Nitin Agrawal Moneycontrol Research

Tyre companies posted a healthy set of Q1 FY19 earnings. Low base of last year due to the Goods & Services Tax (GST), falling raw material (RM) prices and strong demand from automobile manufacturers have all been supportive.

Short term concerns such as change in axle norms and mandatory long term third party vehicle insurance could dampen demand from original equipment manufacturers (OEM). However, what remains a big concern for tyre companies is the outlook on RM prices. While the sector will have to live with RM volatility, the end market, nevertheless looks promising. We expect some near term volatility in stock prices and pick Apollo Tyres and CEAT for the long term.

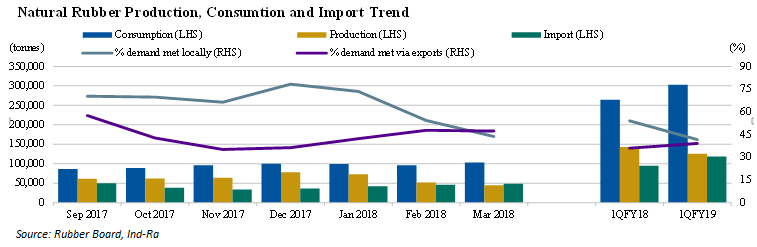

RM prices a big worry Kerala accounts for around 90 percent of the nation's natural rubber production. The Kerala floods will negatively impact tyre companies as 50 percent of their RM requirement is fulfilled through domestic production. Subdued production and strong demand for domestic rubber could lead to higher prices. Although some companies could resort to imports, the rupee depreciation versus the dollar is playing spoilsport. Therefore, we could see a negative short term impact on the operating margin of these companies.

Axle norm (CV) and long term insurance (2W and PV) may hinder short term demand Demand could be impacted due to increase in axle load by the government. Going by monthly volumes of commercial vehicles (CV), this has not yet dampened demand as industry awaits clarity on the same. The management of tyre companies said this could lead to increase in content per vehicle if truck manufacturers opt for larger tyres, thereby benefitting them.

Recently, the Supreme Court made it mandatory for third party insurance cover on all new cars and two-wheelers (2W) for a three year and five year period, respectively. This is expected to increase the initial outlay for buying a vehicle and may dampen demand for these vehicles in the short term. This could negatively impact volumes for tyre manufacturers as well.

CEAT Tyres: Capacity expansion and reasonable valuation CEAT’s revenue grew 16.8 percent year-on-year (YoY) in Q1 FY19 on the back of 18.5 percent volume growth. The latter was driven by demand accruing from both OEMs and exports. Realisation, however, witnessed a 1.5 percent decline due to unfavorable product mix.

In terms of operating profitability, earnings before interest, tax, depreciation and amortisation (EBITDA) margin witnessed a 668 bps expansion on the back of a fall in RM prices and other expenses. The management undertook a price hike of 1.5-2 percent in Q1 FY19 across all segments to pass on the rise in RM prices.

The management has earmarked Rs 4,000 crore as capital expenditure to be invested over FY17-FY21 to increase capacity by 50 percent. The capex would be done across segments to attain strategic product mix and improve revenue contribution from focus areas. It expects strong demand for the new capacity.

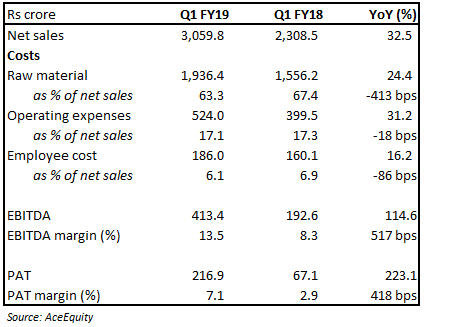

MRF: Deserves a premium In Q1, MRF posted subdued YoY growth (8.1 percent) in net sales. This was primarily due to its inability to participate in radial tyres because of capacity constraints and stiff competition in the 2W segment. EBITDA grew 116.5 percent on the back of a fall in RM prices. This led to YoY EBITDA margin expansion of 773 bps.

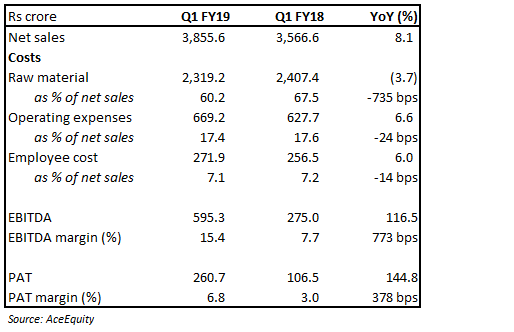

Apollo Tyres: Overhang is almost done With the capital expenditure cycle coming to an end, the company has started to deliver a strong set of numbers. Sales increased 32.5 percent on the back of strong performance across regions. Asia Pacific, Middle East and Africa (APMEA); Europe and other regions witnessed a growth of 33 percent, 22 percent and 29 percent, respectively. Within the domestic market, it continues to perform well and posted a volume growth of 100 percent, 60 percent and 20 percent in 2W, CV and passenger vehicles, respectively. Volumes in Europe grew 2 percent. On the back of a significant decline in average RM price per kg, it achieved 517 bps expansion in EBITDA margin.

On the capacity expansion front, the management said the company is on track to ramp up its Chennai plant to touch 12,000 tyres per day (TPD) from 10,000 TPD currently. New plant construction in Andhra Pradesh for CVs and PVs has started and is expected to be commissioned in H2 FY20. Capacity of its Hungry plant is expected to rise to 16,000 TPD by FY19-end.

Apollo and CEAT valuations at reasonable levels MRF is the leader in this space and deserves premium valuation due to its formidable record. We would advise investors to accumulate the stock on any short term weakness arising from a rise in RM prices.

After the recent correction in CEAT, valuations are at reasonable levels. Similarly, Apollo Tyres is also trading at a reasonable valuation and would advise long term investors to accumulate these two stocks on any weakness as these companies might witness some pressure due to rise in RM prices and moderation in demand in upcoming quarters.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!