Many people tend to procrastinate when it comes to investing. Some explain away their inaction by saying they just don’t have enough money to invest.

Sometimes, all you need is a just a nudge to stop procrastinating and act. New-age fintechs like Appreciate, Jar and Niyo are here to give you just that nudge.

You can invest small sums of money, which we usually call change money, in assets ranging from digital gold and mutual funds to US stocks.

What is change investing?The concept of change investing is based on micro-investing. These fintechs monitor your spending. Everytime you spend money to make a purchase, say clothes, food or anything else, they also nudge you to invest a small sum in assets.

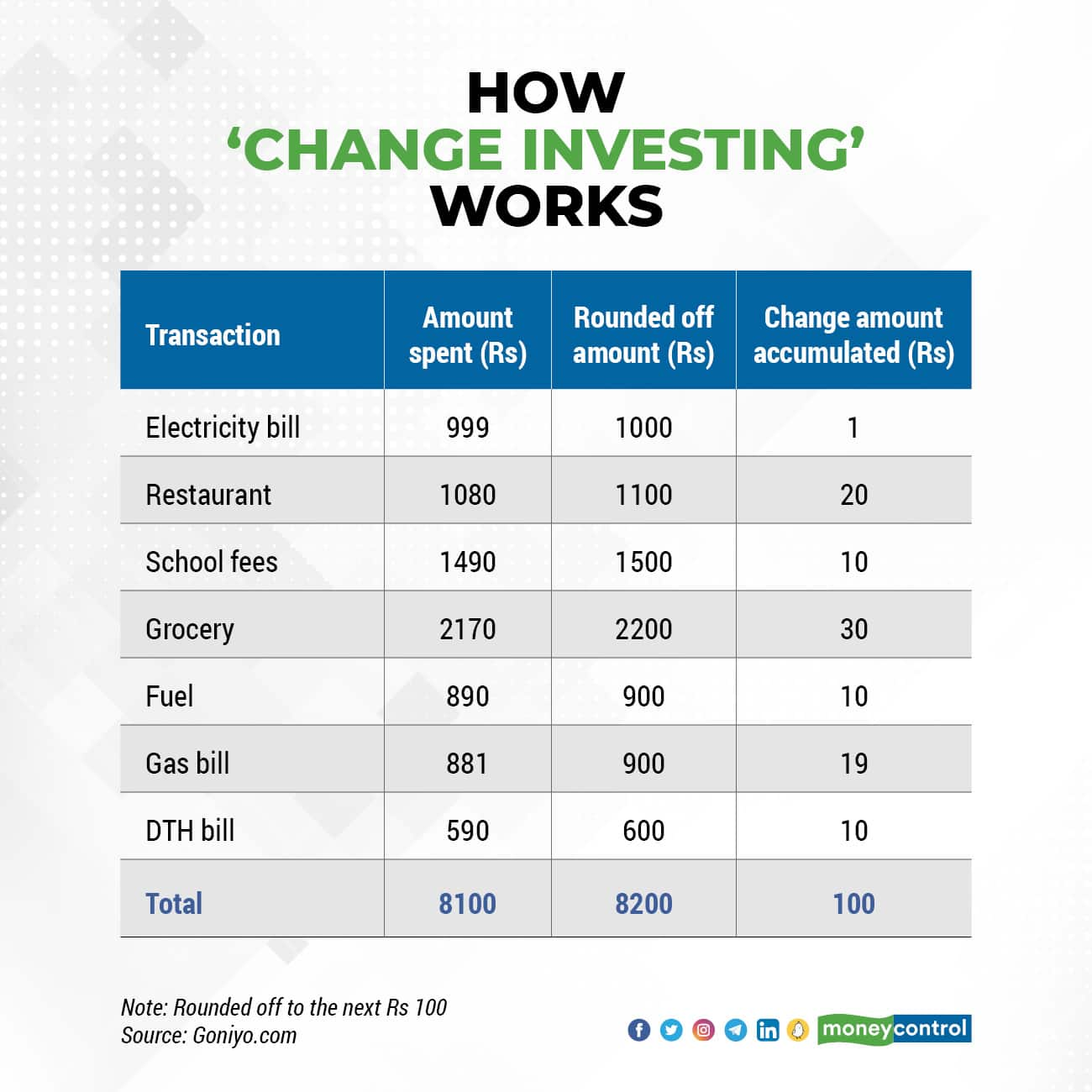

Here’s how it works.

These fintech apps fix an amount--let’s call this a roundoff amount--to the next Rs 10, Rs 50 or Rs 100, depending on what they offer and what you choose.

When you spend money to buy something, using your debit card or net banking account the apps mandate linking them to, they calculate the difference between the amount you’ve just spent and the nearest roundoff amount.

When you spend money on other such transactions, the differential gets added up and when it reaches, say, Rs 100, Rs 500 or Rs 1,000, the app nudges you to invest it in a financial asset available on its platform.

The Niyo app rounds off the differential on your transactions to the nearest Rs 100. The app accumulates the differential in each transaction in a corpus that gets invested in a mutual fund. You get to choose the schemes in line with your risk appetite.

If your accumulated corpus reaches Rs 500 and that is when you choose to invest, then all the MF schemes requiring a minimum investment of Rs 500 or less will be open to you as options.

“Invest the Change feature is best suited for millennials who are high on many smaller value digital transactions - many under Rs 1,000 or even several Rs 100 transactions within a day or a week,” said Parijat Garg, a personal finance expert.

It also suits investors who may lack the discipline to park money every month (or week) in investment assets, Garg added.

Appreciate, Niyo and JarTo avail of the change investing facility at Niyo, you need to open a NiyoX savings account after installing the app. The bank tracks the spending from your savings account through net banking, debit cards and Unified Payment Interface (UPI) transactions and accumulates change for investing.

When the corpus hits a certain threshold, you can invest it in a mutual fund.

“At any point in time, you can change the mutual fund scheme on the app to invest the corpus built through Save the Change feature,” said Swapnil Bhaskar, head of strategy at Niyo.

If you do not change the mutual fund, everytime your corpus hits the pre-defined mark, your money will go into the same fund.

Appreciate requires your authorization to read your transactions through SMS for its change investing feature.

Appreciate tracks your spending through net banking, UPI, mobile wallets and debit cards linked to its apps. Everytime you spend money, the app will round off the differential to the nearest Rs 10 and withdraw the change from your bank account to invest.

Niyo requires you to open a savings account with the company, which styles itself as a neo-bank. And use its net banking, debit cards and UPI for spending. The bank will track your NiyoX savings bank account and allow you to activate a change investing feature as an add-on.

“Through the Appreciate app, your change is automatically invested in a portfolio of US stocks which our proprietary AI algorithm determines based on your risk profile,” said Shlok Srivastav, co-founder and chief executive officer of Appreciate. AI stands for artificial intelligence. You can choose to save on a daily or a monthly basis to progress towards your financial goals. You can start investing after signing up and completing the Know Your Customer (KYC) process. The app is currently in Beta, but will be available to all potential investors shortly.

On Jar, you may choose between automatically rounding off your daily expenses to either the nearest Rs 5 or nearest Rs 10, depending on your needs.

For instance, if your daily spending is Rs 93, Jar will invest either Rs 2 or Rs 7 for you in digital gold.

“We invest daily savings in digital gold. Assume you did 10 transactions in a day, we will track all these from your SMS, accumulate the change and will do one debit from your linked bank account for investment,” said Nishchay Ag, co-founder and CEO of Jar.

What worksChange investing works well for millennials who have just started earning and do not have enough savings to invest.

The change investing feature ensures that some of their money gets invested.

“It invests multiple times within a month, so it’s better than even monthly SIP (systematic investment plan) to average out in terms of when to invest,” said Garg.

Small amounts can be invested in assets that investors would otherwise ignore and wait to accumulate Rs 1,000 or Rs 5,000 before investing, he said.

What doesn’tThe avenues your money gets invested in through these apps are limited as of now. If you choose a particular fintech app, you also choose, in a way, the asset type.

“You may not have an option of switching to another asset unless you switch a platform,” said Garg.

The returns on assets shall determine the value of your investment.

“When young investors invest now and see the investment portfolio going down after a couple of years because of an uncertain event, they might take the first investing experience as a poor investment decision and might go away from the equity market,” said Anupam Roongta, a research analyst registered with the Securities and Exchange Board of India (SEBI).

So, the purpose of attracting millennial investors to the capital markets may be defeated.

There is a risk of personal data leakage as you are giving away access to your SMS transactions -- the platform reads and analyzes all your messages.

“With change investing the quantum of savings/investment value may not be substantial enough even after a few years of use of such a service to help you meet any of your critical life goals,” said Garg.

Liquidity may be a challenge in case of US stocks when investing through Appreciate. Exit charges may apply as in case of investing in mutual funds through NiyoX.

To invest through NiyoX, a customer also has to make it his primary account.

“For investors having a primary account with some other bank and shifting everything to NiyoX will be a pain point,” said Garg.

Investing in digital gold is not a regulated instrument. Jar’s Nishchay Ag said: “The services offered by the Jar app are offered by SafeGold as a provider. SafeGold is a platform to buy, sell and gift 24K gold online. The gold you buy is backed by a Reserve Bank of India (RBI)-regulated trustee—IDBI. That makes the investments through the Jar app quite safe. Your savings will remain yours forever.”

Should you opt for change investing?Change investing a new concept in India and these fintech apps are also new. Although these apps nudge you to invest small amounts, you cannot build wealth over the long term through such investments.

“Millennial investors--who these apps are targeting--also need to learn the basics about financial investment and various assets,” said Roongta.

It’s important to know which asset your money gets invested in, Garg said. Potential customers must ask the fintechs if they plan to increase asset classes in the future so they can diversify. Don’t get influenced by marketing campaigns like those who claim save just Rs 5 or Rs 10 per transaction and convert them into a lakh.

Change investing holds promise if more firms enter and offer a variety of assets. But if you are serious about building wealth, invest in a holistic way; perhaps a small amount to begin with and a commitment to increase the amount, and through asset allocation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.