Highlights - Revenue, profit and margin all shaped up

- Fertilizer volume play took the lead- Expansion of phosphatic acid facility supported margins- Covid-19 a major challenge, supply disruption may impact business- Long-run story intact---------------------------------------

Fertiliser manufacturer Coromandel International (CORO) (CMP: Rs 619; Mcap Rs 18,175 crore) stood tall in the December quarter, giving a good account of itself in revenue, profits as well as margins.

Manufacturing volumes picked up pace, but there was subdued growth in trading business. Thanks to backward integration, debottlenecking and new launches, the performance is expected to improve. That said, input supply disruptions caused by the Coronavirus, or Covid19, pose a big challenge.

About the company

Coromandel deals in manufacturing and trading of fertilisers, crop protection chemicals, speciality nutrients and organic compost. It offers various products in the fertilizer segment, including Nitrogen, Phosphatic and Potassic (NPK) variant, in various grades. Its speciality nutrients consist of water soluble fertilisers, sulphur products, micro nutrients and organic manure while crop protection covers insecticides, fungicides and herbicides. .

Financial performance

Key highlights

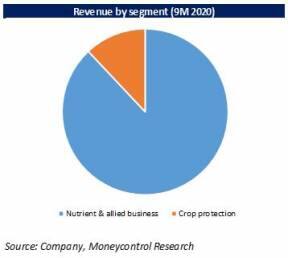

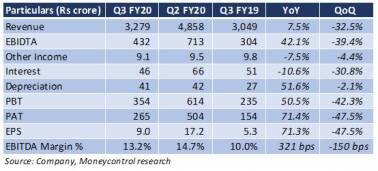

Revenue grew 7.5 percent year-on-year (YoY). Segment-wise, revenue in the nutrient business was up 8.4 percent, driven by a 42 percent jump in the manufactured fertiliser volumes. For crop protection chemicals, top line rose 3.6 percent as four new product launches gave sales a lift.

Profit in the fertiliser segment improved as the company benefited from cheaper inputs, along with operational efficiency and other cost savings, a result of expansion in the phosphatic acid space. The company has set up a new 10,000-million tonne (MT) phosphatic acid plant in Vishakhapatnam.

Its crop protection portfolio saw a margin contraction due to softness in prices of its end product mancozeb.

Lower tax rate and interest cost rubbed off on net profit, which zoomed 71 percent from a year earlier.

Other comments

The fresh launches are instrumental in driving the sales growth. One more product is in the pipeline for FY20.

Coromandel lining up a capex of nearly Rs 40-45 crore for FY20, of which some Rs 25 crore had already been spent till December 2019. Another Rs 40-45 crore is planned for FY21, which will be used for debottlenecking and capacity expansion of key molecules.

Outlook

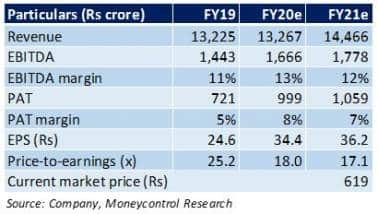

With an improving product mix and cooling off of prices of some key raw materials, we expect Coromandel’s margins to hit an upper circuit in coming quarters. But the current volatility caused by the spread of Coronavirus is expected to hit the company hard.

If this situation persists, there could be more pain, which in turn would squeeze its business, especially the crop protection segment. Our view is there would be some sort of offset because of debottlenecking of its fertiliser plants and traction from new product launches.

The stock has seen a run-up in the past few weeks and is trading at a 2021e price to earnings of 17x. The current supply disruption due to the Covid19 scare is a hard nut to crack in the short run. In the longer term, however, we expect better growth on a growing share of the non-subsidy business, greater operating leverage and an improvement in crop protection business.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.