Highlights - No change in the Federal funds rate - Fed prefers to wait for impact of previous rate cuts - Stance is for credible improvement in inflation - Liquidity support to continue for money markets - Positive for risky asset classes; Coronavirus outbreak warrants caution

The US Federal Reserve pulled out no surprises at its first policy meet of 2020 as it decided unanimously on Wednesday to maintain the key overnight lending rate in a range of 1.50-1.75 percent.

The Coronavirus outbreak in China, which has claimed many lives so far, cast its shadow on the Fed's economic outlook.

The Fed commentary for the US economy largely remains similar to previous occasions - A strong labour market but weakness in investments, manufacturing and exports continues. In his news conference, Fed Chair Jerome Powell pointed to signs of global economic growth stabilizing and diminishing uncertainties around trade.

Data shows US inflation still trends below 2 percent. November PCE (personal consumption expenditures) inflation stood at 1.5 percent, and core inflation (ex-food and energy prices) read 1.6 percent.

The reading for household spending was a notable exception. It was seen as rising at a “moderate” pace, implying moderation in assessment for domestic consumption growth. The Fed, however, noted that solid job markets, broad based rising trends for wages and upbeat consumer confidence are supportive of household spending in the near future.

The other takeaway is change in language for inflation targeting. The Federal Reserve release talks of the target of inflation returning to the 2 percent objective instead of the “near” 2 percent earlier. Powell qualified this by saying it has a signaling effect and the Fed will not settle for inflation target “below” 2 percent.

Overall, the Fed appeared positive on the developments so far on the economic front since last meet. Leading indicators and the conclusion of Phase 1 trade deal are suggestive of an improving growth outlook. However, the central bank gave no hints that it plans to increase borrowing costs anytime soon. It said the policy would remain at the current level unless there is a material change to the economic outlook, particularly on the inflation front in a persistent manner.

Liquidity support to stay

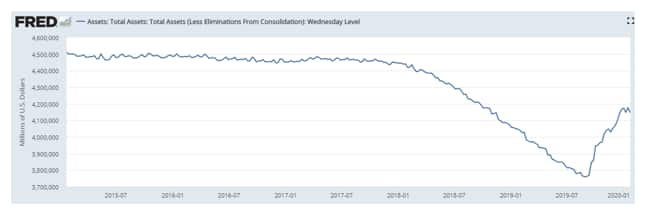

The broad based asset purchase programme – better known as Quantitative Easing (QE) – has been a key tool of the Fed to meet the challenges of the economic recession in 2007-08. As the economy scaled back, interest rate normalization started followed by unwinding of balance sheet to earlier levels.

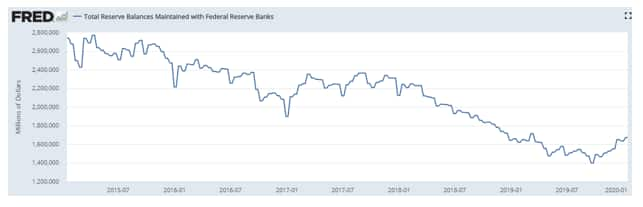

Following money market volatility in September 2019 and thereafter, the Federal Reserve felt the need for higher level of reserves. This led to a series of open market operations to provide ample liquidity to the system.

As a result, Fed’s balance sheet is already up by 9 percent from its August 2019 lows. In other words, during five months (September 2019- January 2020), there has been a liquidity infusion of about $350 billion by the Federal Reserve.

Powell said open market operations (about USD 60 billion per month) will stay at least till April 2020 or till the time banks have ample reserves. Fed has decided to keep the reserve balances maintained with Federal Reserve Banks over an above the level existed in early Sept’19 which is about USD 1.5 trillion. Once the ample reserve balances level is achieved or sustained, balance sheet will be expanding gradually over time as in the pre-crisis period. This means balance sheet would be reflecting the trend growth in the demand for currency and other Federal Reserve liabilities

Chart: Federal Reserve balance sheet

Chart: Total reserve balances maintained with Federal Reserve Banks

Economic sentiment stabilising

Trade outlook has improved after the US-China preliminary tariff deal. However, Powell called for patience about its positive impact on the domestic economy. It would require sustained reduction in trade tensions over a period of time for a positive spill over to macro-economic growth.

Other than China, the US is already in talks with other trade partners such as the EU (European Union) and India. This means trade policy uncertainty still remains elevated.

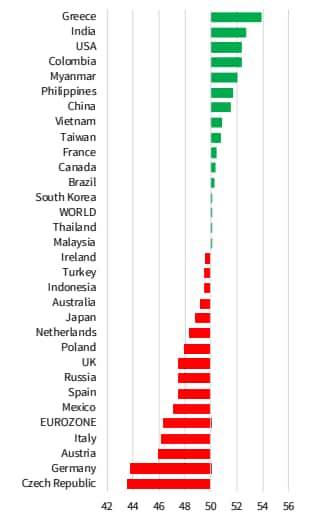

Powell suggested that leading indicators such as Manufacturing PMI (Purchasing Manager’s Index) for many countries are witnessing some stabilization. In a few cases, growth is seen to have bottomed out.

All said, the Coronavirus outbreak in China has emerged as a key risk to monitor for global growth.

Chart: Manufacturing PMI

Outlook

We believe that the Federal Reserve’s January meet reaffirms its accommodative stance with a guidance of providing ample liquidity to money markets in the near future as well as its commitment to the 2 percent interest rate goal in a consistent way.

As per CME Fed Watch tool, the market expects an accommodative stance in the policy rate throughout 2020. In fact, it suggested that the probability of a further rate cut is higher than 60 percent towards the end of this year.

Fed’s commentary also suggests that the threshold for the rate hike is now sufficiently high. So, only when inflation goes past the target level and remains persistent for a while, only then it makes a case for rate hike.

Thus, Powell’s “lower for longer” narrative for interest rates continues, which should be positive for risky asset classes unless the current epidemic in China or any negative surprise on hard economic data derails the thesis.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.