2022. The outflow was huge for a category with assets under management of Rs 81,384 crore as on August 31, 2022. Does that mean investors should stay away from these funds or there are better times ahead?

Why the sell-offArbitrage funds are used by high networth individuals to park short-term money, given the equity taxation benefits they enjoy. Short-term capital gains on units held for less than one year are taxed at 15 percent in case of arbitrage funds. For the long-term capital gains, they are taxed at 10 percent. For non-equity (debt) schemes the gains turn long term only after one holds them for three years and are taxed at 20 percent post indexation. For short-term capital gains the slab rates apply.

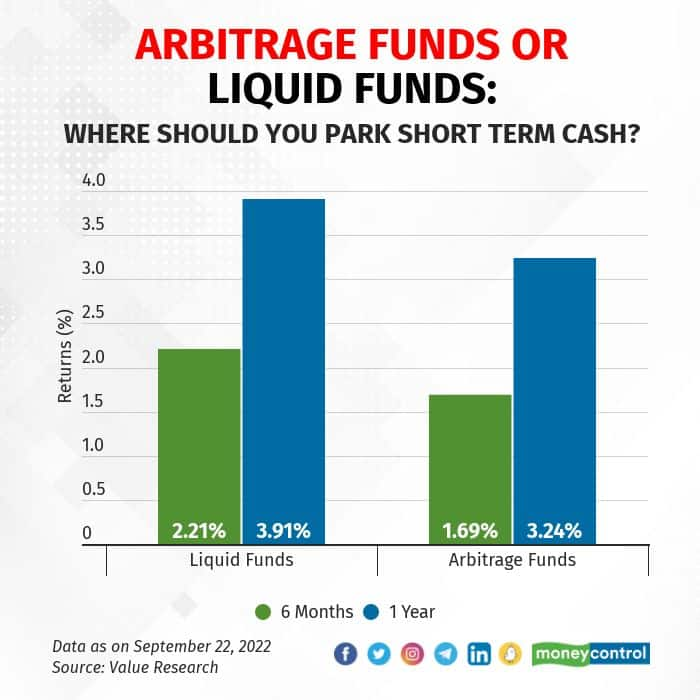

This makes investors compare the post-tax returns on both arbitrage funds and liquid (and other very short-term debt schemes) funds with each other. But there is a catch. Liquid funds offer better visibility of returns than arbitrage funds since liquid funds invest in very short-term money market instruments and arbitrage funds aim to capture spreads between cash market price and futures price. These spreads are volatile, depending on the stock market sentiment.

Although smart investors use arbitrage funds as a proxy for liquid funds on account of better tax treatment, a liquid funds’ net asset value (NAV) moves almost unilaterally up. Arbitrage funds, on the other hand, are volatile.

In April-June 2022 period, the stock markets came down, leaving arbitrage funds with shrinking spreads. After making just four basis points in March 2022, arbitrage funds as a category made absolute returns of less than 35 basis points each month in this period, as per Value Research data. At the same time, liquid funds were making absolute monthly returns of more than 30 basis points consistently with an upward bias. The hike in policy rates by the Reserve Bank of India ensured that the short-term rates went up and worked in favour of liquid, overnight and ultra-short debt funds. No wonder investors preferred debt funds over arbitrage funds.

Sirshendu Basu, Head-Product, IDFC Asset Management Company says, “Rising short-term yields attracted investors with short-term investment timeframe to liquid funds, as yields on arbitrage trades took some time to catch up with rising interest rates.”

While parking the funds for a very short term, there is a tendency among investors to give utmost importance to the safety of capital over returns. Peace of mind offered by liquid funds was the deciding factor in a volatile market.

Returns on arbitrage funds in the longer term should be close to money market returns since the cost of carry of futures position is dictated by the short-term cost of funds among other factors. In a rising interest rate environment, the arbitrage funds too should see a bit more returns than a few months ago, other things remaining the same. It happens with lag, say experts.

“In the last one month, the market was trending up which has led to better returns than the previous months when the market was volatile. Arbitrage funds do well in a trending market,” says Nitin Rao, CEO, InCred Wealth.

An upward trending market ensures that there are ample opportunities in arbitrage trade. Also, the money that moved out of these schemes earlier means less money chasing them, which translates into better yields, compared to what they were earlier in April-June period.

Basu says, “Arbitrage positions in mutual fund schemes for September series offered an annualised yield of around 6 percent compared to around 4 percent in the previous few months.”

If the markets do not turn too volatile then the yields are expected to remain attractive and investors could come back to arbitrage funds, he added.

Going forward, the market participants will remain watchful of the market sentiment. After a hike of 75 basis points by the US Federal Reserve, the RBI will be forced to increase policy rates. Depending on the quantum of the rate hike, the market may see volatility. To add to the woes of investors, geopolitical tensions and fears of recession in various parts of the world may bring back selling pressure by foreign institutional investors.

“It makes sense to stay away from arbitrage funds till the time the interest rates are rising and the stock markets are volatile,” says Rao.

What should you do?Anup Bhaiya, Managing Director, Money Honey Financial Services finds the liquid funds better positioned given the rising short-term interest rates.

“The expectations of volatility in stock markets bring down the visibility of returns for arbitrage funds in the near term.” He prefers liquid funds over arbitrage funds as short-term parking space for your money. “Arbitrage funds may make sense next year when the interest rate hike cycles and resultant volatility may be behind us,” he added.

Abhay Mathure, a Mumbai-based mutual fund distributor, has a different take. “Do not ignore the relatively higher expense ratio of arbitrage funds compared to liquid funds. In volatile times they are a drag on investors’ returns. Do not invest in them blindly for equity taxation with a very short-term view,” he says.

Even if you are keen to explore the arbitrage funds due to improvement in expected yields, go with a minimum six months timeframe, he says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.