ITC's quarterly result marks another quarter of improvement, which is becoming increasingly broad-based.

While the cigarettes business is gradually stabilising, other growth levers (hotels, paperboards) are also helping. The stock remains a value play with an improving growth outlook, in our opinion.

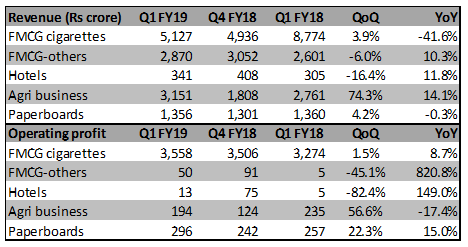

Q1 FY19 results: Stabilizing cigarettes business Table: ITC reported Q1 numbers

ITC’s topline Q1 results were in line with our expectations. The company’s comparable growth in revenue was 13.5 percent yoy (year on year), mainly aided by volume growth in FMCG sector, stabilisation in cigarette segment and improvement in agri-business. Improved margins seen in Q4 FY18 have sustained in Q1 FY19 wherein margin expansion in Paper business have compensated moderation in other segments.

Cigarette business stablising: A steep increase of tax incidence in the GST regime, estimated to be about 20 percentage points, have impacted volume growth of the cigarettes industry.

While ITC has been no exception to this downward drift in volume growth, the quarter under review suggests that ITC’s cigarette business is stabilising with sequential improvement in revenue.

FMCG (Others): The company's FMCG business grew 14 percent YoY, slightly higher than the trend in the last couple of quarters. This was driven by strength in branded packaged foods and the personal care products, even though ongoing restructuring of retail footprint and sluggish growth in the lifestyle retailing business weighed.

The operating margin, though improved significantly on a YoY basis, is still mediocre as new categories such as juices, dairy, chocolates besides health and hygiene in the personal care products segment, typically have a gestation period.

Other key updates from the segment are ITC's foray into the floor cleaner segment under the recently acquired 'Nimyle' brand. Further, capacity utilisation was scaled up at the recently commissioned facilities at Kapurthala, Panchla and Guwahati.

The company said over 15 of its projects are underway and in various stages of development like land acquisition/site development, construction of buildings, equipment installation and other infrastructure.

Hotels: There has been a sequential dip in the business but the company remains a beneficiary of improved industry cycle, leading to better room rates, operating leverage and growth in F&B (food and beverages).

Growth in the agri-business was strikingly good on topline though margins are weak on a YoY basis. The segment's bottomline was impacted by high tobacco leaf cost due to a drought in Andhra last year.

ITC has further scaled up in the food processing industry with the launch of packaged prawns, super safe spices, fresh fruits and vegetables and dehydrated onions under the ITC MasterChef and Farmland brands.

Among the segmental results, most noticeable was from the counter of paperboard business. While the revenue was stable due to slow pick up in end industries, margins improved due to strategic investments in imported pulp substitution and process innovation leading to improved pulp yield.

ITC remains a value play.The stock has been in the trading range of about Rs 251-287 for about one year, with challenges of GST related transition, subdued cigarettes volume growth and higher taxation have been the main drags.

Few of its businesses have recently witnessed encouraging growth traction – volume growth in FMCG business, growth outlook in hotel business and paper business and now stabilisation in cigarettes.

We believe on account of the above factors, ITC stock remains a value play (27x 2019e of earnings) with improving growth outlook.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!