Anubhav Sahu Moneycontrol Research

Highlights: - Steady volume growth aided by flagship Almond Drops Hair Oil - Weaker performance of other hair oil categories remain a concern - Rural demand witnesses widening of growth differential compared to urban - Product diversification remains a key aspect to watch -------------------------------------------------

Bajaj Consumer Care’s quarterly result reflected a sequential improvement for both rural growth and margin. Going forward, while the management seems assured of its ability to maintain gross margin, its product diversification strategy remains a factor that deserves a close watch for investors.

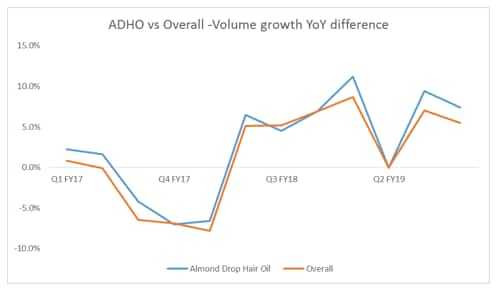

Key positives Q4 FY19 sales growth of 11.1 percent was aided by both volume and pricing growth. Volume growth of 5.5 percent was in line with expectations and came on a base of 5.9 percent last year. Flagship ADHO (Almond Drops Hair Oil) witnessed a reasonable 7.4 percent volume growth on a base of 6.9 percent.

Domestic market saw a steady performance (10.2 percent sales growth), wherein rural demand growth remained ahead of urban. In fact, unlike some of its peers in the FMCG sector, the management said the rural–urban growth difference is widening, which is currently about 450 basis points for the company. (100 bps=1 percentage point)

Among trade channels, modern and general trade performed strongly, with 21.8 percent and 10.8 percent sales growth, respectively.

Result snapshot

Source: Company

Key negatives Sales through Canteen Stores Department (CSD) channel remains a sore point. There was a de-growth of 15.6 percent this quarter, in contrast to 35 percent sales growth seen in Q3 FY19, and underlines uncertainties with respect to government policy on CSD. In fact, excluding CSD, volume growth for the company was seven percent YoY.

Source: Moneycontrol Research

Source: Moneycontrol Research

There remains a case for weaker performance of other hair oil categories. Supply chain feedback on Coco Jasmine has not been as per management’s expectations and hence some restaging would be required.

Other observations Over the last two-and-a-half years, the company has lowered wholesale channel contribution to 33 percent from 60 percent. While part of the impact is due to implementation of the Goods & Services Tax (GST), the company has had a higher share of direct reach, which at present is 5.02 lakh outlets compared to 2.8 lakh outlets at the end of last fiscal.

Secondly, there is an uptick in product diversification for the company. It recently launched products for sunscreen (Nomarks Ayurvedic Antimarks Sunscreen) and cooling oil categories (Bajaj Cool Almond Drops). This is broadly an extension of existing brands. However, an overhaul of company’s existing hair oil business is on cards, for which the management has mandated consulting firm – Bain & Company. It might take at least six months to receive initial recommendations from consultants.

Competitive intensity and limited portfolio range remains key constraints Positive takeaways from the result are steady performance of its flagship product and improved growth in the hinterland. While there is an apparent recovery in international sales, it needs to be watched closely if the improvement is steady enough.

While company has been attempting a product diversification, lack of success in the hair oil category is visible. Other categories are at a nascent stage and hence it would take some time to become significantly important.

There has been an uptick in raw material prices for the company, which has prompted the management to implement a price hike in current quarter. Its raw material inventory covers its requirement for the current quarter and hence gross margin is likely to remain stable in the near term

The stock has corrected by 37 percent from its 52-week high and is currently trading at 18.6 times FY20 estimated earnings. This makes it among the cheapest FMCG stock available.

Participation in rural growth and a favourable distribution strategy makes a constructive case for the stock at current price levels. On account of competitive intensity and limited diversification, we expect it to trade at discount to the median trading multiple of the FMCG sector.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.