Madhuchanda Dey

Moneycontrol Research

Mindtree reported an interesting set of Q3 FY19 earnings, reversing the weakness that was witnessed in the preceding quarter.

Key positives

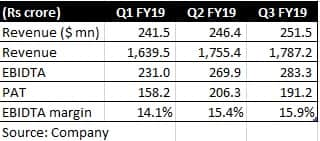

- Revenue momentum encouraging. Q3 FY19 revenue at $251.5 million - up 2.1% sequentially in dollar terms and 2.4% in constant currency. Year-on-year (YoY) growth in constant currency for Q3 stood at 17.8%

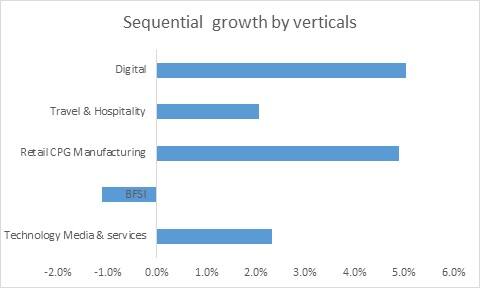

- Digital continues to grow faster – 32% YoY and 5% quarter-on-quarter (QoQ) and constitutes 49.5% of total revenue

- Strong increase in realisation at 3.2% as newer offerings are commanding better prices

- Operating margin grows 50 basis points (100 bps = 1 percentage point) sequentially to 15.9 percent on account of efficiency gains

- Management expects revenue growth to improve in Q4 and margin to remain stable. Looking to end FY19 with industry leading growth

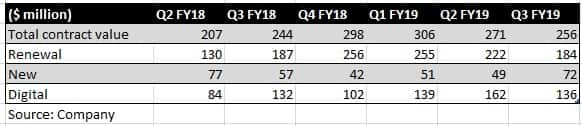

- Encouraging commentary on demand environment and steady deal wins reflecting strong end-market demand

- Employee addition remains strong and attrition stable

Key negatives

- In terms of verticals, while retail, consumer packaged goods (CPG) and manufacturing has made a comeback, banking, financial services and insurance (BFSI) de-grew sequentially due to a client-specific issue and year-end furloughs

- Tepid growth in top client

Other observations

- Although large IT companies have alluded to supply-side constraints leading to higher costs of subcontracting, the management didn’t sound worried

- Clients are looking to transform their core businesses. Deals are having more digital share, especially in the consumer facing businesses, and deal sizes are getting larger. Hence, management is in a position to move more work offshore

- Mindtree doesn’t see incremental risk to growth in FY20 at this point in time

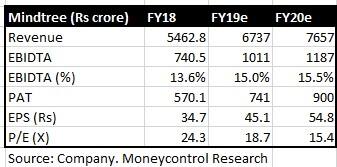

Outlook As an early adopter of digital and with the latter contributing close to 50% of revenue, Mindtree is likely to maintain its industry leading growth going forward. After the recent correction, post its disappointing Q2 result, the stock looks reasonably valued at 15.4 times FY20 estimated earnings. We recommend a buy on the stock.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.