Moneycontrol Research

Highlights:Strong volume growth 9.6 percent aided by health and personal care portfolioInternational business shows signs of pick upVolume guidance moderates for FY20 due to rural slowdownGross margins gains to be deployed behind brands and reachStrong and sustained positioning in naturalsMarket share gains in key categories positive; Headwind in beverages key concernDabur’s quarterly result comes with its Yin and Yang perspective. Robust volume growth came as a clear surprise, but this was outweighed by tapering demand sentiment and a weaker growth outlook.

Category concern for the beverages was another spoiler. However, the company’s growth strategy of deploying gross margin gains for defending market share and investment behind brands defines the investment case for a longer term, in our view.

Key positives

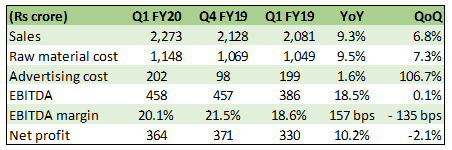

Q1 Financials

Dabur’s consolidated sales grew 9.3 percent YoY, mainly led by domestic demand which constitutes about 68 percent of sales. India business grew by 10.5 percent on the back of an exceptional 9.6 percent volume growth, which interestingly came on a high base of 21 percent.

International business sales growth was at 7.7 percent, mainly led by strong recovery in Turkey (+40.7 percent). The management expects that such a growth in international business should sustain with a marginal improvement in margins.

Dabur’s EBITDA margin improved from a year ago as higher material cost was more than offset by moderate increase in employee cost, other expenses and advertising cost. Taking account of accounting standard changes, EBITDA margin improvement was about 117 bps.

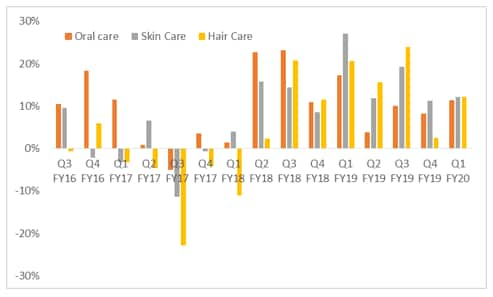

Strong growth was led by double-digit growth for healthcare (27.1 percent of sales) and home and personal care (52.5 percent of sales) segments. This was aided by market share gains in Glucose, hair oil, shampoos and oral care. While performance in Glucose was aided by strong seasonality, in the hair oil segment, the company benefited from customer switch towards low-priced Amla franchise in the recent slowdown.

Chart: Home & Personal Care sub-segments performance

Key negatives

While the domestic volume growth was unexpected, the management commentary suggests that there is a gradual deterioration in hinterland demand trend. Note that rural demand is about 47 percent of total sales for the company. Demand in June was weaker than that of the start of quarter. This is primarily due to rural distress, shrinkage in rural per capita wallet leading to significant credit stress, particularly in the rural-oriented supply chain.

Second, the foods segment (20.4 percent of sales) was the key laggard with just 1 percent sales growth YoY. The company reports that low growth in beverages was on account of the late onset of summer in North India and competitive intensity, and what is even more concerning is the decline in the category itself.

Dabur has been facing intense competition mostly in the beverage segment where juices now closely compete with dairy-based drinks. In recent times, several frontline companies (ITC, Britannia) have ventured into this business. This is the first time when any management has explicitly acknowledged that juices category by itself has declined.

Other observations

Plans for distribution reach add to conviction for medium term. In urban areas, the company has a direct reach to 1.14 million outlets and plans to reach till 1.2 million in FY20. In the medium term, it aspires to have a direct reach in urban areas of ~2-3 million outlets.

In the case of rural areas, the firm has a direct reach to 44 thousand outlets and plans to take it to 55 thousand this year. In the medium term, it aims to have a direct coverage for about 60-65 thousand villages.

This is important as the management notes that 60-65 thousand villages (total village count: 6,00,000) contribute about 50 percent of FMCG consumption. Further, the management says e-commerce (1.4 percent of sales) and modern trade (15 percent) channel contribution is under-indexed compared to the sector and hence, that should also have a higher share going forward. In e-commerce, the share should improve to ~2 percent in FY20.

Expanding oral care portfolio: The FMCG player is re-emphasising its naturals reach by restaging Babool brand with the launch of Babool Ayurvedic. Next quarter, it plans to re-stage Meswak brand as well and thus expand the range of options in the naturals segment. It continues to believe naturals as a big driver of growth in the Rs 8,000 crore oral care category. Currently, this category sub-segment is growing at ~18 percent and constitutes 25 percent of total.

Stock outlook

We remain constructive on the stock as the interplay of factors like distribution reach and strong positioning in key categories continue to provide a competitive edge. Going forward, weaker rural consumption growth and the category headwind for the juices are the prime concern. Due to this, the management has marked down its volume growth expectation from high single digit to a range of mid to high single digit growth in FY20.

Second, the management has also optimised its EBITDA margins expectations to ~ 20 percent. While the company believes raw material inflation (both crude oil based and agri based) is expected to remain moderate, it intends to deploy additional gross margin gains for increasing distribution reach, product launches and investment behind brands. Note that the company is covered till October-November 2019 for its raw material requirement.

On account of new inputs, we revise down our earnings growth estimates to 13 percent earnings CAGR (FY19-21e) from 18 percent earlier. Taking this into account, the stock is trading at 40.8x FY21e earnings. In the short term, we expect pricing pressure to continue. In a longer term assessment, we remain positive about the company’s successful execution of product wise business strategies which helped in gaining or defending market share.

We believe that the company’s thrust on distribution reach and focus on deploying gross margin gains behind brands are positive. And hence, consider the stock as accumulation on decline candidate for a longer-term investment horizon.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.