Highlights:- - Jewellery sales remained strong during the quarter gone by

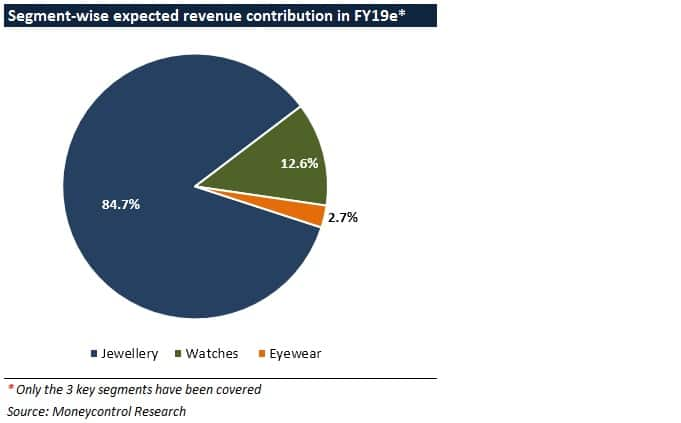

- Smart wearables and e-commerce trade drove sales in the watches segment - Growth in eyewear revenue was mainly volume-driven - Chances of a multiple re-rating in Titan's stock are limited in the short-term --------------------------------------------------Titan is expected to report a strong Q4 on the back of a brisk pace of store additions, product launches across all 3 segments (jewellery, watches, eyewear) and expectations from a strong wedding season demand. While the growth in jewellery is likely to be in double-digits, the encouraging show from watches, eye wear and other segments is the key takeaway from the company's recent guidance.

Investments in digital initiatives (to strengthen online trade) and growth in the institutional clients order book will also be prioritised in FY20.

JewelleryFor FY19, top-line growth would be close to 22 percent year-on-year (YoY) as against a revenue uptick of 24.9 percent YoY in FY18. New collections such as Diamond Treats, Gulnaaz, Utsava and Preen have been well-received during FY19.

To capitalise on the robust brand appeal of 'Tanishq', the management continued its aggressive network augmentation drive by adding 40 new outlets and closing five existing ones during FY19. As on March 31, 2019, the total count stood at nearly 290 stores pan-India. Most of the new outlets will be opened in tier 2 and 3 regions.

Caratlane, Titan's subsidiary and online jewellery retail store, witnessed a strong revenue growth of 42 percent year-on-year (YoY) in FY19. This was largely due to brand awareness programmes and extensive adoption of retail omnichannels.

Market share gains, higher contribution of premium products (high-value wedding, diamond and studded jewellery) and positive response to gold exchange programmes will help derive operating leverage in the coming fiscals.

WatchesThis vertical registered a 16 percent YoY revenue growth in FY19 (compared to the flat performance reported in FY18), led by introduction of new varieties across all brands (Sonata, Fastrack and Titan) and healthy traction in e-commerce channels.

Digital smartwatch and accessories sales cumulatively crossed the Rs 200 crore mark in FY19. Availability of innovative products in the smart wearables space, market leadership (Titan was ranked number 2 in the smartwatch market) and good offtake at 'Helios' offline stores will be crucial in driving future growth.

Introduction of occasion-specific watches will be undertaken at regular intervals during the course of the year, as has been done in the past.

EyewearIn this division, the customer base grew from 2.5 million in FY18 to 3.5 million by the end of FY19. In the next 4 years (ie. by FY23), the aim is to serve at least 10 million customers every year.

Top-line grew by 23 percent YoY in FY19, a sharp improvement when compared to the flattish performance in FY18. This was on account of availability of products at affordable price points. Going forward, revenue growth will be predominantly volume-driven.

Titan's frames and lens manufacturing facility has been operationalised in entirety as well. Besides saving costs associated with dependence on external suppliers, the company would be able to leverage its in-house design strengths to serve various buyer segments.

Furthermore, sale of spectacle frames through the company's regular trade channels will gain scale heading into FY20.

Lifestyle productsSKINN, Titan's perfume brand, has been one of the best-selling brands in departmental stores across India. Owing to extensive marketing and steps taken to strengthen the distribution chain, SKINN products are now available across 3,000 points of sale and recorded sales to the tune of Rs 100 crore (1 million units sold) in FY19. SKINN continues to grow at a brisk pace.

'Taneira', Titan’s ethnic saree brand, has garnered good demand in the two years since its launch. This arm is gearing up for gradual expansion from FY20.

Is this the right time to invest?A sharp recovery in headline indices, coupled with expectations of a good Q4, played a key role in Titan's outperformance over the last 2 months.

At 44.3 times its FY21 projected earnings, Titan’s stock, quite clearly, discounts all the moats from a short to medium term perspective. While we remain enthused about the company’s earnings prospects, the room for any further noticeable re-rating is fairly limited in the immediate future.

For more research articles, visit our Moneycontrol Research page(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.