Anubhav Sahu Moneycontrol Research

Emami witnessed moderate sales growth (seven percent year-on-year), supported by 3.5 percent volume growth in the domestic market in Q3 FY19. Gross margin contracted about 160 bps quarter-on-quarter (QoQ) due to the impact of high mentha prices but was in line with the margin guidance provided in Q2.

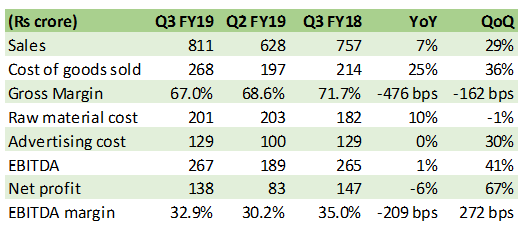

Result snapshot

Source: Company

Key positives Key positive for Q3 has been strong performance by the Kesh King range, which grew 26 percent YoY. It speaks well about the management’s confidence in re-positioning the brand in the premium hair oil segment. Similarly, Zandu Pancharishta sales (30 percent) seems to have benefited from tweak in the company’s product strategy.

Navratna continues to do well. With 10 percent growth in Q3, its share in the cool oils segment has improved to 66.1 percent (up 340 bps) in the quarter gone by.

International business (12 percent of sales) grew 18 percent, led by performance in SAARC (South Asian Association for Regional Cooperation) and MENA (Middle East and North Africa) region.

Concerns on account of domestic distribution is easing. Wholesale channel’s share has stabilised at 38 percent. Direct reach has improved to near 9.25 lakh outlets, which is 50 percent higher than two years back. Sales from modern trade channel has improved and now contributes eight percent to total sales.

Key negatives Unlike Hindustan Unilever (HUL), winter portfolio (47 percent of sales) of the company was impacted because of a delayed winter. Sales for BoroPlus range grew by only four percent. The segment’s 9M FY19 sales performance was flattish compared to last year.

Male grooming segment continues to remain weak with a two percent decline in sales.

Sales through Canteen Stores Department (CSD) channel (4 percent of sales) remained subdued at two percent, unlike improved performance from some of its peers. Management attribute this to limited Emami brands approved, at present, for the CSD channel.

Key observations Key concern from investors is the high (47 percent) pledge of promoters holding. Borrowings based on that are being utilised for group companies like Emami Cements and Emami Edible Oils. The company is looking at ways and means to reduce the pledge such as private equity investments in privately owned entities.

New distribution reach keeps hope for broad-based growth The company is witnessing improving signs of success of its product-based strategy and has been able to improve demand traction for key products.

Rural growth continues to trend higher than urban but doesn’t seem to be as robust compared to peers.

Both rural-led growth and market intervention should improve given the significant progress the company has achieved in terms of direct distribution reach. Together, this should broad-base growth, which has not been visible for the last few quarters. For instance, HUL has been successful in its market intervention strategy and nimble response to demand conditions.

Margin pressures have eased off for the company in Q4 FY19 from mentha prices and crude oil perspective. Hence, the company is hopeful of maintaining margin similar to Q4 FY18 in Q4 FY19 as well.

The stock is currently trading at 30 times FY20 estimated earnings, which is at a steep discount to the sector. This makes it an interesting stock to look at as the company is showing signs of improving product strategy execution. We need to see more broad-based improvement in growth to get more constructive. In our view, elevated pledge percentage of promoters holdings would continue to weigh on stock multiple given the turbulence in the financial market.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.