Sachin Pal Moneycontrol Research

Highlights:- Q3 performance driven by strong topline growth across business segments - Operational profits grew 12 percent as margins contracted YoY - Strong demand during festive season aided consumer durable sales - Distribution network to expand by 10-15 percent in FY20 - Valuations expensive at 45 times FY20 estimated earnings

-------------------------------------------------

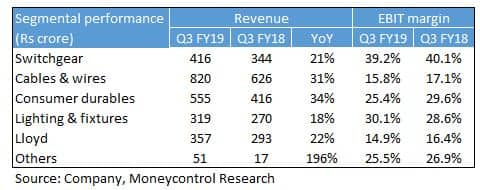

Havells India reported a decent set of numbers for Q3FY19. While the topline grew 28 percent, the margins remain subdued on account of high commodity costs. The management hopes for margin recovery in coming quarters as metal prices in the global as well as the domestic market have softened over the last six months.

Key positives

- Favourable revenue base along with a strong consumer demand across all its business verticals drove the overall topline growth for the quarter.

- Revenue growth of 31 percent in the Cables & wires segment was largely volume driven (up 24-25 percent YoY) aided by strong demand from infrastructure and power sectors.

- New product launches (water purifier, water heaters etc.) along with market share gains in some of its existing product categories aided the growth in the Consumer durables segment.

- Lloyds’ business posted a robust quarter on the back of higher TV and AC sales. Havells through its brand development and distribution is trying to reposition Lloyds from a mass brand to a mass premium brand.

- The management expects the growth momentum gained in previous quarters to continue into Q4. Further, metal prices have cooled off in recent months and should support a recovery in margins in the coming few quarters.

Key negatives

- The operating profits grew 12 percent, despite the topline growth in excess of 20 percent, as the high commodity costs led to a 160 bps contraction in margins. The same, however, improved slightly on a sequential basis.

- The management has indicated a slight contraction in consumption (in certain pockets) due to liquidity crisis emerging from IL&FS issue. The liquidity situation continues to improve and demand should normalise over the next couple of months.

- Inventory for Lloyd’s business continues to remain at elevated levels. A weak Q1 (unseasonal rains in most regions of India in summer), followed by a sluggish Q2 (due to monsoons), has caused an AC inventory build-up across the trade channels.

- The company has witnessed a sharp jump in intangibles after the acquisition of Lloyd’s business. The balance sheet at the end of December 2018 shows intangible assets worth Rs 1,473 crores, which is near twice its FY18 net profits.

Other Developments

- Havells has a network of 7,500 distributors which services 100,000 retail touch points. The company aims to further expand penetration into tier-2 and 3 markets through 10-15 percent expansion in the distribution network.

Outlook and recommendation

- A strong quarterly performance on almost all fronts reinforces our faith on the execution capabilities of the management.

- Over the past couple of years, Havells has gained a strong foothold in the sector with the launch of new products and gain in market share across segments. The company seems well positioned to benefit from an expanding distribution network and increased brand visibility.

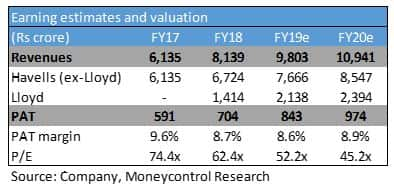

- The stock currently trades at 45 times FY20 projected earnings and seems priced to perfection. However, given its strong positioning, we recommend keeping the stock on the radar for accumulation during a weak phase of the market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.