Jitendra Kumar GuptaMoneycontrol Research

Highlights - Strong order book about 6 times sales provides robust revenue visibility - One of the most efficient engineering companies generating superior return ratios and margin - Dominant position in the growing railways sector - Trading at 8 times earnings and offering a 5 percent dividend yield

-------------------------------------------------

IRCON International, the recently listed state-run entity, had a bad debut with the stock slipping to a low of around Rs 340, down 28 percent from its issue price of Rs 475 per share. At the low point, the stock was trading at about 8 times its FY18 earnings, offering a dividend yield of close to 6 percent. The tempting valuation and comfort on the business front made it one of the top investments in our Diwali picks.

While the stock has already recovered from the lows, it still continues to be a good bet as valuations remain depressed and growth prospects are yet to be factored in by the market.

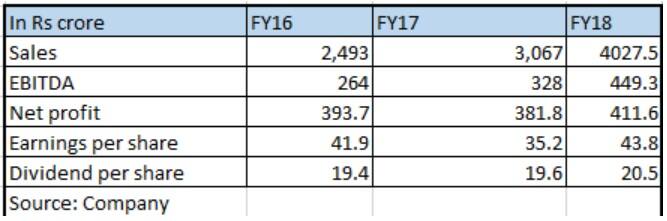

Strong revenue visibility IRCON is an integrated engineering and construction company generating 87 percent revenue from the railways. Because of opportunities in the railway sector and its monopoly in undertaking such projects, it has emerged as one of the fastest growing state-run entities.

Source: Company

Source: Company

This is precisely the reason why the company is sitting on an order book of close to Rs 22,400 crore, or about 6 times its FY18 sales. This provides it strong revenue visibility and greater scope for improved profitability.

Source: Company

During Q2 FY19, the company reported a 32 percent revenue growth, with profits expanding 154 percent on a year-on-year basis. While the current order book should ensure growth, the company is also increasingly looking into international markets and focusing on larger projects to drive higher growth. That apart, it is also gradually reducing its dependence on the railways as a segment, which accounts for close to 87 percent of its order book.

An efficient business model

If we annualise the net profit of Rs 246 crore in H1, the company should be reporting a profit of close to Rs 500 crore for FY19, which is close to 38 percent (also considered as core return on equity) of its FY18 adjusted net worth.

The latter is adjusted for cash in the books and capital work in progress. Not only are its returns superior, the company generates large free cash flow and that is why its net debt is zero.

It is sitting on a net cash of about Rs 1500 crore, which is close to 36 percent of its current market capitalisation. Superior return ratios, an absence of management or promoter risk and a strong balance sheet lends huge comfort.

Valuations At the current market price of Rs 432 per share, the stock is trading at 8 times its FY19 estimated earnings which is quite attractive considering the cash in its books, superior return ratios, strong revenue visibility and a dividend yield of close to 5 percent.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.