Nitin Agrawal Moneycontrol Research

Highlights:

- Eye-catching valuations - Leadership position in automotive cable industry - Growth drivers: capacity expansion, aftermarket and export market - Well diversified business with strong clientele--------------------------------------------------

The market's fall in the last few months has uncovered many buying opportunities that become more attractive if the company has a dominant position in the market.

One such company is Suprajit Engineering Ltd (SEL), a manufacturer of automotive and non-automotive cables, which has established itself as India's largest manufacturer of automotive cables. What's more, it is well diversified across products and clients, has a promising aftermarket and export market, plus capacity expansion coupled with attractive valuations. These qualities make SEL a long-term buy.

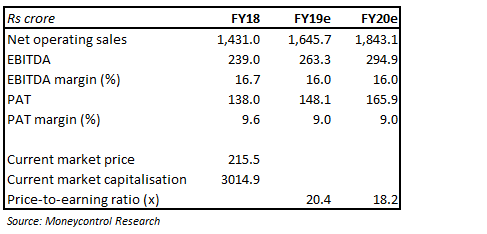

Attractive valuations

There has been a 38 percent correction in SEL's stock price from its 52-week high, making the valuation extremely attractive. The stock currently trades at 20.4 and 18.2 times FY19 and FY20 projected earnings, respectively.

Leadership position

SEL is a dominant player in the automotive cable segment with 70 percent market share in the two-wheeler (2W) segment. From being only a two-wheeler cable supplier, SEL has started focusing on four-wheelers and increased its market share from 20 percent to 35 percent in the last five years. It recently got new business from Tata Motors and plans to bring the leader, Maruti, on board.

Capacity expansion to fuel growth

SEL has been investing in increasing production, with cable capacity registering a compounded annual growth (CAGR) of 15.6 percent over FY11-17 to reach 250 million units. Now, it has earmarked Rs 100 crore to boost capacity to 300 million units in the next two years. It has started working in that direction with two greenfield projects.

Strong aftermarket opportunities

After the introduction of GST, the company has been receiving benefits of a shift in business from the unorganised sector to organised players. SEL senses a big market opportunity in the space and has been focusing on expanding its presence. This would not only help in achieving strong topline growth, but in margin expansion as margins are higher in the aftermarket.

Export market seems promising

The management has highlighted that automotive exports through Suprajit Automotive and Suprajit Europe have been doing well. The company has bagged significant new export orders as well. The management expects automotive exports to double to Rs 280 crore by FY21, from Rs 140 crore in FY18.

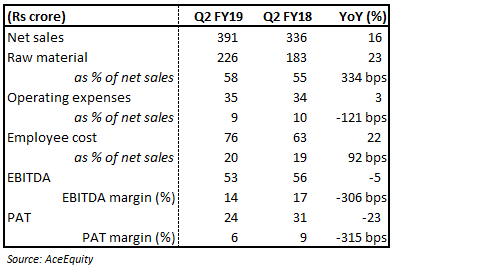

Decent Q2 FY19 performance

Reflecting the growth in the automobile industry, SEL posted a year-on-year (YoY) growth of 16 percent. The growth came from the core cable business, partially offset by poor performance from its acquired businesse--Phoenix Lamp (PLL) and Weson. PLL saw muted growth due to subdued demand in Turkey and Iran, coupled with challenges in Europe. Suprajit Engineering non-automotive (SENA) division’s overall performance was satisfactory. What troubled SENA is the margin contraction at Wescon attributed to the rise in commodity prices, US tariff on imports from China, freight cost and expenditure on new business development.

In terms of overall operating profitability, earnings before interest, tax, depreciation and amortisation (EBITDA) saw a year-on-year decline of 5 percent and margin contracted y-o-y by 306 bps. This was primarily due to a significant surge in raw material (RM) prices and rise in employee cost, which was partially offset by reduction in operating expenses.

Well diversified

Started as a cable supplier to 2W segment only, it now caters to customers from passenger vehicles, commercial vehicle and non-automotive segments. In the first half of FY19, it generated 36 percent of its business from 2W and 21/21/22 percent from aftermarket/ non-automotive/ automotive businesses, respectively. Moreover, the acquired businesses of Phoenix Lamp and Wescon Control also de-risk SEL’s product portfolio.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.