Tech Mahindra reported a strong performance in Q3 FY19, marked by robust revenue growth, improvement in operating margin and steady order inflows. Management commentary was optimistic and the stock offers value in an uncertain market.

Key positives Revenue in reported currency at $1,260.8 million exhibited year-on-year (YoY) and sequential growth of 4.3 and 3.5 percent, respectively.

The BPO business continued its strong performance, growing 22 percent YoY and 13 percent QoQ. The company has been steadily adding employees in this business, which stands testimony to its growth outlook.

Digital continues to be at the heart of this growth journey, surging 10 percent sequentially and constituting 33 percent of revenue.

In terms of geographies, Americas and rest of the world (RoW) were strong, whereas Europe was a tad soft.

Turning to the verticals, growth was supported by both communications as well as enterprise, with the former growing 2.5 percent sequentially on the top of a strong growth registered in the previous quarter. Enterprise also aided with a robust four percent quarter-on-quarter growth. Manufacturing, retail, transport and logistics and as well as an improvement in healthcare were the drivers within enterprise.

Deal win momentum was strong with the company bagging deals worth $440 million in the quarter under review ($240 million from communication and the rest from enterprise).

The company added one net new client each in the top brackets of over $50 million and $20 million and saw five new net addition to its total clientele.

The improvement in margin that started about six quarters back continued with Tech Mahindra witnessing a 50 basis points (100 bps=1 percentage point) sequential improvement in margin to 19.3 percent. An improvement in utilisation and lower sales and marketing expenses aided, although the company continued to invest in deal ramp-up.

Key negatives While targeting to maintain an upward margin trajectory, the management does not expect a significant improvement from hereon as most of the short-term levers have played out. Change in business mix, better pricing on the back of digital revenue and improved contribution from subsidiaries could be long-term margin drivers.

Attrition rate continues to remain high at 21 percent, or upper end of the historic band for the company. The management, however, reiterated that attrition is much less among high performers.

Other observations It mentioned that automation is releasing people who are available for redeployment and the company is effectively sub-contracting to keep a low headcount addition, especially in the IT services business.

Adoption of 5G technology is a big opportunity and trials for the same has commenced in markets like the US.

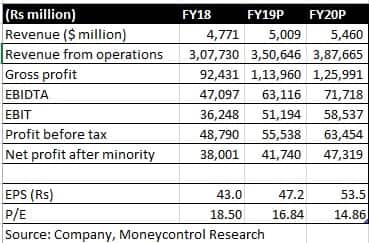

Outlook With both communications and enterprise meaningfully driving growth and management optimistic on the market outlook, we expect Tech Mahindra to comfortably grow in double-digits. Even after rallying post its result, the stock offers upside given its reasonable valuation at 14.9 times FY20 estimated earnings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.