Royal Enfield maker Eicher Motors (EML) has posted in-line set of numbers amid concerns over volume growth due to subdued consumer sentiments.

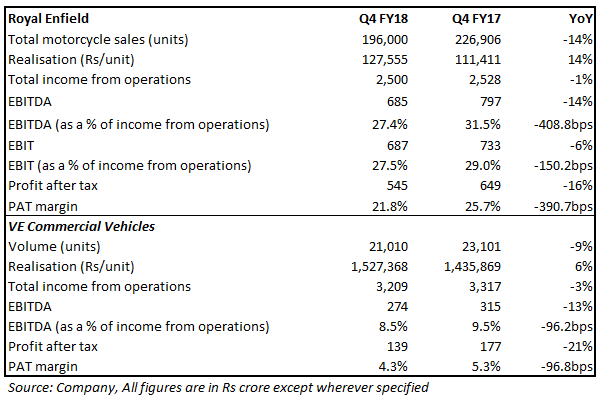

Royal Enfield registered a significant volume decline of 14 percent on a year-on-year (YoY) basis during the quarter. The volume growth was hit due to overall weakness and subdued customer sentiments in the auto sector. This was because of a rise in the total cost of ownership due to mandatory long-term insurance and regulatory safety requirement. Realisation, however, witnessed a YoY increase of 14 percent. The company posted a YoY growth of 1 percent in its net revenue.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin contracted 408 bps, primarily, due to rise in raw material prices and negative operating leverage.

In terms of Volvo Eicher CV (VECV) performance, the company registered a volume decline of 9 percent on YoY basis and net revenue declined 3 percent. EBITDA margin contracted 96 bps on the back of negative operating leverage.

We see limited upside in the stock price as near-term outlook continues to be weak and stock trades at elevated valuations.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.