VIP Industries reported a disappointing set of Q3 FY19 earnings. While business momentum remains robust, cost pressures impacted margin. Although the pain might persist for a while, the long-term secular proposition for this consumer business and shift in the market from unorganised to organised players cannot be denied. The soft patch may just be an ideal opportunity for long-term investors.

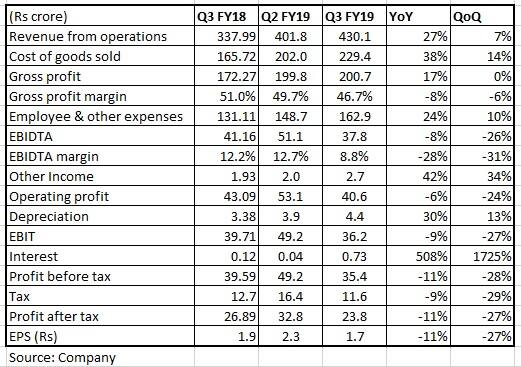

Key positives Strong topline momentum. Sales grew 27 percent year-on-year (7 percent sequentially) driven by volumes that grew faster than overall revenue.

Lower ticket size brands like Skybag (for backpack) and economy range of the company -- Aristocrat as well as ladies handbag rage Caprese -- did well in the quarter under review.

The company has not witnessed any slowdown in demand so far.

VIP is launching a new range of products in Aristocrat with superior gross margin because of better costing.

The company is witnessing a gradual shift in demand from unorganised to organised players post-implementation of the Goods & Services Tax (GST) and this is reflected in the faster growth in sales of lower-ticket items and economy brands.

Performance of most of its sales channels have been positive except for canteen stores.

To counter cost pressures, the management is contemplating price increases in measured doses that should not impact its market share.

To reduce dependence on the Chinese market, the company is gradually expanding its capacity in Bangladesh.

The management is optimistic about its growth outlook for FY20. Large number of marriage dates should positively impact the business.

Key negatives Due to the depreciation of the rupee versus the dollar, coupled with import duty, the company experienced significant cost pressure that led to a 300 basis points (100 bps=1 percentage point) sequential contraction in gross margin.

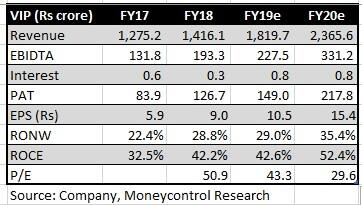

VIP saw significant contraction in earnings before interest, depreciation, tax and amortisation (EBIDTA) margin to 8.8 percent. Cost of promotion was high due to higher sales through the hyper market channel. The management expects to return to double-digit margin in the next couple of quarters, although Q4 is expected to remain soft as the company is still holding substantial amount of high-cost inventory.

Weighted average selling price was lower due to change in product mix in favour of economy and lower ticket items.

Other observations With an increasing share of budget products, the company is making steady efforts to improve its gross margin. Due to of intense competition, price revision may not be feasible and the effort would be to reduce costs.

Outlook VIP is the market leader in a market where unorganised players still dominate and the shift to the organised is gradually underway.

Growth of travel infrastructure such as roads, airports and railway stations have contributed significantly to the development of the travel industry in India. Over the years, both domestic and international air travel has shown consistent double-digit growth and is likely to accelerate.

These trends have a significant positive impact on the long-term fortunes of the luggage industry.

In addition, luggage has also become an important part of the wedding trousseau, with even people in Tier II and III cities buying branded suitcases and strollers during the wedding season. The penetration of luggage as a category is much lower than other consumer products.

Albeit the short-term blip of subdued earnings for the past few quarters, we feel the long-term thesis is intact and investors should use the subdued sentiment to gradually accumulate the stock for the long-term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.