Capital and commodities markets regulator, SEBI, has found ICICI Prudential Asset Management Company (ICICI Pru AMC) guilty of violating rules while bidding for the shares of firm ICICI Securities (I-Sec) on the last day of initial public offer. Accordingly, it has directed the fund house to refund Rs 240 crore with an annual interest of 15 percent to five schemes of mutual fund which invested in the IPO. Further, the regulator has also ordered compensating investors who redeemed their units since the date of allotment of shares in IPO. SEBI’s order leaves a lot of questions unanswered. Also read: Comment | Did SEBI just say that the ICICI Securities issue flopped?

While the SEBI rule is another blow to ICICI Group’s corporate governance standards, we try to understand the financial implications of the order on the group companies.

Financial impact on ICICI Pru AMC If the fund house decides to appeal to Securities Appellate Tribunal (SAT), there will be no immediate financial impact.

However, if the fund house obeys the SEBI directive, it will have to take Rs 240 crore worth of I-Sec shares in its books as investment. The amount to be compensated can be converted into extra units and allotted to every investor who held the units at the time of allotment of I-Sec shares.

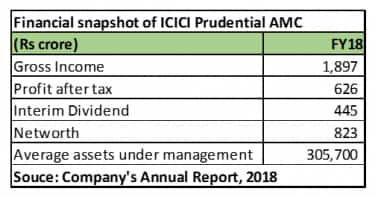

The fund house’s average assets under management (AUM) in FY18 stood at Rs 3,05,700 crore and posted net profit of Rs 626 crore, growth of 30% year-on-year.

Though the financials of the AMC will be adversely impacted, its current balance sheet size of Rs 1,167 crore and net worth of Rs 823 crore as on March 31 can withstand the impact. We don’t envisage a situation wherein the parent ICICI bank which holds 51 percent in AMC has to infuse capital. Though, the amount of dividend that bank receives from the fund house can drop in FY19.

Financial impact for group companiesICICI Securities ICICI Securities’ IPO got a lukewarm response from institutional investors. The issue sailed through after the size of the IPO was reduced and ICICI Pru AMC's bid for more shares on the last day. The stock listed 14 percent below its issue price and is down 36 percent since its listing in April’ 18.

The fund house in order to comply with SEBI order will have to get rid of at least the contentious application of Rs 240 crore which is 2-2.5 percent of I-Sec’s current market capitalisation. Noteworthy point here is that the fund house is the largest institutional holder in I-Sec with a 3.82 percent at the end of March 31, 2018.

It is unlikely that the AMC will sell the shares in the open market as it will further depress the stock price. As mentioned above, it will most likely take the stock in its book.

ICICI Bank We don’t see any major financial impact on ICICI Bank because of the SEBI order. In the hindsight though, the bank could have reported a loss in Q4 FY18 had the I-Sec issue not sailed through. The bank reported a one-off gain of Rs 3320 crore in the March quarter, from partial sale of stake in I-Sec.

Having said that, the AMC contributes only around 4 percent to the bank’s sum of part valuation. We value AMC at 5 percent of its FY20 (estimated) AUM and would not take into consideration one –off effect of the SEBI’s order on its financials. However, we would be watchful of how the events unfold and be worried only if there is further reputational damage that adversely impacts the flows into the funds.

What should investors do?ICICI Securities We remain positive on the macro factors supporting brokerage business (increasing share of financial savings, internet penetration) and believe that I-Sec is well positioned to benefit from such long-term trend. After the correction, I-Sec’s stock is trading at attractive levels.

Also read: ICICI Securities Q4 show appears good, valuation reasonable post correction.

Having said that, the ongoing issue will be a huge overhang on the stock. Hence, we advise clients to accumulate the stock in a staggered manner as there could be further downside till the dust settles.

ICICI Bank ICICI Bank shares have had a rough run in the past few years with the piling up of bad loans in corporate loan book. The corporate governance issues and uncertainty around management change will add to the volatility in the stock. Nevertheless, investors should look at the stock as a long-term bet as the valuation is attractive at 1 times FY19 (estimated) price to book value. Over the long term, we do believe the market will ignore the noise and focus on improving asset quality as well as return ratios of the bank.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.