On April 3, the Tata Group-owned private carrier Air India re-launched its airmiles programme, called Flying Returns. Originally launched in 1994, this is India’s oldest existing airmiles loyalty programme.

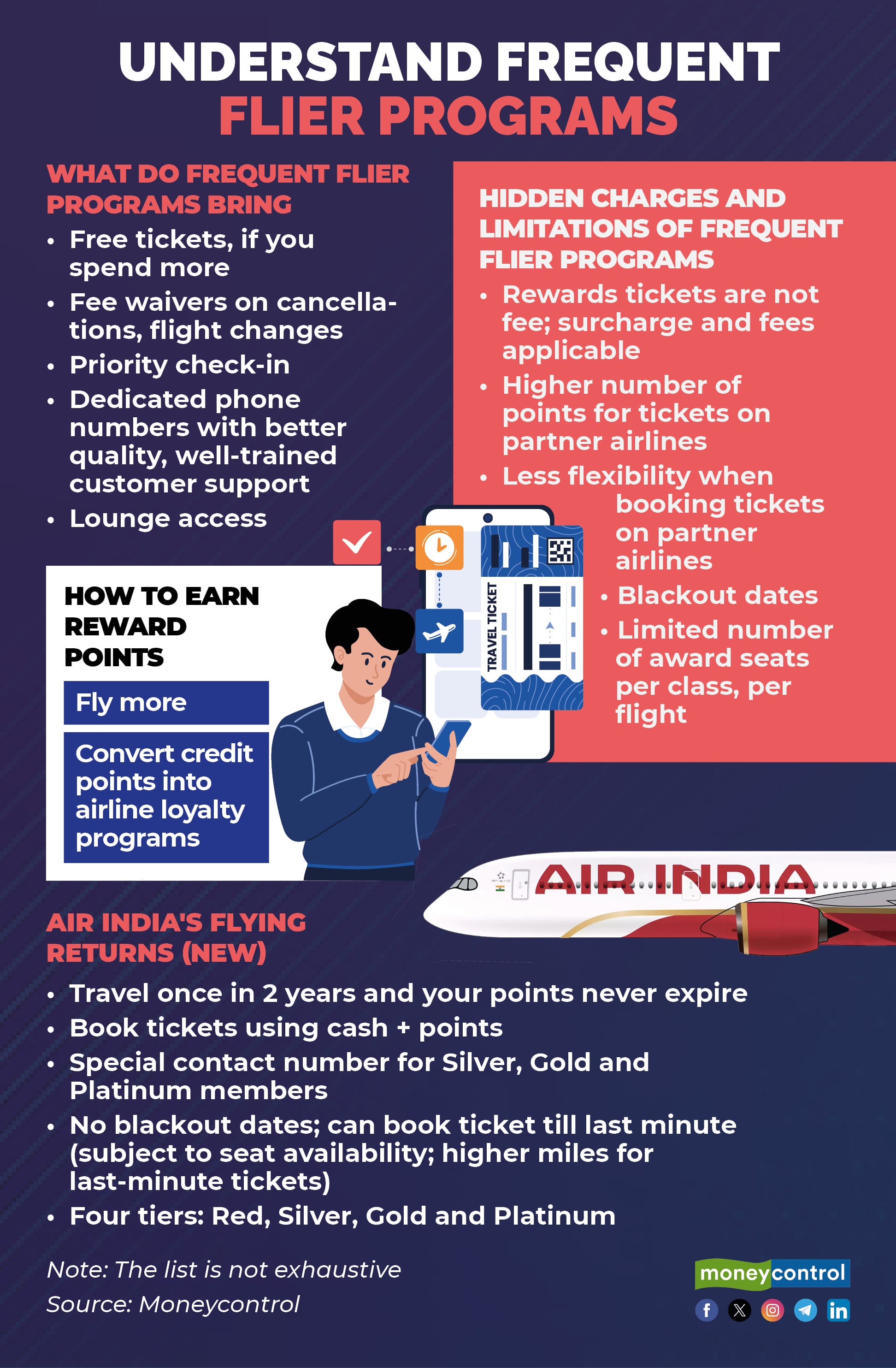

The re-launch is part of a larger transformation exercise that the Tata Group has undertaken since acquiring Air India from the government in January 2022. The new programme compares with some of the best in the world; it gets you upgraded to the upper tiers faster than before, and you can now book tickets using a combination of airmiles and cash. Plus your points don’t expire, provided you travel at least once in two years with Air India.

To the uninitiated, especially those who do not have much experience with an airmiles loyalty programme, airmiles look like a lot of free tickets. Little is known about airmiles among Indian travelers largely due to Air India being India’s only international carrier for many decades. Although Jet Airways operated for close to 25 years, flew international, and had a successful airmiles programme, it folded up in 2019. Currently, Indian citizens only have a choice between Air India and its group entity Vistara, with the latter’s airmiles programme called Club Vistara (CV). In the near future, CV will be subsumed into Flying Returns when Vistara is merged into Air India, since both carriers are owned by the Tata Group.

Anyway, here's how to get the best out of your airmiles programme.

Value vs distanceFrequent flier programmes are aimed at regular fliers. Put simply, the more you fly, the more you earn. But airmiles across the world are now changing the way you earn points. They now aim to give you more bang for the buck.

Also read: 6 tips to secure the hottest holiday deals

Earlier—and even today, with a handful of airlines such as Singapore Airlines—airlines used to reward you based on the distance you covered. This rewarded fliers who opted for stops in between. For instance, if you were to fly Mumbai to New York non-stop, the shortest distance, as per www.distance.to is 12,542 kms. But if you wish to make a halt in London to stretch your legs, you travel 12,767 kms. The via-London used to earn you more points, whereas a non-stop flight would work out to be more expensive.

That’s changing globally now.

Air India, for instance, has now moved towards a spends-based approach. The more money you spend, the more airmiles you earn. For instance, a Mumbai–London ticket on Air India for a May 5 departure shows two fares; Rs 50,765 (‘Comfort Plus’ fare) and Rs 70,240 (‘Flex’ fare). Earlier, both of these fares used to earn the same number of airmiles. Now, the ‘Flex’ fare in Air India’s case would earn you more miles than ‘Comfort Plus’. “Your earnings will now be in line with the money you spend. It is now a value-driven programme,” says Ajay Awtaney, Founder and Editor of LiveFromALounge.com, who is an expert on loyalty programmes, credit cards and frequent flier programs, and one of the pioneers in India in deciphering loyalty programmes.

Calculating air miles for free tickets

Calculating air miles for free ticketsExperts like Awtaney say that this system rewards the true frequent flier, instead of someone who tries to reach the destination with multiple stops at leisure that cover a greater distance.

Not just flight tickets; your credit card helps, tooEven if you don’t fly as much, you could still earn airmiles. To begin with, you could convert your credit card points to airmiles. This means that when you wish to use your accumulated credit card points to buy some goodies, you could buy airmiles of the air carriers that your credit card has tied up with.

Also read: Window seats, tasty meals. How airlines charge you over and above the base fares

Air India’s revamped Flying Returns has tied up with close to 50 partners, such as car rentals, hotels, shops and department stores, other lifestyle experiences and so on.

To be sure, this is not the same as a co-branded credit card. In a co-branded card, such as the Air India–SBI Signature Card, all the credit card points that you earn get automatically converted into the airmiles partner of your card. But in a normal credit card, you have a choice of spending your points any way you want. Typically, credit cards have tie-ups with multiple partners, including more than one airline, that card users can spend their points on.

Sumanta Mandal, Founder, TechnoFino, a platform that analyses credit cards, say that a general credit card that gives you reward redemption options works far better than a co-branded card. “As credit cards get more popular by the day, this works better in adding points and then transferring them to the airlines miles programme of your choice,” says Mandal. He adds that frequent flier points needn’t just buy tickets; they can also buy an upgrade from, say, economy class to business class.

The nuts and bolts of a frequent flier program

The nuts and bolts of a frequent flier programAshwin, a loyalty programme and credit card expert who prefers to go by his first name and is known on Twitter by his handle @drgrudge, says how fast you earn points is important. He cites examples of frequent flier programmes of US-based airlines such as United, American Airlines and Delta, which have their own portals where you can shop, book hotels rooms, and so on. Every dollar spent earns you reward points.

When redeeming, be flexibleNow, just because you have a lot of airmiles, it doesn’t mean you can get a free ticket on any flight. “The frequent flier programme is capacity-controlled. Many airlines have only limited seats available for tickets bought using airmiles. Such seats, for instance, are in very limited supply during festive seasons, long weekends and so on,” says Ashwin, who adds that award seats during busier days may also have already been booked well in advance. In other words, the limited capacity ensures that you won’t be able to book a free (airmiles) seat for, say, tomorrow’s travel. In fact, on blackout dates—busy days such as Diwali, New Year’s Eve, Christmas and so on—airmiles seats will not be available at all.

Here, Air India says that it has gone a step ahead and removed blackout dates. In other words, it means that can book an airmiles seat today to fly tomorrow. But there’s a catch.

How many airmiles you need to earn a free seat depends from airline to airline, how much in advance you’re booking and how many 'saver'-level seats are available in stock. Ashwin says that to book an airmiles seat on, say Air France for a Mumbai–Paris trip, you’d need as few as 70,000 points to as many as 5 lakh points. This doesn't necessarily mean a high cost for last-minute bookings. It also means that the 'saver' level seats are sold out and you are essentially buying a revenue ticket with your points. Expect a range the next time you try to burn Air India Flying Returns points as well.

Different airlines have different thresholds for the number of points you need to burn to earn a free ticket. This, of course, depends a lot on sectors, but even within sectors, some offer you a better deal than others. Air India claims that you now need to burn fewer Flying Returns points to earn a free ticket. A Delhi–New York (JFK airport) miles ticket used to command 80,010 points earlier; now, an Eco Value ticket would cost you just 61,500 miles, as per another aviation analyst who spoke to Moneycontrol on condition of anonymity. This analyst tells us that other airlines demand 49,500 to as much as 1.27 lakh miles (points) on the same sector for similar dates.

Still, bear in mind that frequent flier programmes work only if you fly frequently. Even in its new avatar, to earn 61,500 points on Air India's Flying Returns programme so as to buy a free Delhi-New York ticket, you need to spend Rs 7.68 lakh on Air India air tickets if you belong to the Base (Red) category.

Then again, with one return, business class ticket on the Delhi - New York route, costing Rs 2 lakh, you can get a return Delhi-Mumbai ticket (available for 10,000 points). A spend of Rs 2 lakh gives you 12,000 points as Red member.

While booking award tickets, be flexible. Ashwin tells us that on a recent holiday to New Zealand with his wife and daughter, all three had to take different flights and in different classes (economy, business). “If you want to go Mumbai to New York, you might get a cheaper reward ticket from Bengaluru to New York or Mumbai to Washington. Or you should be willing to take a hopping flight via Frankfurt,” says Ashwin, referring to the availability of rewards seats on your desired flight as well economising on the points you need to burn.

Be loyalAwtaney says that people have to see which frequent flier works best for them and then enrol. Typically, many Indians take the Gulf routes to fly to the West, so an Emirates or a Qatar frequent-flier programme would have worked so far. When Vistara started operations, it used to fly largely out of Delhi. “People from Mumbai and other cities couldn’t use Vistara exhaustively in its initial years, and as a result, saw their CV points expire eventually. Now, Vistara has as wide a network as any,” says Awtaney.

Airlines reward loyalty as well. Airline miles programmes have multiple tiers; the higher you go up, the more benefits you get. Air India has four tiers: Red, Silver, Gold and Premium. The re-imagined Flying Returns now make it easier to go up one level. For instance, earlier, if you wanted to graduate from the base level to Silver Edge (the next level up) you needed to amass 25,000 points. Now, you need 15,000 points to go to the Silver tier.

Rewards can come by way of privileges as well, as you move up the programme. Dedicated phone numbers to higher tier members and fee waivers in case of cancellations or flight changes and priority check-in are some of the privileges that higher-tier members get.

TaxesA miles or a reward ticket is not entirely free. You still have to pay some fees and taxes. There are fees and surcharges that you need to pay over and above the miles that you earn. Further, if you book a reward ticket on the airline whose programme you are on, the fees and surcharges are usually lower. But if you book the same ticket (same sector and date) on a partner airline, your charges might be higher—at times way higher.

Moneycontrol's takeFrequent flier programmes are not for everyone. They reward the high spender and the frequent flier. Those who do not fly regularly should not have any expectations from such programmes—instead, accumulate points through your credit card and be patient.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.