Highlights- Strong growth in revenue, profit and margin - International segment turns around - Healthy growth in occupancy and rates - Substantial reduction in finance costs - Balance sheet position remains stable -------------------------------------------------

Indian Hotels Company (IHC) reported a stellar performance in Q3 FY19, which is a seasonally strong quarter for the company. The management witnessed strong topline growth and decent margin expansion, which was driven by healthy growth in the international segment that has been a laggard in the past few quarters.

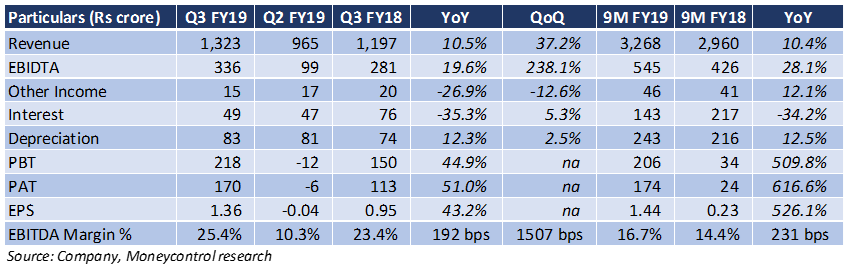

Result snapshot

Key highlights - The company saw strong topline growth (10.5 percent year-on-year), driven by an improvement in the operating performance of its international properties in the US (The Pierre Hotel, New York) and UK (St. James Hotel, London)

- Favourable currency impact led to a performance improvement in its international segment

-Higher occupancies (domestic: 67 percent, international: 70 percent) and hike in room rates led to a 192 basis points improvement in earnings before interest, tax, depreciation and amortisation (EBITDA) margin

- Revenue from the domestic food and beverage (F&B) segment grew 6.2 percent. The same for the international segment grew 18.5 percent

- Reduction in interest costs (-35 percent YoY) contributed to a healthy 45 percent uptick in Profit Before Tax (PBT)

- Net profit included an exceptional gain of around Rs 41 crore with respect to currency derivative contracts. However, adjusted profit also remains substantially above last year’s numbers

Other notes - Going forward, the company aims to make its balance sheet leaner by unlocking value through sale, leaseback and monetisation of non-core assets like ITDC shares, residential apartments etc

- The company is planning to add to the room portfolio through an asset light model in the future, thereby bringing in higher operating leverage. IHC has signed 20 new properties with around 2,750 rooms, which will largely be management contracts

- The company plans to fund all major capex in the upcoming year through internal cash flows

- The revised price contracts for corporates kick in from Q4 and this is expected to improve room realisations even further in the current quarter

- Sector dynamics are favourable, with demand growing at a faster pace than room supply, thereby providing pricing power and bringing in higher occupancies. The management expects the trend to continue in FY20

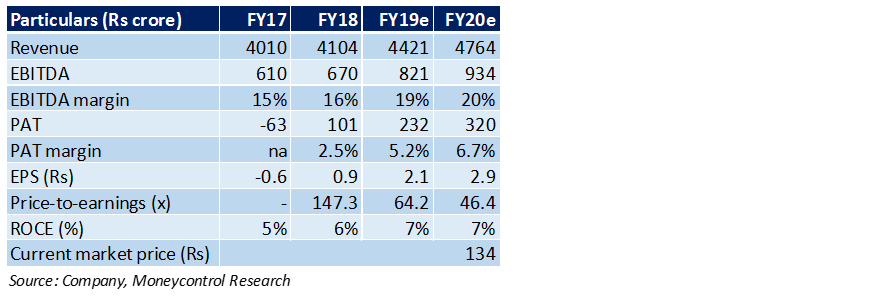

Outlook With improving sector dynamics, revival of the international operations, fast monetisation of the brand via strategic management contract model and improving domestic demand for hospitality services, we stay convinced about the growth story of the company. Performance in Q4 is expected to remain strong, given the seasonally strong quarter and the favourable sector dynamics.

The stock is currently trading at a 1.15 times its trailing 12-month enterprise value per room, which is much lower than that of international peers, and at an estimated FY20 EV/EBITDA of 19.4 times. With a healthy uptick in occupancies and rates, lean balance sheet and a strong brand, we believe IHCL is positioned to capture benefits of an upcycle in the segment.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!