Nitin Agrawal Moneycontrol Research

Highlights: - Diversified product portfolio and client base - Leadership position in its product segments - Focus on aftermarket - Lean balance sheet, strong return ratios and reasonable valuation --------------------------------------------------

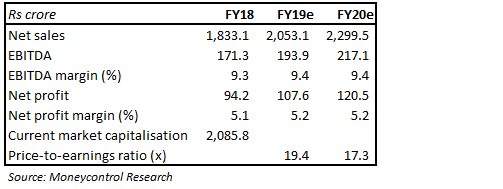

Gabriel India with a strong and diversified customer base, improving product mix towards passenger vehicles, focus on high-margin after-market segment, strong financial performance and reasonable valuation (PE FY20- 17.3 times) is an ideal candidate for long-term investors.

The business Gabriel India is the flagship company of ANAND, which is a leading manufacturer and supplier of the widest range of ride control products in India, including shock absorbers, struts, and front forks, across automotive segments and railways. It has seven manufacturing facilities in India and two satellite plants.

Strong client base - boosts confidence Backed by engineering abilities and robust design, Gabriel has been able to meet the evolving needs of clients. It has been able to partner with strong companies, except Hero MotoCorp where Munjal Showa is the sole supplier in the same product category. A strong clientele has helped it achieve robust financial performance and provide investors the required confidence.

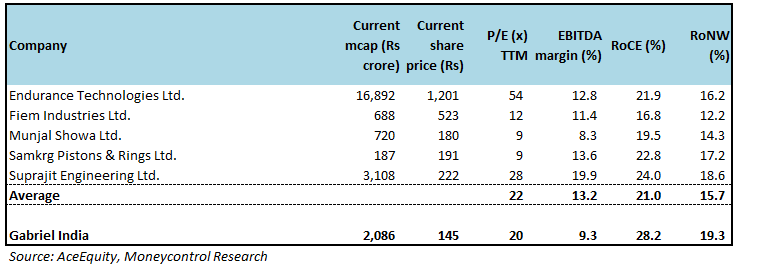

Leadership position Superior product quality and strong client base have established Gabriel as a dominant player in the industry. It has 25 percent market share in 2W segment, 65 percent in 3Ws segment, 25 percent in passenger vehicles (PVs) and 85 percent in commercial vehicles (CVs).

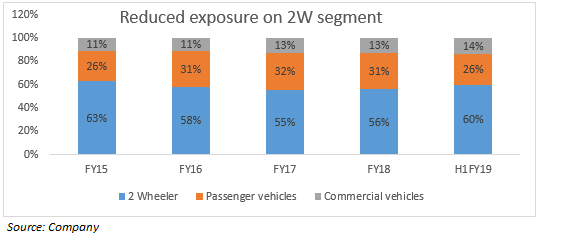

Diversification – no client and product risk Gabriel has been focusing on diversifying its revenue stream to avoid single segment/ client dependence. As of FY18, it generated 56 percent revenue from 2W/3W segment, down from 63 percent in FY15. Around 31 percent and 13 percent of revenues came from PVs and CVs, respectively, up from 26 percent and 11 percent in FY15. Revenue share from 2W segment, however, moved up to 60 percent in H1 FY19, primarily due to strong order from 2W segment and muted PV orders. But, the company continues to make efforts to reduce concentration.

Client concentration is minimal with no client contributing over 20 percent of sales. TVS, the largest client, contributed 18 percent to sales.

Industry opportunities – murky in short term, bright in long term The automobile sector is going through a rough patch led by muted consumer sentiment caused by a liquidity crunch, non-availability of retail finance and subdued festive demand. However, its customers such as TVS and Bajaj Auto continue to be resilient and have been posting better monthly sales number despite all challenges. This might continue to augur well for Gabriel. We believe the sector will continue to face challenges in the short term but the long term looks promising with some support likely from a pick-up in the rural economy, especially in the election year.

Strong focus on aftermarket Gabriel India has been focusing aggressively on aftermarket as there is a huge opportunity. It has a strong network of 500 dealers and has 10,000 retail outlets with trained sales force. The company plans to leverage brand strength and distribution network and increase aftermarket revenue share from the current 11 percent. Aftermarket revenue has clocked a compounded growth rate of 10 percent over FY15-18.

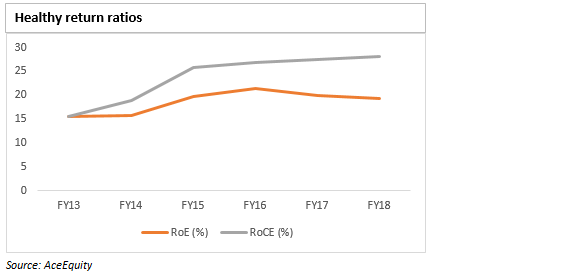

Financial performance snapshot – lean balance sheet, high return ratios Gabriel’s net revenue grew 8.4 percent compounded annually over FY12-FY18. Its earnings before interest, tax, depreciation and amortisation (EBITDA) witnessed much higher growth of 10.5 percent over the same period. EBITDA margin averages around 8.3 percent over the same period. It has also reduced debt-to-equity from 0.53 times to be virtually debt free.

Additionally, Gabriel has a very strong return profile with RoCE and RoE averaging around 23.65 percent and 19.57 percent over FY12-FY18, respectively.

Risks Gabriel generates most of its sales from original equipment manufacturers (OEMs) and any slowdown in their sales would hurt the company. Additionally, raw material prices continue to be a big risk. With close to 14 percent of raw material imported in FY18, volatility in currency and change in the customs duty could have an adverse impact.

Valuation Amid the stock market volatility in mid/small cap stocks, the stock price has corrected 28 percent from its 52-week high, making valuations attractive. Currently, it is trading at 19.4 times and 17.3 times FY19 and FY20 projected earnings.

Peer comparison

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.