Jitendra Kumar Gupta

Moneycontrol Research

In the business-to-business (B2B) segment it is difficult to win the hearts of customers particularly when products are commoditised. Taking up this challenge, Arfin India, which is into aluminium products, has consistently evolved its product categories through innovative techniques and research to stand tall in its category. During March, the company was conferred 'India’s Best Aluminium Products Manufacturing Company of the Year 2017' by IBC Infomedia, a division of International Brand Consulting Corporation, USA.

Prudent growth reflected in high return ratios

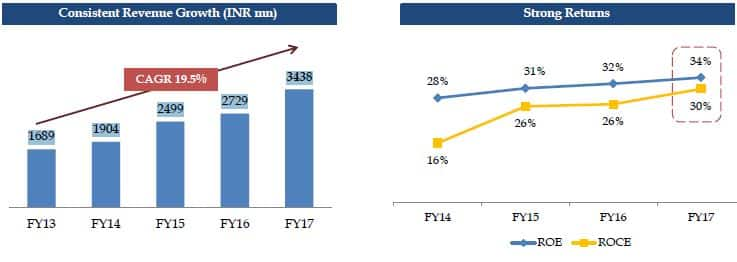

One direct reflection of its capabilities and strength is improving margins and return ratios. The company has consistently improved its earnings before interest, depreciation, tax and amortisation (EBIDTA) margin from 3.4 percent in FY13 to 8.1 percent in FY17, through cost optimisation, scale and better pricing.

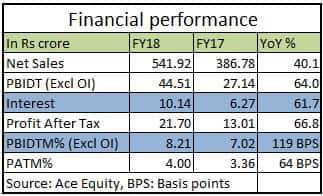

The company has been adding value added products, which have been contributing to overall margin increase. During 2013-17, volumes grew 22 percent annually and revenues rose 20 percent CAGR (compounded annual growth rate). During FY18, it delivered a strong 40 percent sales growth and 67 percent increase in net profit to Rs 21.7 crore.

Aided by strong growth and optimisations of resources, it has consistently improved its return on capital from 16 percent in FY14 to 30 percent in FY17.

Marquee clientele

Arfin manufactures aluminium wire rod, aluminium deox, aluminium alloy ingot, conductor and cables and few other aluminium-based products that are used in industries such as steel (72 percent), power, automobiles and others. The company is a key supplier to companies like Jindal Stainless, Jindal Steel & Power, Essar Steel, Tata Steel, ArcelorMittal, Steel Authority of India, JSW Steel, Bhushan Steel, Larsen & Toubro, Adani Transmission, Endurance Technologies, Banco Products, Rico Auto Industries and Toyota.

Revenue visibility

The company is fast growing in emerging product categories and adding more clients in the domestic and international market. Led by demand from the automotive and infrastructure construction, demand for aluminium products is growing at a slightly higher pace of about 7-9 percent.

It is also eying the exports market aggressively. Exports account for a mere 3 percent of overall revenue, but is expected to grow faster after the addition of new clients.

Capacity expansion

Considering the strong demand, the company is expanding its manufacturing capacities. Its wire rod capacity will be enhanced from 15,000 tonne at present to 20,000 tonne by FY19 and alloy ingot capacity will triple from 6,000 tonne to 18,000 tonne by FY19. While there is increased demand from existing clients, the company has also added few export clients in FY18, who will be taking deliveries from additional capacities. It recently commercialised the conductor and cables facility in Q3 FY18, whose products are approved by 7 state electricity boards and Adani Transmission. After expansion, capacity will increase to 73,600 tonne as against the current manufacturing capacity of 55,700 tonne per annum.

Valuations

Based on FY18 net profit of Rs 21.7 crore, current market price of Rs 332 per share and market capitalisation of Rs 437 crore, the stock is trading at a reasonable 20 times FY19 price-to-earnings, considering its strong earnings visibility and dominant industry position. We would also like to highlight the management's penchant for innovation and hunger for growth, strong return ratios and prudent financial risk management such as maintaining adequate debt-to-equity (1.1 times) and coverage ratios (interest coverage 5 times).

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.