Krishna Karwa

Moneycontrol Research

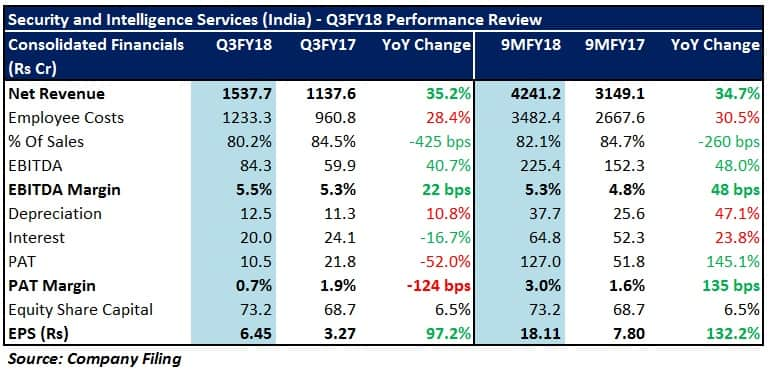

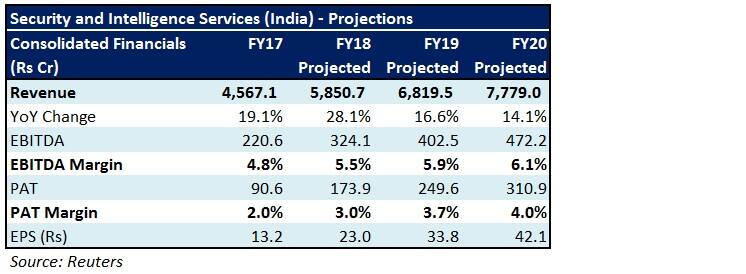

Security and Intelligence Services (India) (SIS) (market cap of Rs 8,632 crore), a stock under our coverage purview, reported a good set of numbers in the quarter gone by.

For 9MFY18, the company benefited from economies of scale (in its India-based security operations and facility management services segments), whereas reduction in interest costs (by paring debt through IPO proceeds) led to a visibly improved bottom-line.

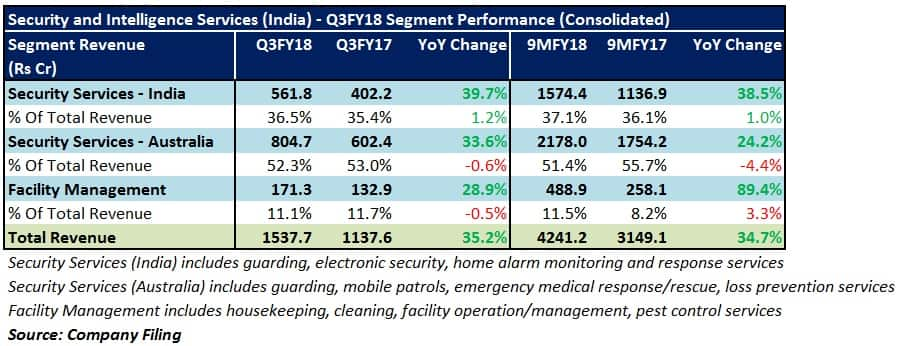

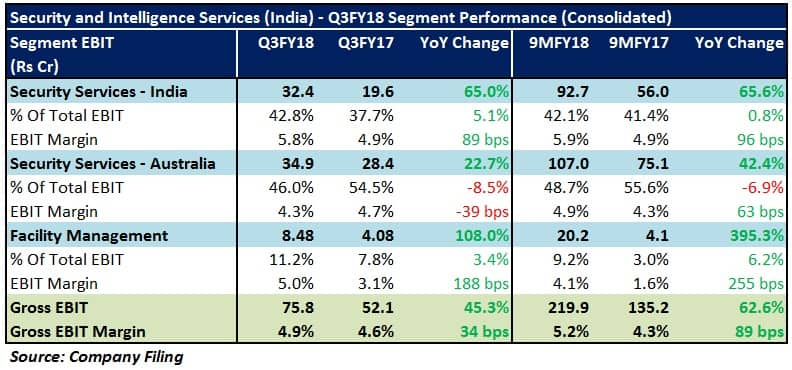

From a segment-specific perspective, the company fired on all cylinders on the back of organic growth, as seen in the exhibits below:-

What lies ahead?

Security segment

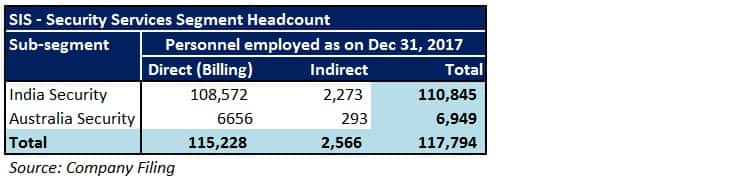

SIS, the second largest and fastest growing security service provider in India, is bullish about the revenue growth prospects for its India security operations in FY19 given its large trained manpower supply chain, 151 branches pan-India, human-technology integration capabilities, and a robust order pipeline.

SIS Australia Group Pty Limited (a subsidiary of SIS) acquired majority stake in Southern Cross Protection (Australia’s largest mobile patrol and aviation security entity) in July 2017 to strengthen its leadership position there. The move is likely to yield synergistic benefits of nearly Rs 5 crore over FY19 and FY20.

Facility management segment

With 42,373 employees (41609 – direct, 764 – indirect) on the company’s payroll, SIS is the fourth largest facility management services company in India. Going forward, it aims to tap new clients primarily across domains such as pharma, business to government, and MEP (mechanical, electrical, and plumbing).

GST – a booster shot

India’s security services market, where unorganised players comprise a considerable chunk of the industry size, is projected to grow at a CAGR of 20 percent from FY15 to FY20. Post GST, organised players like SIS stand to derive the advantages of business transition from their smaller non-compliant counterparts.

Fast-paced growth

SIS continues to gain market share in India, evident from its ability to grow 1.5 times faster than the industry as a whole. In terms of its Australian operations, SIS is not too far behind, apparent from the fact that the company’s operations in the country are growing at 5 times the GDP growth.

Inorganic expansion

Availability of funding access and a strong M&A pipeline suggests SIS’s readiness to pursue inorganic growth opportunities, a domain where it has been fairly active in the past. This will enable the company to consolidate its position and expand geographical reach.

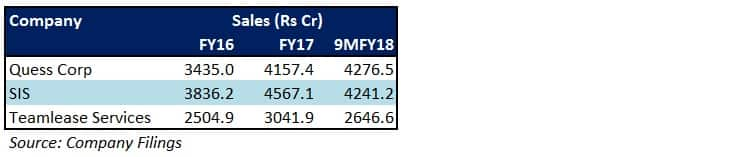

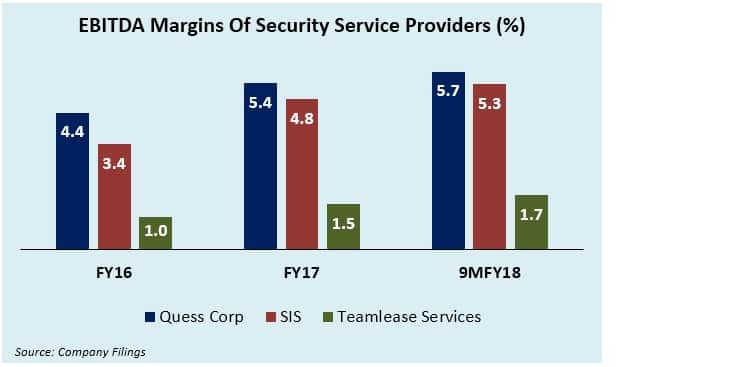

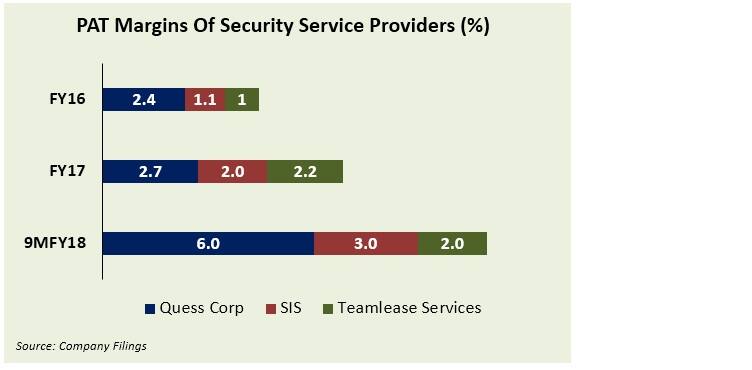

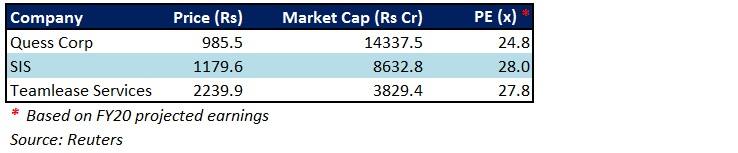

Peer comparison – An overview

Should you consider investing?

Even though security services will continue to remain SIS’s core focus area, the company has been simultaneously laying emphasis on its facility management segment. Acquisition of a 75 percent stake in Dusters (one of the well-known names in this space) in FY17 will bolster the company’s turnover further.

However, employee-related challenges (attrition, rising costs, demand-supply mismatch owing to lack of quality manpower) could have a major bearing on SIS’s performance. To some extent, a cost-conscious approach by the clients may result in pricing pressure and impact margins.

Cost of doing business in the cash logistics segment could go up too because of compliance norms proposed by the Ministry of Home Affairs (mandating more capital investments for securing cash vans and infrastructure).

The stock has rallied by 55 percent since its listing in August 2017. At 28x FY20 projected earnings, the valuation leaves little room for an upside in the near future. However, given the promising nature of the business, investors with a long-term horizon should gradually accumulate the stock.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.