The mid-sized IT company from the RPG stable, Zensar Technologies ended FY19 on a strong note. Having moved up the digital learning curve, bolstered by slew of acquisitions in the recent past, the company is eyeing a strong FY20. With an expected earnings CAGR (compounded annual growth rate) of 19 percent in the next couple of years, valuation at 12.6 times FY21 estimated price-to-earnings deserves attention despite near-term headwinds in the form of the strength in the domestic currency.

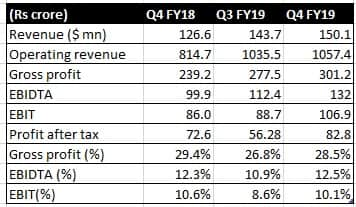

Result snapshot

Source: Company

Key positives Revenue momentum was strong. FY19 saw constant currency revenue growth of 18.5 percent. The two acquisitions of Indigo Slate and Cynosure also impacted growth positively last fiscal. In the quarter gone by, revenue at $150.1 million showed a sequential and year-on-year growth of 4.1 percent and 21.5 percent, respectively, the highest in recent quarters.

Since Zensar has decided to divest its non-core businesses (rest of the world and third-party hardware support), the relevant matrix to focus on is its core business (95 percent of the revenue) performance. In Q4 FY19, its core business showed sequential growth of five percent.

Digital continues to be the key driver for the company, growing 36 percent YoY and eight percent sequentially, and constituted 46.4 percent of Q4 revenue.

In terms of industry verticals, hitech and manufacturing (51.8 percent of total revenue) and retail (21.6 percent) grew well.

The quarter gone by saw Zensar reporting a 160 basis points (100 bps=1 percentage point) sequential improvement in margin. Better utilisation rate, decline in sub-contracting cost and lower furloughs led to margin improvement. While the medium-term target for core business margin is 15 percent, the company achieved 14.1 percent in Q4 FY19. Higher volume in the cloud infrastructure business, automation in application and digital services, better realisation in digital as well as full divestment of non-core businesses are some of the margin levers for the firm going forward.

Deal wins were healthy and the company alluded to strong demand environment. In FY19, the company won deals worth $750 million, more than double that of last year. Deal win in Q4 FY19 stood at $150 million. The company is staring at a $1 billion pipeline.

Key negatives Financial services (share of over 22 percent) de-grew as insurance was soft due to project completion. And this got reflected in the slowdown in cloud and infrastructure services as well. Revenue growth from top five clients was almost flat sequentially. Attrition, while stable, has not declined significantly.

Outlook After having undertaken close to four acquisitions in the past couple of years, the management is likely to go slow on inorganic expansion in the near future. High revenue visibility, thanks to the strong deal pipeline and the margin levers that the company has at its disposal point to decent earnings growth in the future.

With a focus on key verticals of manufacturing and hitech, retail and insurance along with the divestment of non-core businesses, the quality of earnings should improve from hereon. While an appreciating rupee is a near-term headwind, any currency-led weakness impacting sentiment for the IT sector may provide a great opportunity to buy into this mid-sized IT firm.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.