Anubhav Sahu Moneycontrol Research

Broadly as per our expectation, Hindustan Unilever (HUL) posted a decent set of Q3 FY19 earnings mainly led by volume growth. Domestic sales grew 13 percent year-on-year (YoY). Volumes rose 10 percent versus 11 percent in the base quarter.

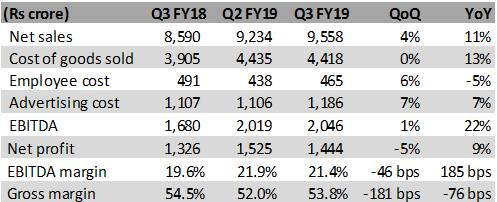

Result snapshot  Source: Company

Source: Company

One of the positive takeaways from the initial management commentary is that rural demand remained the flag bearer of overall growth. All the three divisions posted double-digit sales growth YoY making it the fifth such consecutive quarter. Among key trends from the quarter gone by were premiumisation for fabric wash and personal wash, improved rural reach in household care and new launches.

Gross margin contracted 76 bps on higher crude oil linked raw material cost in the quarter gone by. EBITDA margin, however, improved on better product mix, operating leverage and cost rationalisation.

Outlook We are enthused by the volume-led growth coming on a high base. While pricing growth was a shade lower, it possibly reflects the recent moderation in cost inflation. HUL remains our key stock pick and is likely to benefit from consumption growth led by rural areas (40 percent sales exposure). The stock after seeing a decent run from the October 2018 lows has recently consolidated and hence provides an opportunity to accumulate. It currently trades close to 44 times FY21 estimated earnings after including benefits arising from the recent GSK Consumer Healthcare India deal. The premium valuation factors in limited volatility in earnings, innovation profile and strong execution capabilities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.