Jitendra Kumar Gupta

Moneycontrol Research

Scarcity premium that was enjoyed by a few surviving construction companies in the last upcycle is now fading, with investors booking profits at higher valuations in light of a possible consolidation in the sector. Most new projects have been announced in the engineering, procurement and construction (EPC) segment, with almost zero commitment for equity, allowing more and more players to bid now. Today, there are on an average 10 players bidding for a single project as against 4-5 players about a couple of years back.

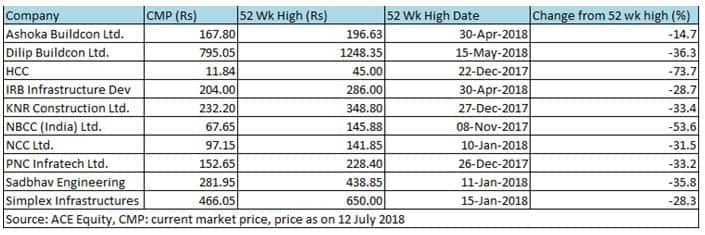

Most construction stocks have corrected significantly in the past month. At their peak, these stocks were trading at 22-25 times FY19 estimated earnings, which has now dropped to about 17-18 times.

A year of consolidation Companies will continue to garner strong revenue visibility, with order book close to 3 times and a strong project pipeline (government likely to award most projects in FY19 before elections in FY20). “Awarding activity is expected to gain traction from Q2 FY19, given the steep award and construction target of 25,000 km and 15,000 km in FY19, respectively. The National Highways Authority of India has already invited bids for 3,700 km, for which preparation of a detailed project report (DPR) has been completed. Given the general election in FY20, we expect major awarding activity to be complete by December,” said Amit Shah, who tracks the sector at Motilal Oswal.

The onus would now shift to companies to expedite execution and deliver on investors’ expectations, particularly in an election year, with the risk of political uncertainty creating hurdles.

During the general elections in April-May 2014, highway project awarding had risen from 1,961 km in FY13 to 7,980 km in FY15. However, highway construction had dropped from 5,732 km in FY13 to 4,410 km by FY15 end. While it may not be a like-to-like situation, it is possible that the political environment could have its bearing on the sector, particularly execution hurdles in terms of clearances and working capital. "While this stiff target seems achievable, especially in the run-up to 2019 general elections, project execution would depend on funding availability. Escalating land acquisition cost has also impacted the overall cost of construction," said Alok Deor, who is tracking the sector at IIFL Research.

Working capital and funding Construction is a working capital intensive activity. While companies are sitting on a huge order book, they will have to fund every incremental capital required for additional construction or generate revenue from projects in hand. In case of a delay in payments, companies will look for greater support from banks, who are already turning risk averse in the light of their own non-performing assets (NPA) and scarcity of capital.

Moreover, hardening of interest rate cycle would make it even more difficult to raise funds. During FY18, 10 year G-Sec yield was at an average 6.99 percent. But this year it is already up 80 basis points to 7.79 percent and is expected to move up further as a result of inflationary pressure and hardening global yield curve.

Even a small change in interest rates would have a huge impact on earnings of highly leveraged companies. Meanwhile, investors would start to factor in impact from the expiry of section 80IA benefits enjoyed by some companies in the past. They will now have to pay tax as a result of the income tax benefits going away.

"With financial closure becoming stringent and banks being selective in extending credit to companies, the sector will consolidate,” Shah said. However, companies with healthy balance sheet would benefit the most. Stringent financial closure would also lead to moderation in competition and thus improvement in pricing and margin of incumbent financially-strong players.

Strong balance sheet In light of these developments, even though the structural story may remain intact, companies with good balance sheet would sail through. Stock may not receive the same valuations as they used to get at the beginning of the year. Investors have already started to factor in or weigh these risks in overall valuations. It is prudent to remain with players having balance sheet strength and industry expertise, but have lower return expectations in the interim.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.