Nitin Agrawal Moneycontrol Research

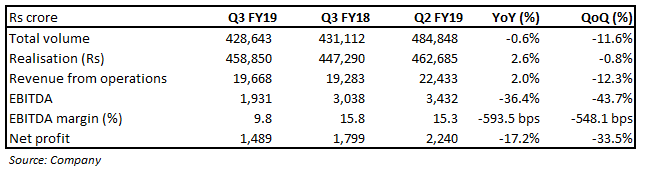

Maruti Suzuki India (MSIL), leader in the Indian passenger vehicle market, posted a weak set of Q3 FY19 earnings. MSIL posted a 0.6 percent year-on-year (YoY) decline in volume, due to subdued demand on lower festive sales, mandatory long-term insurance, rising interest rates and non-availability of retail financing.

Average selling price, however, saw a 2.6 percent improvement on the back of rich product mix, despite discounts offered on weak sales and higher level of inventory. This led to a two percent YoY growth in its net revenue from operations.

The auto major posted a 36.4 percent decline in earnings before interest, tax, depreciation and amortisation (EBITDA) on the back of a decline in volumes and significant rise in raw material and other expenses. These factors also led to EBITDA margin contraction of 593.5 bps (100 basis points = 1 percentage point).

The subdued near-term outlook limits stock upside, although we have a positive long-term view on the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.