Steel Strip Wheels (SSWL) is worth riding for the medium- to long-term on the back of strong industry tailwinds and reasonable valuations. It has a proven track record of delivering strong financial performance, boasts of marquee clients in its kitty and a strong presence in the automotive steel wheel rim industry with large wallet share from leading original equipment manufacturers (OEMs). The management is focusing on commercial vehicle exports and foraying into the high margin alloy wheel segment to drive the next leg of growth.

The business The company is the second largest designer, manufacturer and marketer of steel wheel rims for passenger cars, utility vehicles, two/three-wheelers, tractors, light/heavy commercial vehicles and over the roads (OTRs). The company has entered the alloy wheel segment and extended its CV facility. SSWL has manufacturing units in Dappar (Punjab), Oragadam, (Chennai), Jamshedpur (Jharkhand), and Mehsana, Gujarat.

Key growth drivers:Capacity expansion to meet rising demand Overall capacity utilisation was 89 percent in Q3 FY18 (Dappar plant operating at 91.3%, Chennai at 79% and Jamshedpur at 112%). In order to meet rising demand from the commercial vehicle segment and drive exports from Chennai, the company has set up an additional production line for steel wheel rims. New Chennai truck wheel plant will add 1.2 million wheels capacity to the already existing 1.8 million wheels capacity. Total capacity of the truck wheel segment now stands at 3 million wheels, which makes SSWL the largest truck steel wheel maker in India.

The company is also foraying into alloy wheels and has set up a plant in Mehsana with an initial capacity of 1.5 million units. The plant commenced production from Q4 FY18.

Foraying into alloy wheels: Huge opportunity, high margin product The market share for steel rims has fallen to 75 percent from 85 percent over the last couple of years in favour of alloy wheels. Earlier, alloy wheels used to be part of premium vehicles but over the years they have become popular for the mid-size segment as well. SSWL had an insignificant presence in the alloy wheel segment and now with this market growing, the company sees a huge opportunity.

The management expects to generate operating margin of over 20 percent from alloy wheels as compared to 13-14 percent that they generate from steel rims. In light of this, it has now forayed into the segment and set up a plant in Mehsana with an initial capacity of 1.50 million wheels/annum and total capital outlay of Rs 350 crore.

Industry tailwinds: Strong rise in CV and PV demand The CV industry had a bumpy ride in FY17 as demonetisation and BS-IV implementation impacted sales followed by Goods & Service Tax (GST) led de-stocking. However, things are limping back to normalcy as is evident from the auto sales monthly numbers. Phasing out of vehicles older than 20 years would generate additional demand. All these put together are expected to augur well for SSWL. The company has recently boosted capacity to cater to demand emanating from the CV segment. It has Ashok Leyland and Daimler as its main CV clients.

SSWL is expected to perform well due to of growth in the passenger vehicle (PV) segment. It commands complete wallet share for many of Maruti’s leading models including high growth ones like Brezza, Baleno and Ciaz. The company is expected to benefit from Maruti’s Gujarat plant expansion and new launches/ refreshes.

Targeting exports; new orders flowing in The management has been targeting the export market aggressively and has been receiving orders from Europe, the UK and the US. The company has established itself as a leading supplier of caravan steel wheels in the European region. It has been able to make inroads in the highly competitive UK aftermarket as well. SSWL currently has a very strong order book from export markets, including orders from esteemed German OEM BMW.

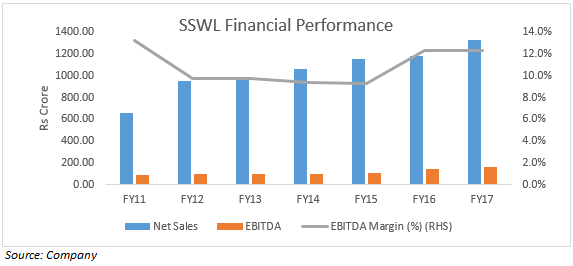

Strong long-term financial performance Historically, the company has been able to deliver strong financial performance. Net revenue posted a healthy 12.5 percent CAGR over FY11-17 and EBITDA also mirrored the strong revenue performance of 11.1 percent CAGR.

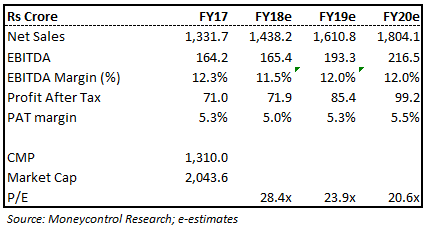

The company has a very healthy EBITDA margin which averages around 11 percent over the same period. In FY16 and FY17, the company has been able to grow its margin to 12.3 percent, because of the fall in raw material prices as a percentage of net revenues. In fact, despite the rise in RM prices in FY18, the company has been able to arrest the fall in margins through effective cost measures and maintained margins above 11 percent.

SSWL posted a 15.6 percent CAGR in profit after tax (PAT) over FY11-17.

In terms of returns, it posted average return on equity (RoE) and return on capital employed (RoCE) of 12.86 percent and 9.22 percent, respectively, over FY11-17. Its debt-to-equity ratio has remained on the higher side which averages around 1.93 times over the same period. With almost all expansion done, debt should peak at current levels.

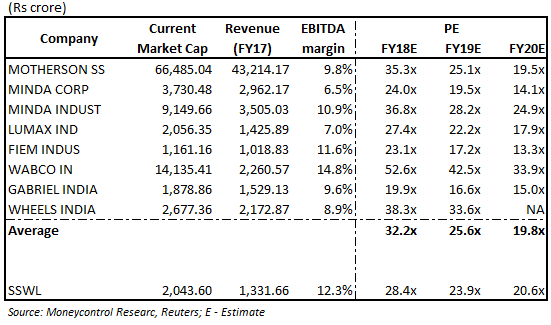

In terms of valuation, the company is trading at 23.9 and 20.6 times FY19 and FY20 projected earnings, respectively.

Peer analysis Peer analysis suggests that the SSWL is currently trading at a reasonable valuation compared to the average multiple of its peers.

Follow @NitinAgrawal65 For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!