Highlights: - Weak volume growth impacted topline - Negative operating leverage and raw material (RM) costs hurt operating margin - Business outlook for PV is weak for short term, positive for long term - Accumulate in a staggered manner --------------------------------------------------

Passenger vehicle demand continues to stay in the soft lane due to multiple macro challenges. The impact is visible in the latest financial performance of Maruti Suzuki India Limited (MSIL), the leader in the car segment.

Its topline was marred by weak volume while operating profitability was hurt due to significant rise in raw material (RM) prices and negative operating leverage.

The company continues to enjoy dominant position in the domestic market, driven by strong product portfolio and dealership network, brand loyalty on the back of competitive prices and resale value.

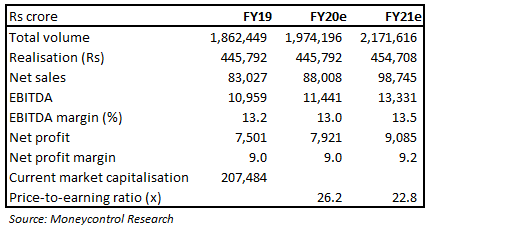

We believe that demand might remain sluggish in the near term. However, long-term outlook remains very positive. The stock trades at 22.8 times FY20 projected earnings.

Quarter in a nutshell

Key highlights:

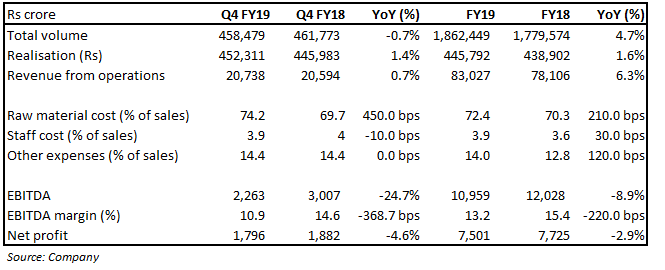

Volume declines, but realisation improves In Q4 FY19, Maruti saw a 0.7 percent year-on-year (YoY) decline in its volume, primarily due to subdued demand in light of multiple challenges such as increase in total cost of ownership after mandatory long-term insurance; rising interest rate and non-availability of retail finance.

Average selling price (ASP), however, witnessed a jump of 1.4 percent on a YoY basis, chiefly because of the rich product mix. This led to 0.7 percent YoY growth in its net revenue from operations.

Significant rise in RM prices dents EBITDA margin

MSIL posted a YoY decline of 24.7 percent in its earnings before interest, tax, depreciation and amortisation (EBITDA) in Q4 FY19 and its EBITDA margin saw a significant contraction of 368.7 bps (YoY). This was on account of a significant rise in commodity prices leading to rise in RM cost, higher sales promotion expenses, negative operating leverage and adverse foreign exchange.

Outlook

The Indian passenger car industry has been passing through a soft patch, thanks to multiple challenges such as an increase in the total cost of ownership due to mandatory long-term insurance and implementation of safety regulations and higher cost of retail finance.

Subdued consumer sentiment has led to muted volume growth for all auto majors.

In fact, the management has highlighted that demand is usually weak ahead of general elections and is going to impact the performance in Q1 of 2019-20 as well. And there is uncertainty regarding fuel prices, which have risen significantly in the past couple of months, and have a negative bearing on demand.

In light of these, the management has guided to a single-digit growth rate of 8 percent from 4 percent in its production and sales growth in FY20.

In the long term, however, we believe, there is a huge potential for cars in India and strong demand is expected to come from urban areas on the back of very low penetration and rising disposable income. Demand could get a further boost from rural market led by government's focus towards rural areas and increase in minimum support price (MSP).

BS VI implementation – Will it impact demand? Another challenge is the implementation of BSVI from April 2020, which is expected to increase the price of vehicles and could affect demand, especially in the entry segment. The management, however, indicated that this may lead to pre-buying of the vehicles as well.

The company is also planning to phase out diesel engines as they would become very expensive after BS VI implementation and would start producing it only after getting customer feedback post BSVI implementation.

New product launches, focus on LCVs to aid growth MSIL continues to focus on widening its product portfolio to aid growth. It has planned multiple new launches in coming years. The management has also highlighted that it has been aggressively focusing on light commercial vehicle (LCV) and has already garnered 12 percent market share.

Operating profitability to improve Commodity prices have been hurting the company’s margin for long and the competitive intensity and subdued demand did not let the company pass on the same to customers. Commodity prices, however, have come off their highs.

Additionally, higher startup cost of its Gujarat plant would go away in a year, which would improve operating profitability.

Further, MSIL imports various electronic parts from foreign countries that hurt its margin in case the rupee depreciates. The management hinted at localising the same despite many technological challenges.

Valuation In light of weak demand, the stock has corrected quite significantly and is down 31 percent from its 52-week high level. It trades at 26.2 times FY20 and 22.8 times FY21 projected earnings.

We advise investors to accumulate the stock in a staggered manner as the long-term outlook continues to be very positive and MSIL is a very strong franchise.

For more research articles, visit our Moneycontrol Research Page.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.