Aditya Birla Sun Life Asset Management Company (AMC) has launched a new schemes that’ll toggle between assets to offer diversification across asset classes. Called Aditya Birla Sun Life Multi Asset Allocation Fund (ABMAAF), it will invest across equities, debt and commodities.

What’s on offerThe equity portion of the portfolio in the scheme will follow a flexi-cap approach with large cap bias and can invest across sectors or themes. Fixed income portfolio will largely use the accrual strategy, which focuses on earning interest income in terms of coupon offered by bonds.

The allocation in the scheme would be equity (65-80%), fixed income (10-25%) and commodities (10-25%). The scheme would invest in commodities through exchange-traded funds (ETFs) based on gold and silver.

“The fund attempts to invest in a diversified portfolio of high-quality debt and money market securities to generate income with relatively minimal credit risk,” says A Balasubramanian, managing director and chief executive officer, Aditya Birla Sun Life AMC.

Also read | Baroda BNP Paribas Multi Asset Fund collects over Rs 1,200 crore via NFOAs per the scheme note, the fund may invest in foreign securities, including overseas gold ETFs, up to 20% of the net assets of the fund.

The fund also intends to invest an amount of $50 million in foreign securities and $ 20 million in overseas ETFs.

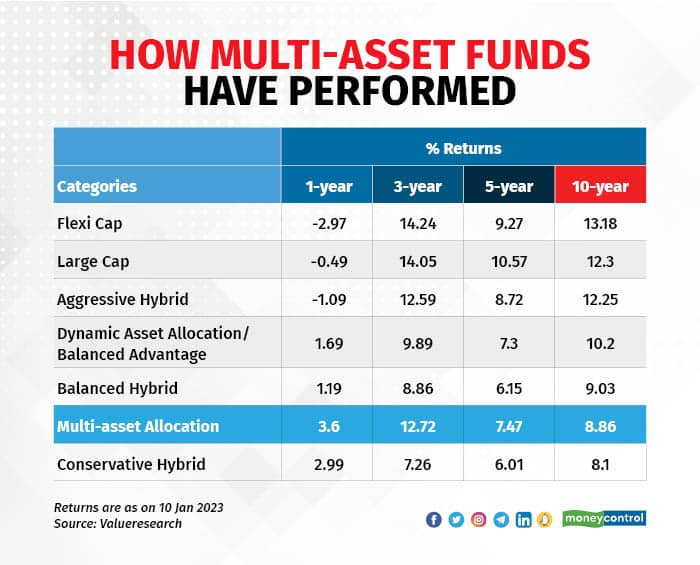

Multi-asset funds have gained in demand during 2022 when equities as well as debt failed to reward investors in a meaningful way. Experts feel that amid high inflation, rising interest rates and tough economic outlook, going with a multi-asset strategy may be beneficial for the investors.

There are around 15 schemes in India with a multi-asset allocation strategy, however, only a few such as ICICI Prudential Multi Asset Fund offers exposure to silver, which is among the newest asset classes in the Indian mutual fund industry.

ICICI Prudential Asset Management Company, had launched India’s first silver ETF in January last year.

Notably, silver-based funds have delivered best returns (16.56%) among all other mutual fund categories over the past three months, as per data available with Valueresearch.

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemesNishith Baldevdas, founder, Shree Financial and a SEBI-registered investment adviser believes in having a separate allocation to asset classes such as equity, commodity, debt and real estate.

“It simplifies investors’ lives by giving clarity on how much to allocate in each asset class based on their risk appetite and goals. This approach also comes handy when they want to make some tactical allocation. It also gives them the clarity whether they are overinvesting or under investing in one or another asset class,” Baldevdas said.

Some experts are of the opinion that multi-asset funds ABSL MF Multi Asset Allocation Fund may work for do-it-yourself mutual fund investors, who want simplicity.

Suresh Sadagopan, Managing Director and Principal Officer, Ladder7 Wealth Planners, who don’t recommend NFOs, said, “Multi-asset funds may be good for investors who don’t have financial advisors. But even for these type of investors, there are already good funds available in the market today, which they should consider first.”

Prableen Bajpai, Founder of FinFix Research and Analytics believes that multi-asset funds can be considered by someone looking to contain downside risk, which comes with pure equity funds.

Also read | Equity inflows jump three times to Rs 7,303 crore in December“These funds move across asset classes based on opportunities and work towards making one’s investment journey less volatile. They are a decent starting point for first time investors vary of the volatility in equity markets. Investors looking for returns more than debt funds and can undertake some risk, can consider this category of funds,” she said.

The new fund offer (NFO) for Aditya Birla Sun Life Multi Asset Allocation Fund will remain open for subscription till January 25, 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.