Highlights - Revenue show rides on healthy volumes

- Product prices under pressure with limited pricing power- Raw material prices easing, gross margin flat- Coronavirus spread a key risk for margins- The company is eyeing better product mix, a long-term positive---------------------------------------------------------

Dhanuka Agritech (DAL) (CMP: Rs 533; Mcap: Rs 2,531 crore) proved its point during the December quarter of 2019-20 with an estimate-beating performance. That was largely driven by 25 percent growth in revenue from a year ago.

The volumes play turned better, especially in western and southern markets. Gross margin remained flat.

About the companyDhanuka is into formulation and marketing of plant protection agro-chemicals, including insecticides, herbicides, fungicides and plant growth regulators. It has three manufacturing facilities in Rajasthan, Gujarat and J&K, along with an R&D centre in Gurgaon.

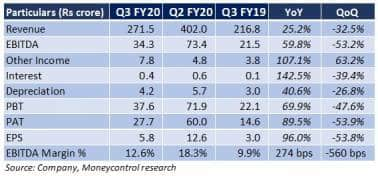

Financial Performance

- Revenue went up 25 percent year-on-year (YoY), mainly aided by volumes that rose 27 percent during the quarter despite a negative 2 percent hit from pricing. The pricing pressure continues to eat into its realisations.

- A revenue growth of a healthy 40 percent in herbicides and 26 percent in fungicides offered a helping hand. Western India accounted for 46 percent of the pie, followed by 26 percent in South and 21 percent in East India.

- What is striking is net margin that swelled 346 basis points (bps), with higher other income playing ball.

- A sales pick-up in new launches has come as a shot in the arm for incremental revenue. The agro chemical player has a healthy pipeline of products and plans to roll out six new products in FY21. Any traction from these new launches is expected to support top line in coming quarters. Fresh products are also driving the company towards a better product mix with improved margins and in turn, a better profile.

- A revamp in its marketing network is on, to accelerate overall business growth. It is focusing more on high revenue-generating customers through its Kohinoor scheme and weeding out uncompetitive dealers.

- High raw material prices continue to give the company a hard time. However, the prices have been on a downward trend since December 2019, offering partial relief.

- The trouble is the Coronavirus scare, which might worsen the raw material scenario. According to the management, the company is covered till March with its current inventory. The bigger worry is, if the epidemic spreads or continues post March, raw material sourcing might take a beating.

Outlook

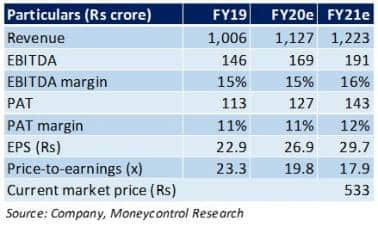

The stock has been in a fine nick of late, which is trading at a P/E of 18 times the FY21 projected earnings.

Riding on a strong pipeline of new products launches, the company is positioned to move towards a better product mix and margin profile.

The raw material prices have been softening, which is a positive. However, the current China situation amid the Coronavirus outbreak remains the key risk for any margin improvement. That’s something to keep your eyes on.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!