Highlights -Delta Corp posted a muted top line for Q3 FY20 - Significant contraction in EBITDA margin - Online gaming and cruise a force multiplier - Nepal casinos to boost net revenue - Buy the stock for long term --------------------------------------------------

Delta Corp, the only listed player in the casino (live, electronic and online) gaming industry in India, stood up to multiple challenges during the December quarter, registering a flat top line growth. But operating margin came under pressure due to dry docking of one of its vessels.

With multiple drivers at play, we advise investors to buy the stock with an eye on the long term.

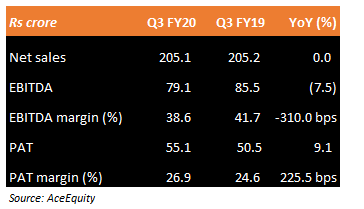

Quarter at a glance

Key highlights A host of factors ganged up to keep revenue on a tight leash -- the broad slowdown, higher market capacity, the worst tourist season in Goa and the dry docking of its vessel. Segment-wise, casino revenue was down 3.4 percent whereas online gaming grew 9 percent.

Earnings before interest depreciation, tax and amortisation (EBITDA) margin, also known as operating profit margin, took a big blow, which contracted 310 bps due to negative operating leverage. By contrast, online gaming EBIT margin stood out, expanding by 890 bps, which cushioned the fall in the overall margin.

The quarter gone by for Delta Corp remained broadly in-line. That said, it has quite a few growth levers, going forward.

Nepal casinos to get off the ground Its Nepal casinos are caught in an operational delay. Now, with all necessary approvals, these are likely to start operations in Q4 FY20. According to the management, its Nepal operations have the potential to generate revenue of Rs 60-70 crore per annum with more than 40 percent EBITDA margin.

Cruise casino – A new growth driver Delta had made a strategic investment of $10 million to acquire 25 percent stake in Jalesh Cruises, a luxury cruise, which went on stream in April 2019 in India. This is expected to bring in revenue of Rs 25-30 crore per year for the company. Any scale-up in operations by Jalesh means significant revenue upside for Delta.

Jalesh’s occupancy level is on the rise, hitting 60-65 percent in October-December from 20-25 percent earlier. Higher occupancy is also seen to yield more revenue for Delta, along with the benefit of operative leverage.

Aggressive focus on online gaming The focus on online gaming remains strong, given its role in driving growth. A growing internet penetration and availability of online payment options have only made the management more optimistic about the future growth prospects. The assessment of a yearly growth of 20 percent basically stems from that.

Goa casino land policy The new casino land policy of the Goa government, which is in the works, is expected to be a game changer. It could lead to creation of gaming zones and formalization of the industry. Delta, being the leader, is well placed to benefit from the change. The policy is likely to be taken up in the winter session.

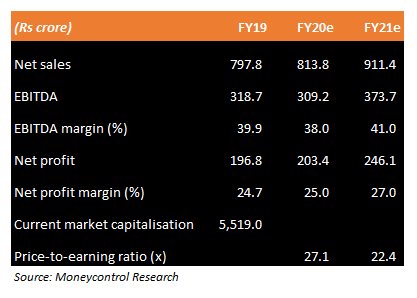

Valuation At the current price, the stock trades at a valuation of 22.4 times FY21 projected earnings. That’s reasonable for a growth company like Delta.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!