Krishna KarwaMoneycontrol Research

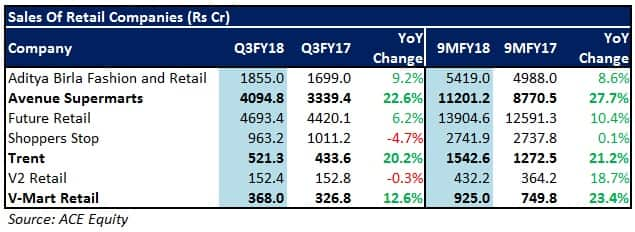

Organised retailers, constituting 10-15 percent of India’s retail industry, remain favourably poised in the aftermath of GST implementation, as the economy transitions from informal channels to formal ones. In this context, the Q3 numbers of India’s leading retailers deserve a closer look.

Aditya Birla Fashion & Retail (ABFR)

ABFR’s quarterly sales were marginally affected at the start due to the preponement of the festive season to Q2FY18. However, tailwinds such as wedding season, a strong winter, and an early onset of the end-of-season schemes during festivities compensated for it. The fast-fashion segment remained a downer.

Bullish prospects in connection with the ‘Pantaloons’ and ‘Lifestyle Brands’ segments, normalisation of GST hurdles, restructuring measures for the ‘Forever 21’ brand, addition of 60-80 new stores in the coming years, and promotional schemes to boost branded innerwear sales could bode well for ABFR in due course.

Avenue Supermarts (D-Mart)

Incremental sales (through 15 new outlets added in 9MFY18), a low base (due to demonetisation in Q3FY17), favourable product mix, centralised sourcing, and lower interest costs (on account of debt reduction) were the key contributors to D-Mart’s impressive Q3 show.

Besides augmenting its current network of 141 outlets further (through a cluster-based format), D-Mart’s future plans entail foraying into omnichannels (in Mumbai, to begin with), efficient inventory management through centralised sourcing, and paring borrowings (mainly from the IPO proceeds).

Future Retail

Future Retail fired on all cylinders in the quarter gone by on the back of a low base (demonetisation took place in the quarter ended December 2017), a favourable format mix, higher apparel sales (from the company’s flagship Big Bazaar outlets), and inventory optimisation steps.

Normalisation of supply chain issues should enable Future Retail to report better same-store sales growth. Rationalisation of ‘eZone’ outlets, completion of ‘HomeTown’ demerger, integration of ‘Hypercity’ with the existing structure, and convenience store expansion will be pivotal in boosting long-term profitability.

Shoppers Stop

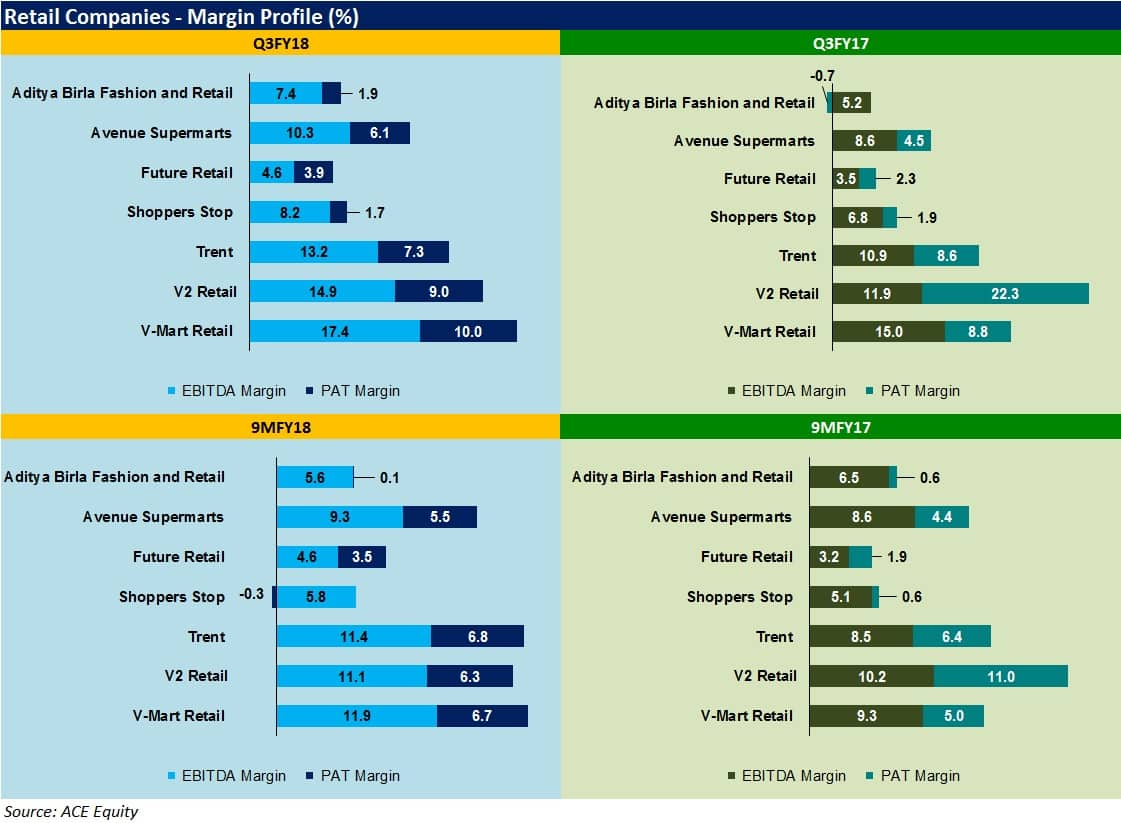

Shoppers Stop’s year-on-year revenue growth was subdued owing to store renovations and GST-induced lower maximum retail prices on non-apparel products (comprising nearly 37 percent of sales). However, the improved bottom-line performance was attributable to cost control initiatives and debt reduction.

Shoppers Stop aims to derive higher asset turns from its Rs 130 crore planned capex in FY19, apart from strengthening its online presence through the Amazon tie-up. Secondly, adoption of a ‘fashion at value’ model, coupled with the objective of deleveraging the balance sheet by FY19, should benefit the company.

Trent

Acquisiton of ‘Zudio’ (apparel, footwear, and home products sold to value cum fashion conscious customers) from Trent Hypermarket (Trent’s JV) in October 2017, healthy like-to-like sales growth at the ‘Westside’ outlets, and operating leverage enabled the company to post a good set of quarterly numbers.

Going forward, accelerated ‘Westside’ store additions, gradual revival of the ‘Zara’ brand, a change in ‘Star Bazaar’ retailing format towards small and medium-sized outlets, enhanced cross-sales from higher ticket size categories, and closure of loss-making ‘Landmark’ stores should augur well for Trent.

V2 Retail

V2 Retail’s (a retailer catering to price-sensitive buyers in Tier 2/3 Indian cities and rural hubs) operating margins witnessed an uptick due to higher contribution of private label brands, a better product mix, and GST-led savings. In contrast, revenue growth wasn’t up to the mark and PAT margins were subdued, too.

Good merchandise quality, value-for-money proposition, growing geographic visibility (target to reach 55/100 outlets by FY18/19 end, respectively), a faster pace of store maturity, and introduction of new margin-accretive apparel variants (wedding wear, kids wear) will be crucial to the company’s success.

V-Mart Retail

V-Mart’s good show in the quarter gone by was led by marginally positive volume growth (same-store sales growth was flat YoY), higher sales (launch of 10 new stores in Q3 caused footfalls to go up), and a sharp margin increase (primarily due to reduction in garment shrinkage and better procurement policies).

Outlet additions (30-35 per year in the upcoming fiscals), attempts to increase the loyalty member base (from the current number of nearly 9 million), impetus towards tier 4 regions, volume-driven clothing revenue growth, and lower overheads (through automation) could give V-Mart a shot in the arm.

Which stocks should you pick?

Though expansion/growth strategies chosen by the retail majors are fairly company-specific, the headwinds faced by them are similar. For instance, a high degree of competitive intensity hints at waning brand loyalty. This may necessitate extension of the ‘end of season sale’ period, consequently impacting margins.

In case of retailing businesses, requirements of working capital are high and margins typically low. Lack of adequate post-GST regularisation in trade channels in the smaller, high-growth regions may affect cash flows. Steep rent costs at marquee locations could influence store break-even dynamics significantly.

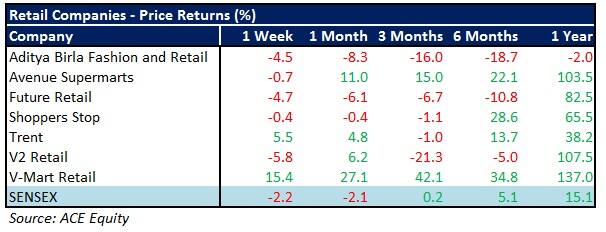

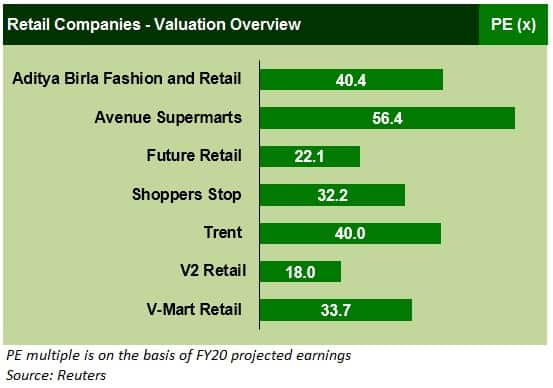

At first glance, Future Retail and V2 Retail are the only ones that seem to be reasonably valued. While the former is undergoing an organisational restructuring, the latter is banking heavily on rural demand and consumption (which appears positive due to rising disposable incomes, expectations of a good monsoon, and government’s higher allocation in the recently announced budget). In our view, investors may consider these stocks from a medium to long-term investment horizon.

In case of the rest, barring V-Mart and Trent, price corrections have been witnessed in the midst of the bearish environment over the past week. However, valuation multiples continue to remain high even at current levels, thereby indicating that the company-specific moats are comprehensively discounted in the prices already. Therefore, further market volatility may perhaps provide a good opportunity to prospective investors to consider accumulation.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!